Pound Sterling Price News and Forecast: GBP/USD soars to new yearly high as UK inflation surges

GBP/USD soars to new yearly high as UK inflation surges, BoE rate cuts in doubt

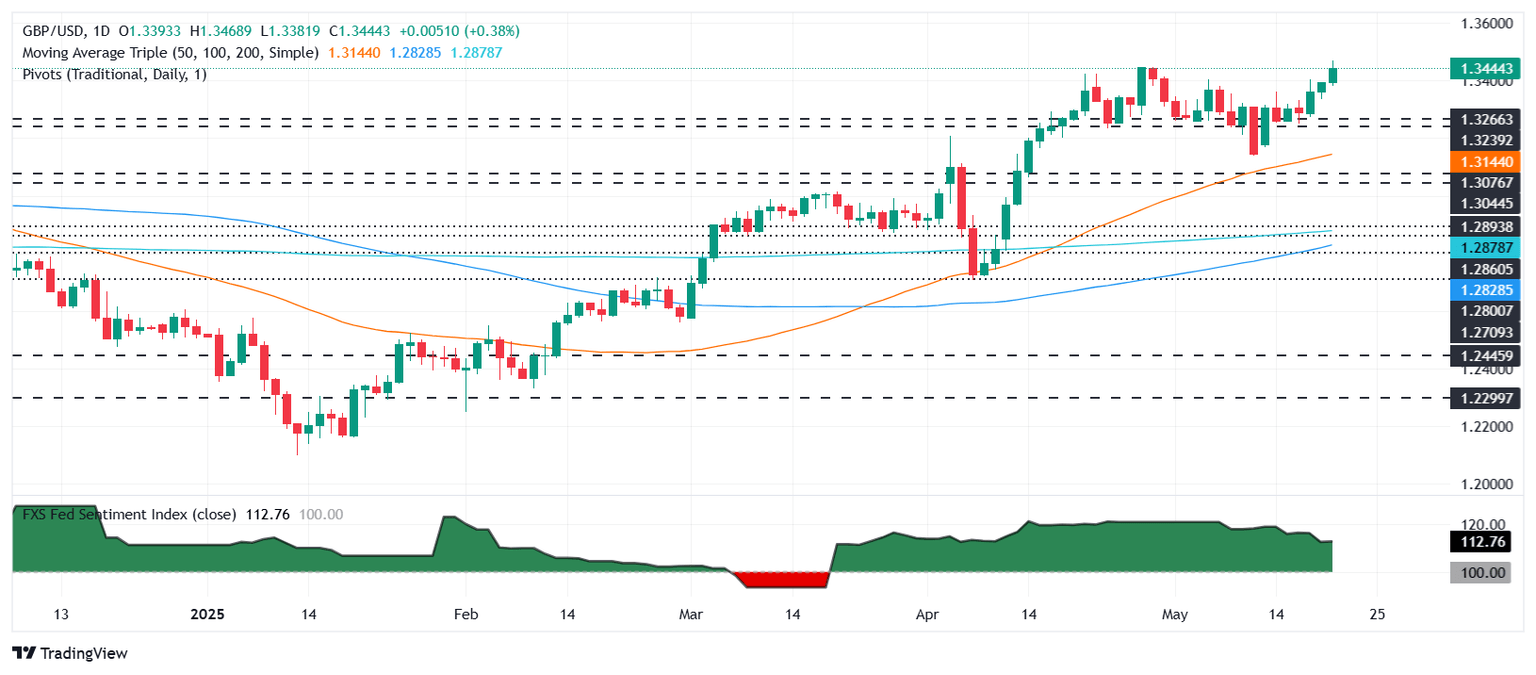

The Pound Sterling (GBP) rose to a new year-to-date (YTD) high of 1.3468 against the US Dollar (USD) on Wednesday as United Kingdom (UK) inflation rose, drifting away from the Bank of England's (BoE) 2% target, which had led to interest rate reductions earlier in the month. At the time of writing, GBP/USD trades at 1.3446, up 0.40%. Read More...

Pound Sterling hits three-year high against US Dollar on hot UK CPI data

The Pound Sterling (GBP) trades close to a fresh three-year high around 1.3470 against the US Dollar (USD) during North trading hours on Wednesday, posted earlier in the day. The GBP/USD pair advances on the release of the hotter-than-expected United Kingdom (UK) Consumer Price Index (CPI) data for April. Read More...

GBP/USD Price Forecast: Rises toward highs since February 2022 near 1.3450

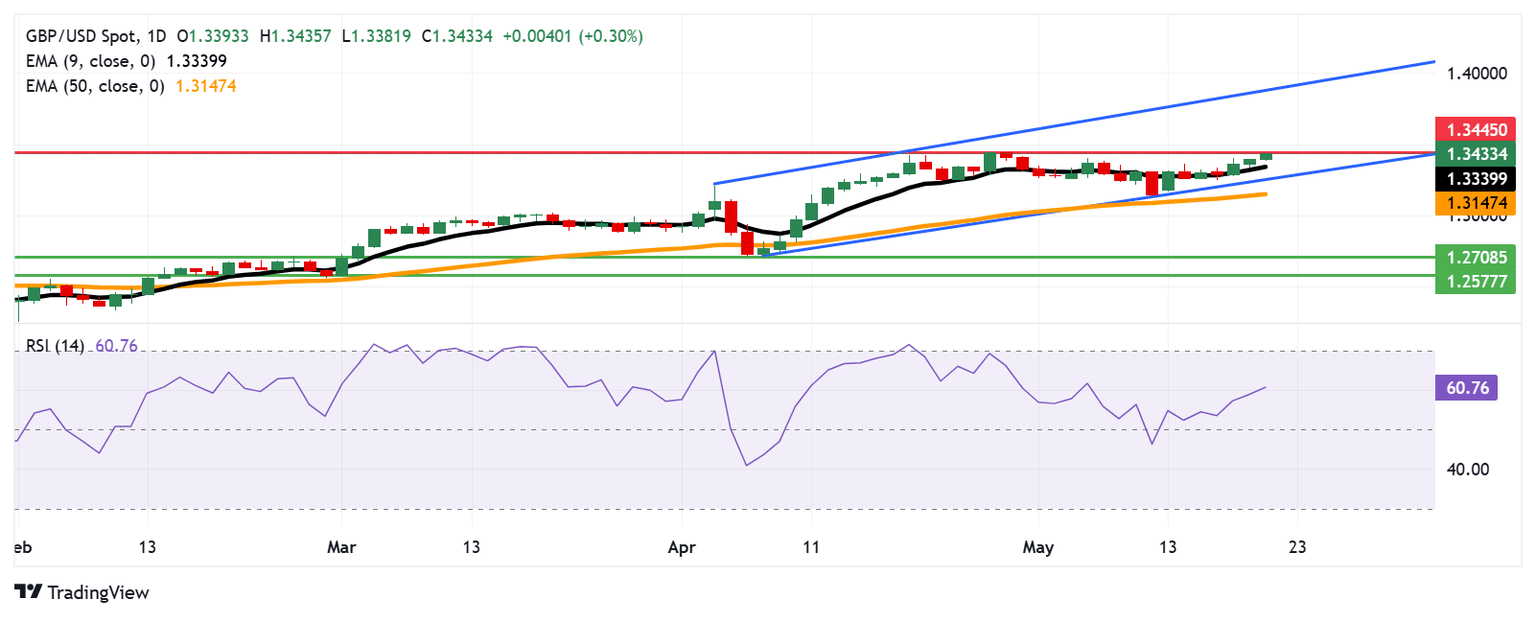

The GBP/USD pair extends its winning streak for the third successive session, trading around 1.3430 during Wednesday's Asian hours. The technical analysis of the daily chart suggests a persistent bullish bias as the pair remains within an ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet