GBP/USD soars to new yearly high as UK inflation surges, BoE rate cuts in doubt

- UK CPI inflation climbs to 3.5% YoY in April, well above the BoE’s 2% inflation target.

- Core inflation accelerates to 3.8%, raising doubts over future rate cuts.

- US Dollar tumbles as G-7 stokes speculation of Washington favoring weaker Greenback.

The Pound Sterling (GBP) rose to a new year-to-date (YTD) high of 1.3468 against the US Dollar (USD) on Wednesday as United Kingdom (UK) inflation rose, drifting away from the Bank of England's (BoE) 2% target, which had led to interest rate reductions earlier in the month. At the time of writing, GBP/USD trades at 1.3446, up 0.40%.

UK inflation spikes past forecasts, derailing BoE’s easing path and lifting GBP/USD above 1.34 as the Dollar weakens

Data from the UK has pushed aside the BoE’s intentions to continue reducing interest rates at forward meetings. The Consumer Price Index (CPI) in April rose 3.5% YoY, up from 2.6% in March, revealed the Office for National Statistics (ONS). The core CPI rose by 3.8% YoY, exceeding the 3.4% increase in March.

On the data, UK’s finance minister Rachel Reeves commented on a statement that she was disappointed and added, “I know cost of living pressures are still weighing down on working people.”

The increases in water, gas, and electricity bills contributed to higher consumer inflation. It should be noted that analysts expected CPI at 3.3% and underlying inflation at 3.6%, both figures above the prior month’s print.

Money market futures are pricing in just 35 basis points (bps) of easing from the Bank of England (BoE) towards the end of the year.

Across the Atlantic, discussions about President Trump's “One Big Beautiful Bill” continued. US House Speaker Mike Johnson stated that they had completed SALT discussions and indicated that a Thursday tax bill floor vote remains realistic.

In the meantime, the Greenback continues to weaken, as the US Dollar Index (DXY), which tracks the US Dollar’s value against a basket of six currencies, falls 0.52% to 99.50.

A meeting of the G-7 in Canada has increased speculation that the Trump administration is seeking a weaker US Dollar to reduce the trade deficit. According to Bloomberg, local media in South Korea reported that the Korean Won (KRW) was discussed at trade negotiations with the US.

Ahead this week, the UK economic docket will feature Flash PMIs and BoE speakers. In the US, traders will eye PMIs and Initial Jobless Claims for the week ending May 17, Fed speeches and housing data.

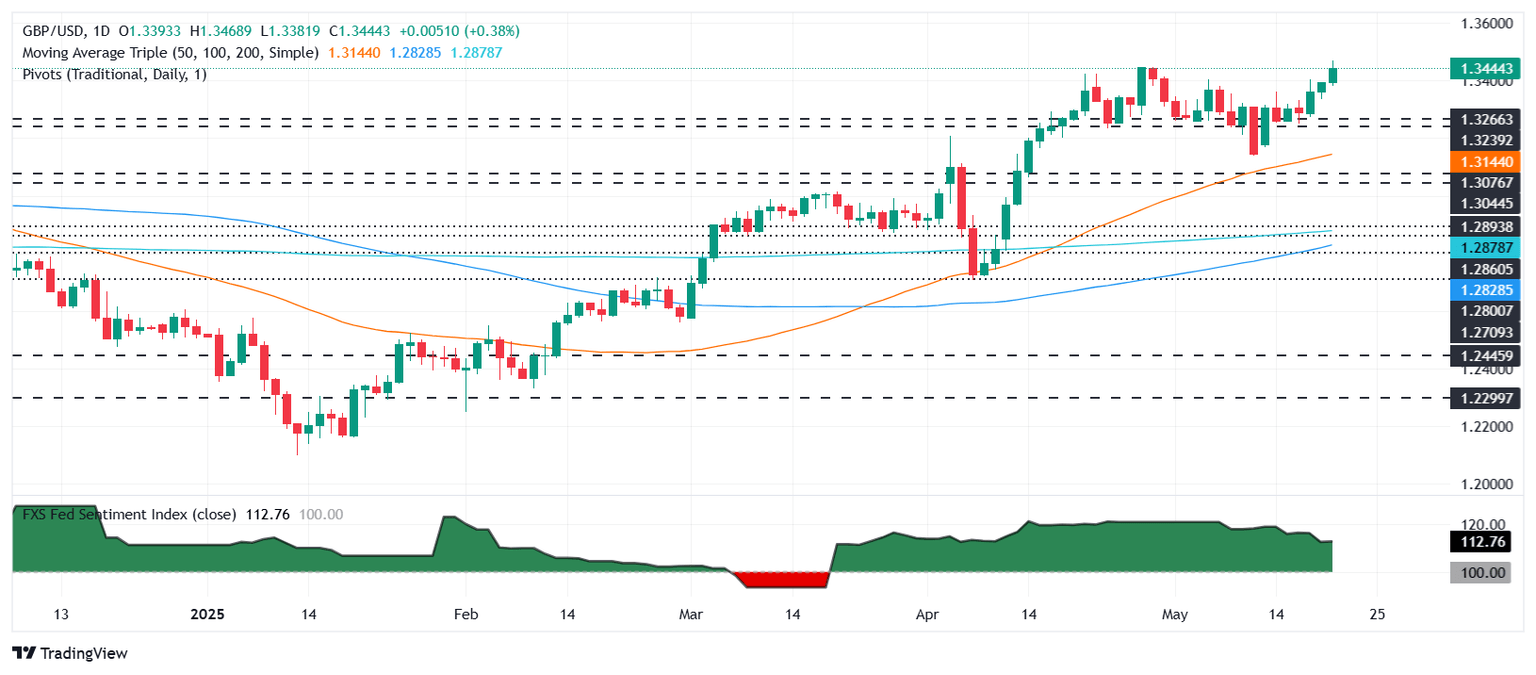

GBP/USD Price Forecast: Technical outlook

GBP/USD uptrend continued as the pair hit a new YTD peak. Momentum remains bullish, as depicted by the Relative Strength Index (RSI), which cleared the latest peak above 60, with enough room before reaching overbought conditions.

That said, GBP/USD's first key resistance level upfront would be 1.3468, followed by the 1.35 figure. If surpassed, the next stop would be the February 18, 2022, swing high at 1.3642.

Conversely, if GBP/USD slides below 1.340, the next support would be 1.3350, followed by 1.3300. Key support levels lie underneath the latter at 1.3250, 1.3200, and the 50-day Simple Moving Average (SMA) at 1.3141.

(This story was corrected on May 21 at 16:05 GMT to say that UK CPI inflation climbed to 3.5 YoY, not 3.6%)

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -1.35% | -1.17% | -1.15% | -1.01% | -0.94% | -1.35% | -1.39% | |

| EUR | 1.35% | 0.16% | 0.26% | 0.41% | 0.55% | 0.06% | -0.03% | |

| GBP | 1.17% | -0.16% | -0.19% | 0.24% | 0.39% | -0.10% | -0.19% | |

| JPY | 1.15% | -0.26% | 0.19% | 0.14% | 0.37% | -0.01% | -0.19% | |

| CAD | 1.01% | -0.41% | -0.24% | -0.14% | 0.08% | -0.35% | -0.44% | |

| AUD | 0.94% | -0.55% | -0.39% | -0.37% | -0.08% | -0.48% | -0.55% | |

| NZD | 1.35% | -0.06% | 0.10% | 0.00% | 0.35% | 0.48% | -0.09% | |

| CHF | 1.39% | 0.03% | 0.19% | 0.19% | 0.44% | 0.55% | 0.09% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.