Pound Sterling Price News and Forecast: GBP/USD slips toward 1.2800 and consolidates ahead BoE’s decision

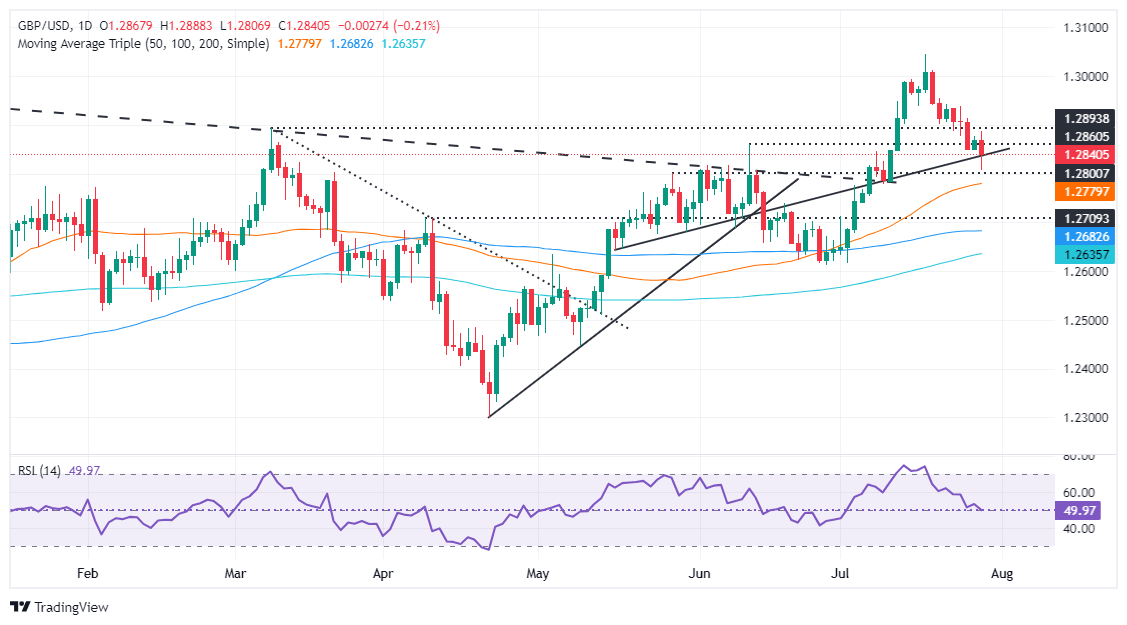

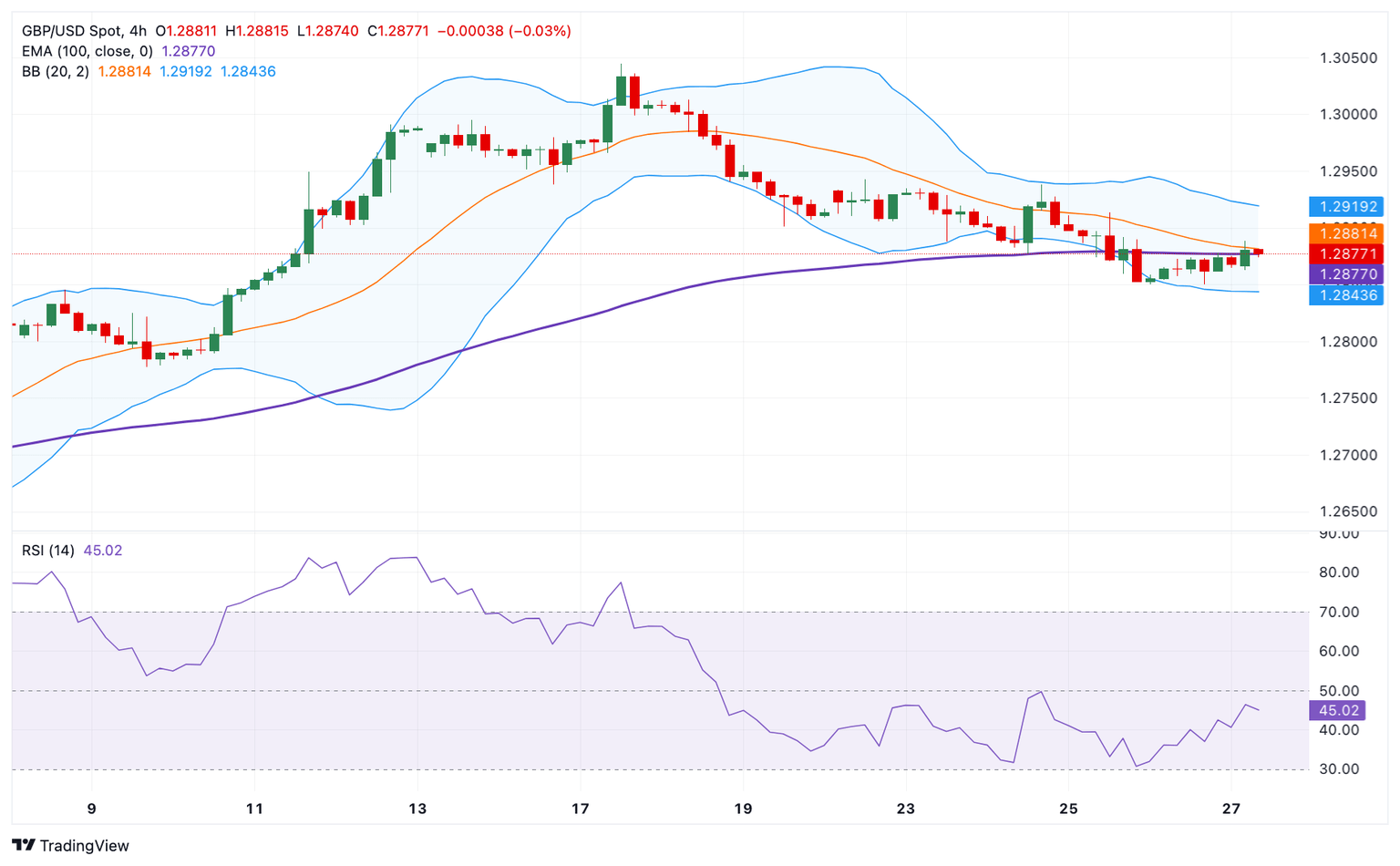

GBP/USD Price Analysis: Slips toward 1.2800 and consolidates ahead BoE’s decision

The GBP/USD begins the week on the back foot ahead of the Bank of England’s monetary policy decision on August 1. Market participants seem convinced that the BoE would cut interest rates, yet the odds are around 59%. The pair trades at 1.2826, down 0.28%. Read More...

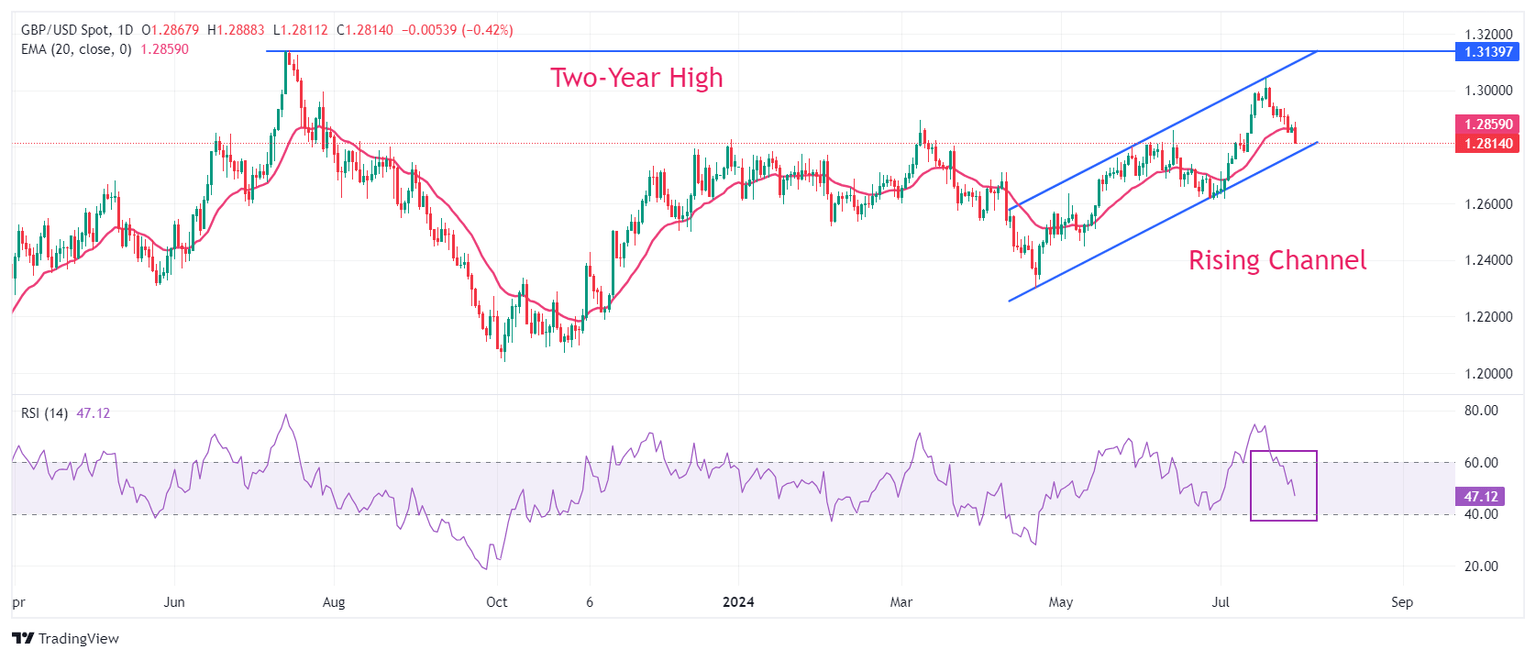

Pound Sterling rebounds with BoE policy meeting in focus

The Pound Sterling (GBP) posts a fresh two-week low near 1.2810 against the US Dollar (USD) in Monday’s North American trading hours. The GBP/USD pair weakens as the US Dollar edges higher amid uncertainty ahead of the Federal Reserve’s (Fed) monetary policy announcement on Wednesday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to 104.50. Read More...

GBP/USD Price Analysis: The first upside target to watch is above 1.2800

The GBP/USD pair trades on a stronger note around 1.2875 during the early European trading hours on Monday. The softer Greenback amid the hope of an interest rate cut by the US Federal Reserve (Fed) in September provides some support to the major pair. The US Federal Reserve (Fed) Interest Rate Decision will be to highlight on Wednesday, with no change in rate expected. Read More...

Author

FXStreet Team

FXStreet