Pound Sterling rebounds with BoE policy meeting in focus

- The Pound Sterling recovers as investors expect the BoE to cut interest rates on Thursday.

- A few BoE policymakers may hesitate to vote for a dovish decision due to high inflation in the UK service sector.

- The Fed is widely anticipated to maintain the status quo.

The Pound Sterling (GBP) posts a fresh two-week low near 1.2810 against the US Dollar (USD) in Monday’s North American trading hours. The GBP/USD pair weakens as the US Dollar edges higher amid uncertainty ahead of the Federal Reserve’s (Fed) monetary policy announcement on Wednesday. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rises to 104.50.

The Fed is widely anticipated to leave interest rates unchanged in the range of 5.25%-5.50% for the eighth time in a row. Therefore, market participants will keenly focus on the monetary policy statement and the press conference of Fed Chair Jerome Powell to know whether policymakers are comfortable with market speculation of two rate cuts this year and choosing the September meeting to kick off the much-awaited policy-easing cycle.

Financial markets expect the Fed to acknowledge significant progress in inflation declining towards the bank’s target of 2% and increasing risks to the labor market. This would indicate the Fed’s readiness for interest-rate reduction.

Contrary to market expectations, Bank of America (BofA) economists argued on Friday that cooling consumer demand and inflation may not be proceeding fast enough to allow for as much policy easing as financial markets expect. They added, "We remain comfortable with our forecast that cuts will start in December, but upcoming inflation and employment data could tip the scale to an earlier cut," Reuters reported.

Apart from the Fed policy, investors will also focus on a string of United States (US) economic data such as JOLTS Job Openings for June, ADP Employment Change, ISM Manufacturing Purchasing Managers Index (PMI), and Nonfarm Payrolls data for July.

Daily digest market movers: Pound Sterling rebounds against its major peers but struggles against US Dollar

- The Pound Sterling recovers against its major peers, except the US Dollar' in Monday’s New York session. The British currency bounces back strongly ahead of the Bank of England (BoE) monetary policy meeting, which is scheduled for Thursday. The BoE is expected to cut its interest rates by 25 basis points (bps) to 5%. This will be the first rate-cut decision in the BoE in more than four years since pandemic-led stimulus forced global central banks to pivot to a restrictive policy framework in an attempt to normalize inflated world markets.

- Market experts expect that the BoE's rate-cut move will be tough, as high inflation in the service sector remains a concern for policymakers. Though annual headline inflation has returned to the desired rate of 2%, high service inflation could dampen its sustainability.

- Meanwhile, the arrival of United Kingdom (UK) Prime Minister Keir Starmer into Parliament with an absolute majority has strengthened the economic outlook. An improvement in activities in manufacturing and the service sector could lead to a rise in input prices, which could also revamp price pressures again.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.39% | 0.17% | 0.23% | 0.09% | 0.16% | 0.36% | 0.23% | |

| EUR | -0.39% | -0.25% | -0.15% | -0.27% | -0.18% | -0.04% | -0.14% | |

| GBP | -0.17% | 0.25% | 0.06% | -0.05% | 0.07% | 0.22% | 0.11% | |

| JPY | -0.23% | 0.15% | -0.06% | -0.18% | -0.05% | 0.12% | 0.03% | |

| CAD | -0.09% | 0.27% | 0.05% | 0.18% | 0.10% | 0.24% | 0.16% | |

| AUD | -0.16% | 0.18% | -0.07% | 0.05% | -0.10% | 0.17% | 0.04% | |

| NZD | -0.36% | 0.04% | -0.22% | -0.12% | -0.24% | -0.17% | -0.11% | |

| CHF | -0.23% | 0.14% | -0.11% | -0.03% | -0.16% | -0.04% | 0.11% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

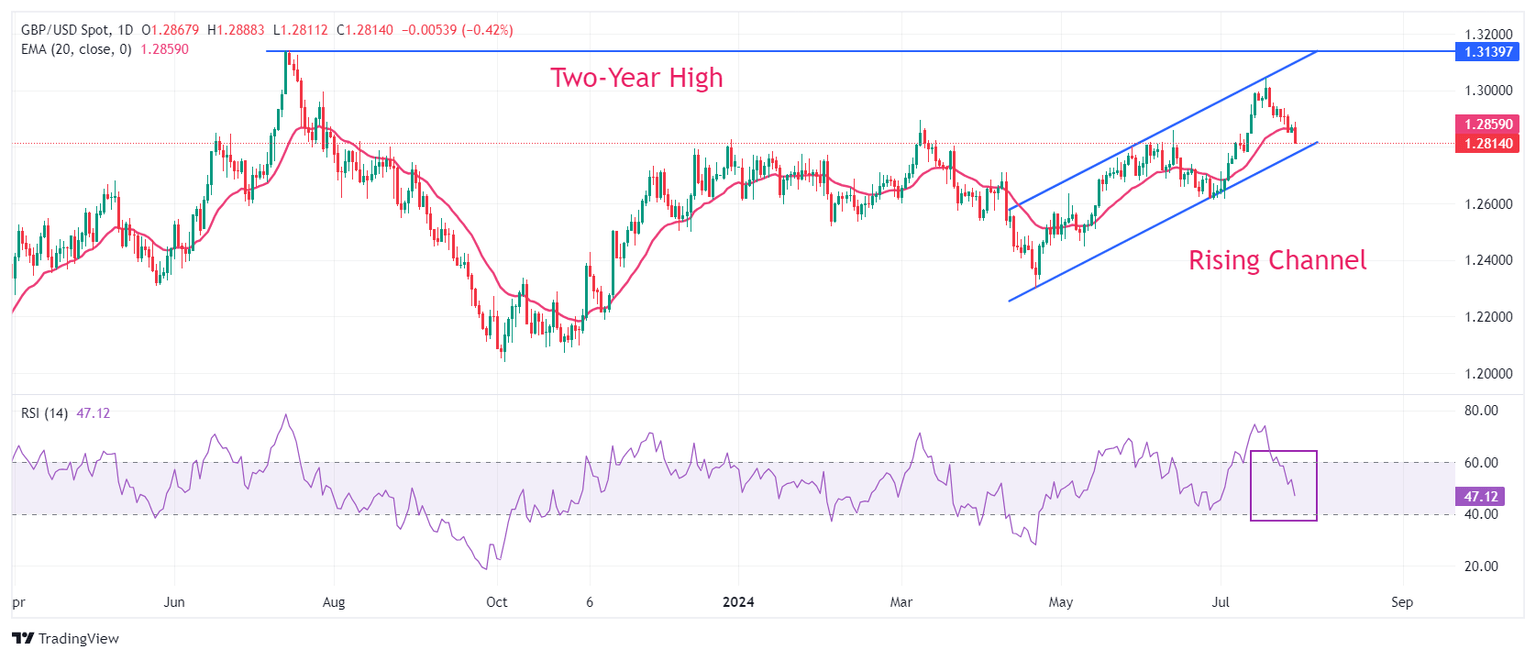

Technical Analysis: Pound Sterling remains steady above 1.2800

The Pound Sterling declines toward the lower boundary of the Rising Channel chart pattern on a daily timeframe. The GBP/USD pair fell on the backfoot after breaking below the crucial support of 1.2900. The Cable drops below the 20-day Exponential Moving Average (EMA) near 1.2860, suggesting uncertainty in the near-term trend.

The 14-day Relative Strength Index (RSI) declines toward 40.00, which would be a cushion for the momentum oscillator.

On the downside, the round-level support of 1.2800 will be a crucial support zone for the Pound Sterling bulls. On the other hand, a two-year high near 1.3140 will be a key resistance zone for the pair.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Aug 01, 2024 11:00

Frequency: Irregular

Consensus: 5%

Previous: 5.25%

Source: Bank of England

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.