Pound Sterling Price News and Forecast: GBP/USD slips slightly despite cooling US inflation, eyes on US PPI

GBP/USD slips slightly despite cooling US inflation, eyes on US PPI

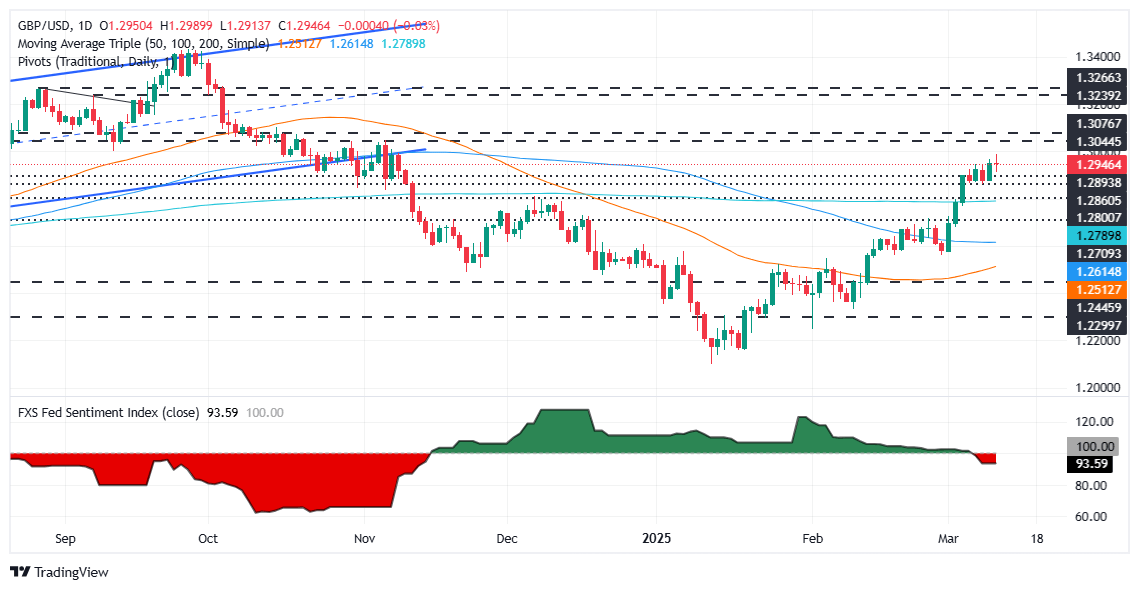

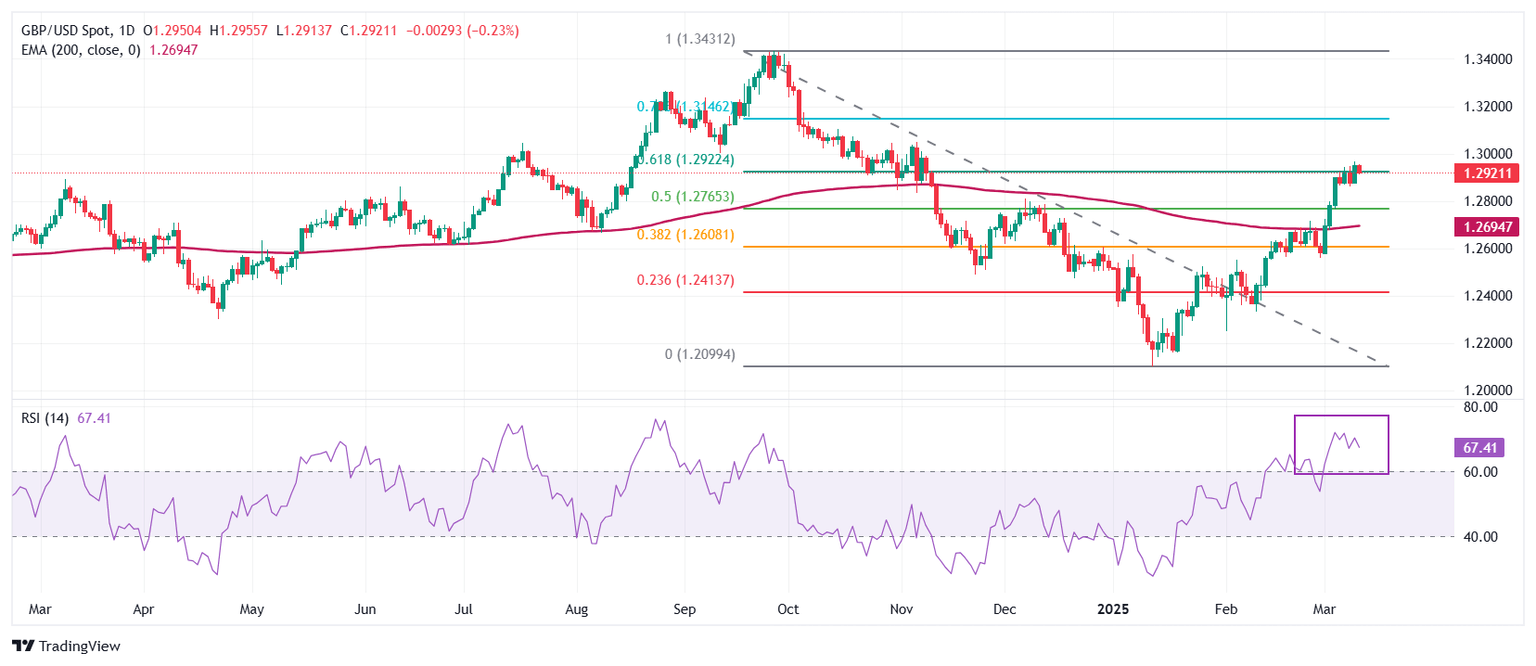

The Pound Sterling (GBP) slightly depreciates against the US Dollar (USD) on Wednesday as United States (US) inflation data revealed the disinflation process continued. At the time of writing, the GBP/USD trades at 1.2925, down 0.13%. Read More...

Pound Sterling refreshes four-month high against US Dollar on soft US Inflation report

The Pound Sterling (GBP) posts a fresh four-month high at 1.2980 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair strengthens after the release of the United States (US) Consumer Price Index (CPI) report for February, which showed that inflationary pressures grew at a moderate pace. Read More...

GBP/USD trades with negative bias below mid-1.2900s, downside seems limited ahead of US CPI

The GBP/USD pair edges lower during the Asian session on Wednesday and erodes a part of the previous day's strong move up to over a four-month peak, around the 1.2965 area. Spot prices currently trade around the 1.2935 region, though the downtick lacks bearish conviction as traders keenly await the release of the US consumer inflation figures before placing fresh directional bets. Read More...

Author

FXStreet Team

FXStreet