Pound Sterling refreshes four-month high against US Dollar on soft US Inflation report

- The Pound Sterling jumps to near 1.2980 against the US Dollar after soft US CPI data for February.

- US President Trump’s tariff policies continue to cap investors' risk appetite.

- The BoE is expected to keep interest rates unchanged in the monetary policy meeting next week.

The Pound Sterling (GBP) posts a fresh four-month high at 1.2980 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair strengthens after the release of the United States (US) Consumer Price Index (CPI) report for February, which showed that inflationary pressures grew at a moderate pace.

Year-over-year headline inflation cooled down to 2.8% from 3% in January and estimates of 2.9%. In the same period, the core CPI – which excludes volatile food and energy prices – decelerated at a faster-than-expected pace to 3.1% from expectations of 3.2% and the prior release of 3.3%. Both headline and core CPI rose by 0.2% on a monthly basis, slower than the forecast of 0.3%.

Soft US inflation data is expected to prompt market expectations that the Federal Reserve (Fed) should resume the policy-easing cycle, which it paused in December. On Friday, Fed Chair Jerome Powell said the central bank could maintain “policy restraint for longer if inflation progress stalls”.

Surprisingly, the US Dollar has also moved higher after the US inflation data release, which was anticipated to face more downside in the light of soft CPI data. The US Dollar Index (DXY), which tracks the Greenback's value against six major currencies, rises to near 103.75 from an over four-month low of 103.20.

Daily digest market movers: Pound Sterling steadies ahead of UK monthly GDP, factory data

- The Pound Sterling trades quietly against its major peers on Wednesday as investors look for fresh cues about next week’s Bank of England’s (BoE) monetary policy meeting. Traders are confident that the BoE will keep interest rates steady at 4.5% as a slew of officials have guided a ‘gradual and cautionary’ monetary easing approach.

- Last week, four BoE policymakers, including Governor Andrew Bailey, guided a gradual path for “unwinding monetary policy restrictiveness” as the inflation persistence is less likely to fade “on its own accord”. Contrary to them, BoE member Catherine Mann supports a swift policy-easing approach due to “substantial volatility” coming from financial markets, especially from “cross-border spillovers”.

- This week, investors will focus on the United Kingdom's (UK) monthly Gross Domestic Product (GDP), and Industrial and Manufacturing Production data for January, which will be released on Friday. The UK economy is expected to have grown at a moderate pace of 0.1%, compared to the 0.4% economic expansion seen in December. Monthly factory data is estimated to have declined in the first month of 2025.

- On the geopolitical front, US President Donald Trump’s tariff agenda continues to keep investors on their toes across the globe. Trump threatened to double tariffs on imports of steel and aluminum from Canada but scrapped his decision after Canada’s Ontario Premier, Doug Ford, agreed to roll back a 25% surcharge levied on electricity exported to the US.

- Comments from US Commerce Secretary Howard Lutnick in an interview with CBS on Tuesday indicated that Trump’s tariff is more a negotiation tactic to have the upper hand while closing deals with his trading partners. “Let the dealmaker make his deals,” Lutnick said.

Technical Analysis: Pound Sterling aims towards 1.3000

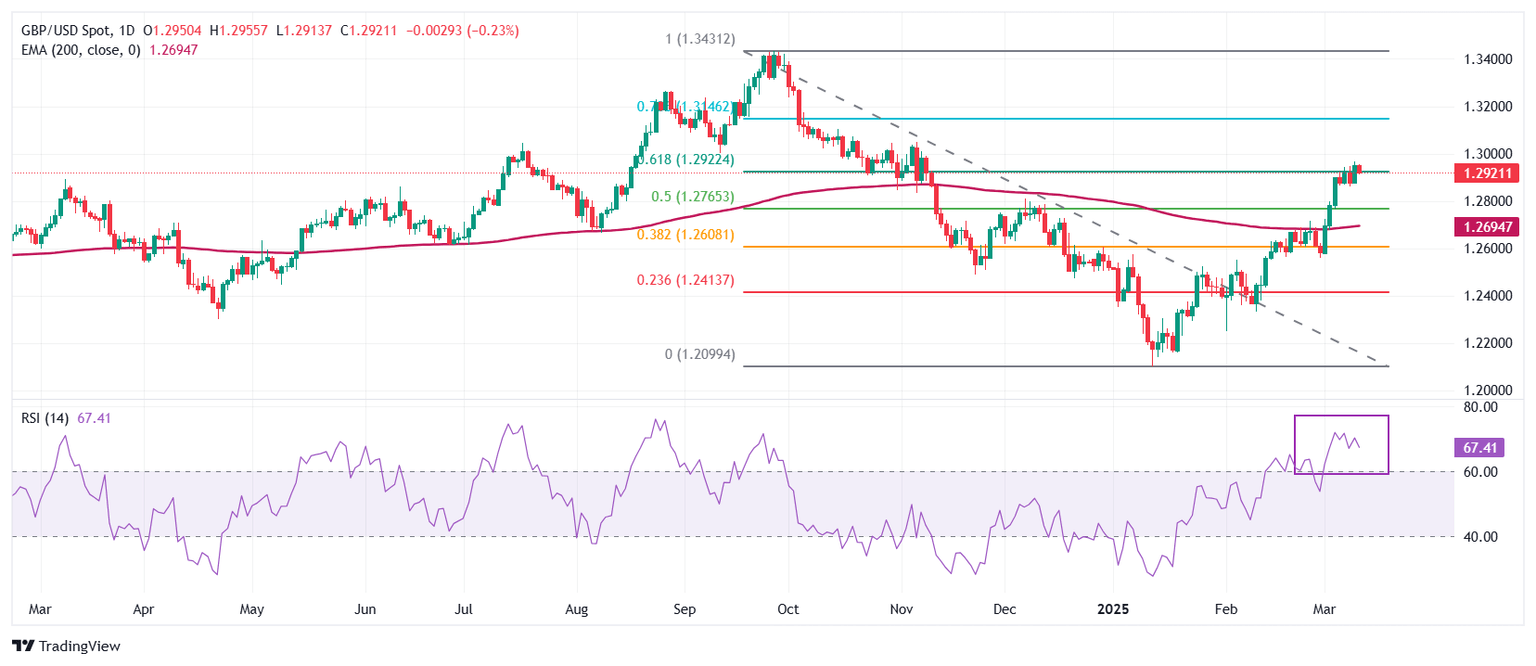

The Pound Sterling aims to extend its upside above the four-month high of 1.2965 against the US Dollar posted on Tuesday. The long-term outlook of the GBP/USD pair has turned bullish as it holds above the 200-day Exponential Moving Average (EMA), which is around 1.2695.

The 14-day Relative Strength Index (RSI) holds above 60.00, suggesting a strong bullish momentum.

Looking down, the 50% Fibo retracement at 1.2767 and the 38.2% Fibo retracement at 1.2608 will act as key support zones for the pair. On the upside, the psychological 1.3000 level will act as a key resistance zone.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.