Pound Sterling Price News and Forecast: GBP/USD sinks below the 1.1000 figure, registering fresh 37-year lows

Breaking: GBP/USD sinks below the 1.1000 figure, registering fresh 37-year lows

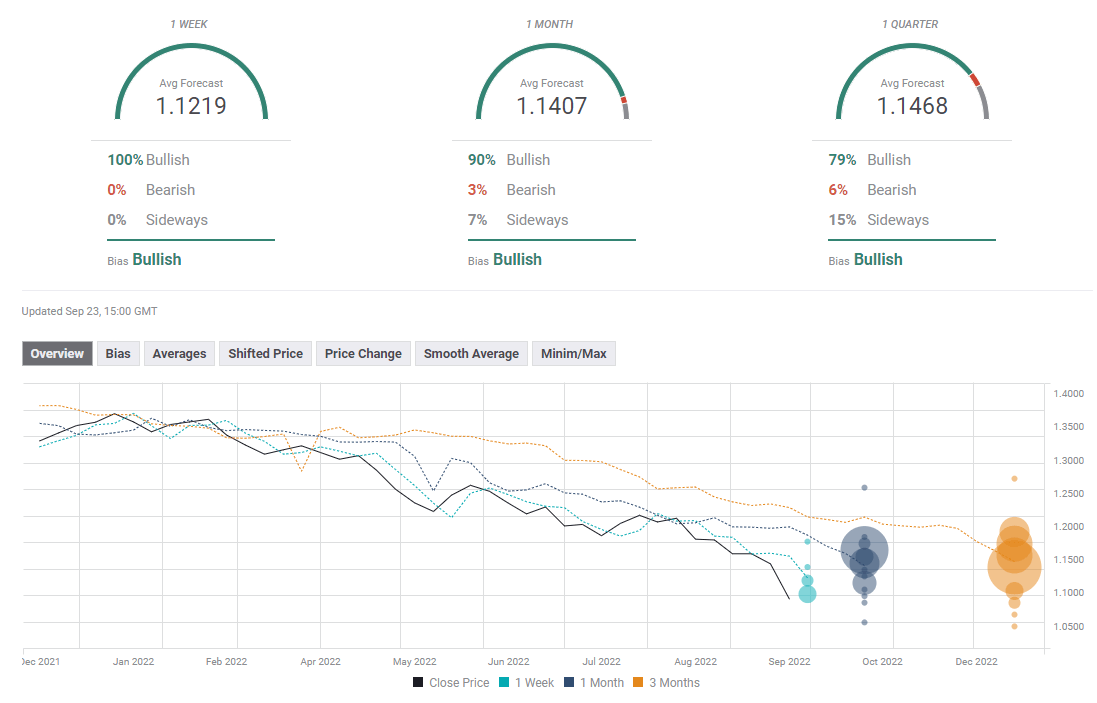

The GBP/USD is collapsing from 1.1200, eyeing a break below the 1.1000 figure, which was last seen in March 1985, courtesy of dismal market sentiment, spurred by worldwide central bank tightening to quell price pressures. The GBP/USD is trading at 1.0965, below its opening price by more than 2%, after hitting a daily high of 1.1273. Read more...

GBP/USD Weekly Forecast: Oversold but is selling overdone?

Nothing could stop GBP bears in the last week, as GBP/USD booked two straight weeks of decline. The US Federal Reserve (Fed) and the Bank of England (BOE) rate hike decisions underscored the widening policy divergence while geopolitical tensions also played a part in the pair’s over-400-pips weekly loss. Next week, all eyes will be on the US economic data and Fedspeak, as the UK docket remains relatively scarce. Read more...

Pound can’t find its footing

GBP/USD is down sharply today and has fallen below the 1.11 level for the first time since 1985. In the European session, GBP/USD is trading at 1.1125, down 1.16%. The British pound can’t seem to find any love. GBP/USD is looking dreadful, down 2.1% this week and 3.8% in September. The currency hasn’t sunk to such levels since 1985 and the strong US dollar could extend the pound’s current downtrend. Read more...

Author

FXStreet Team

FXStreet