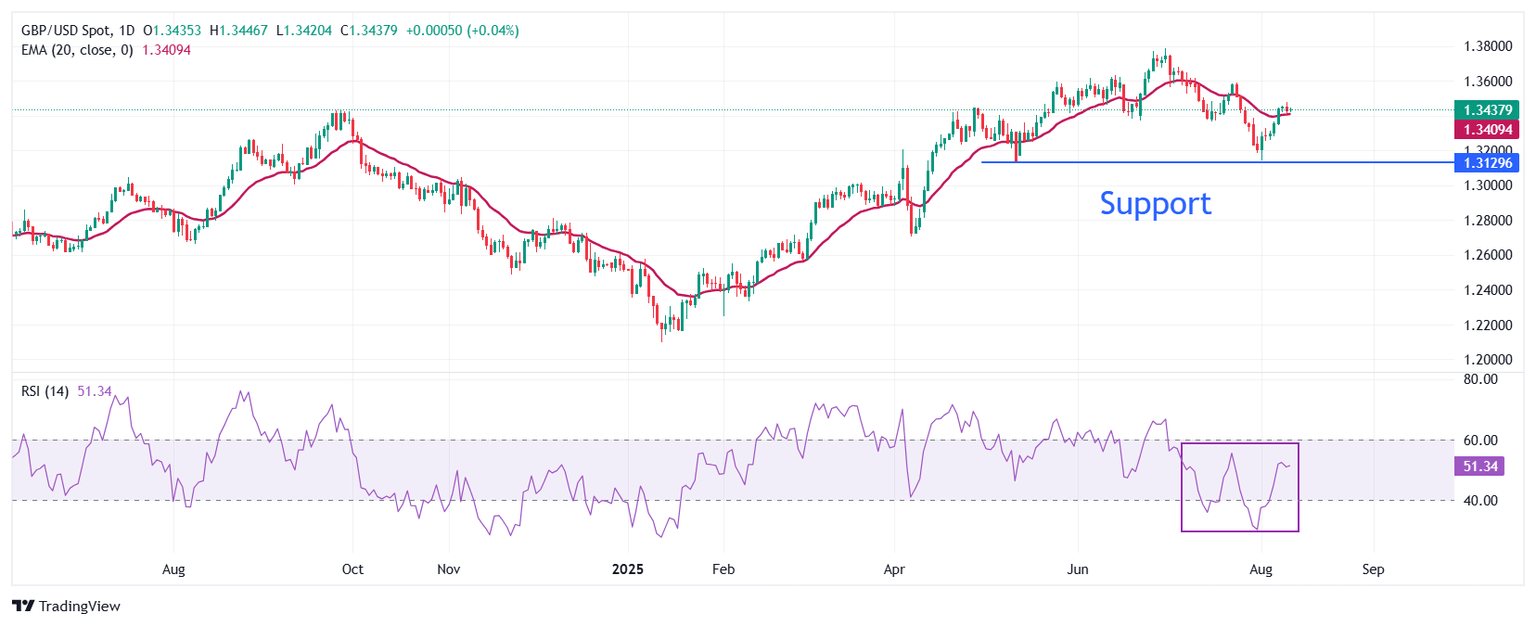

Pound Sterling Price News and Forecast: GBP/USD rises as US CPI data bolsters Fed rate cut expectations

GBP/USD rises as US CPI data bolsters Fed rate cut expectations for September

The British Pound (GBP) strengthens further against the US Dollar (USD) on Tuesday, with GBP/USD edging higher after the release of mixed UK labor market data and the latest US inflation figures. While signs of cooling employment growth in the UK were offset by robust wage gains, a softer US Dollar following the CPI report helped keep the pair supported, as traders increased expectations that the Federal Reserve (Fed) will resume easing monetary policy as soon as September. Read More...

Pound Sterling strengthens on strong UK employment data, US inflation awaited

The Pound Sterling (GBP) attracts significant bids against its major peers on Tuesday after the release of the upbeat United Kingdom (UK) labor market data for the three-months ending June. Read More...

GBP/USD steadies below 1.3450 following BRC Like-For-Like Retail Sales, UK labor data eyed

GBP/USD moves little after the release of Like-For-Like Retail Sales by the British Retail Consortium, hovering around 1.3430 during the Asian hours on Tuesday. Focus is shifted toward the United Kingdom (UK) labor market data, including Claimant Count Change, Employment Change, and ILO Unemployment Rate, scheduled to be released later in the day. Read More...

Author

FXStreet Team

FXStreet