Pound Sterling strengthens on strong UK employment data, US inflation awaited

- The Pound Sterling moves higher against its peers on strong UK employment data for the three months ending June.

- Growth in UK Average Earnings showed signs of slowing down.

- Investors await US inflation and the UK Q2 GDP data as the next catalysts.

The Pound Sterling (GBP) attracts significant bids against its major peers on Tuesday after the release of the upbeat United Kingdom (UK) labor market data for the three-months ending June.

The Office for National Statistics (ONS) reported that the economy created fresh 239K jobs in the second quarter of the year, well above the 134K workers hired in the three months ending May. This is a significant recovery from earlier indicators, which showed that firms became reluctant to increase their workforce due to the increase in employers’ contributions to social security schemes to 15%.

The ILO Unemployment Rate came in steady at 4.7%, as expected. Claimant Count Change for July declined by 6.2K, while it was expected to increase to 20.8K.

Meanwhile, Average Earnings data, a key measure of wage growth, showed signs of slightly moderating growth. Excluding bonuses, earnings rose at a steady rate of 5% on year, as expected. Average Earnings Including Bonuses grew at a slower pace of 4.6%, compared to estimates of 4.7% and the prior reading of 5%.

Upbeat job growth data is expected to allow Bank of England (BoE) officials to maintain their “gradual and careful” monetary expansion stance. Last week, the BoE cut interest rates by 25 basis points (bps) to 4%, with a slim majority.

This week, investors will also focus on the UK Preliminary Q2 Gross Domestic Product (GDP) and factory data for June, which is scheduled to be released on Thursday.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.25% | 0.19% | 0.06% | 0.28% | 0.15% | -0.32% | |

| EUR | -0.02% | -0.26% | 0.19% | 0.08% | 0.30% | 0.15% | -0.30% | |

| GBP | 0.25% | 0.26% | 0.54% | 0.34% | 0.56% | 0.43% | -0.04% | |

| JPY | -0.19% | -0.19% | -0.54% | -0.11% | 0.08% | -0.04% | -0.41% | |

| CAD | -0.06% | -0.08% | -0.34% | 0.11% | 0.25% | 0.08% | -0.38% | |

| AUD | -0.28% | -0.30% | -0.56% | -0.08% | -0.25% | -0.15% | -0.61% | |

| NZD | -0.15% | -0.15% | -0.43% | 0.04% | -0.08% | 0.15% | -0.55% | |

| CHF | 0.32% | 0.30% | 0.04% | 0.41% | 0.38% | 0.61% | 0.55% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Daily digest market movers: Pound Sterling advances against US Dollar

- The Pound Sterling recovers early losses and jumps to near 1.3480 against the US Dollar (USD) during the European trading session on Tuesday, following upbeat UK employment data. Investors brace for significant action in the US Dollar once the United States (US) Consumer Price Index (CPI) data for July is published at 12:30 GMT. Investors will closely monitor the US inflation data to gauge whether the impact of the tariff-driven inflation is one-time or persistent.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades stably near the two-day high around 98.50.

- Economists expect US headline inflation to have risen to 2.8% in July from 2.7% in June. The core CPI inflation, which excludes the volatile food and energy categories, is forecast to rise to 3% year-over-year (YoY) from 2.9% the previous month. Over the month, the CPI and the core CPI are seen advancing by 0.2% and 0.3%, respectively.

- Signs of price pressures accelerating might force traders to reassess bets supporting interest rate cuts by the Federal Reserve (Fed) in the September policy meeting. On the contrary, cooling prices would boost these odds.

- Lately, the comments from Fed officials have signaled that they are more concerned about deteriorating job demand than fears of inflation.

- Over the weekend, Fed Governor Michelle Bowman supported a gradual move from monetary policy restrictiveness to a neutral setting amid cooling labor market conditions. Bowman added that July’s employment figures have strengthened her confidence in her forecast that there will be three interest rate cuts this year.

- On the trade front, the US and China have agreed to extend their tariff truce for another 90 days. The Chinese Commerce Ministry stated earlier in the day that it is working towards reducing non-tariff barriers to American companies, and will suspend adding some US firms to its unreliable entity and export control lists for 90 days.

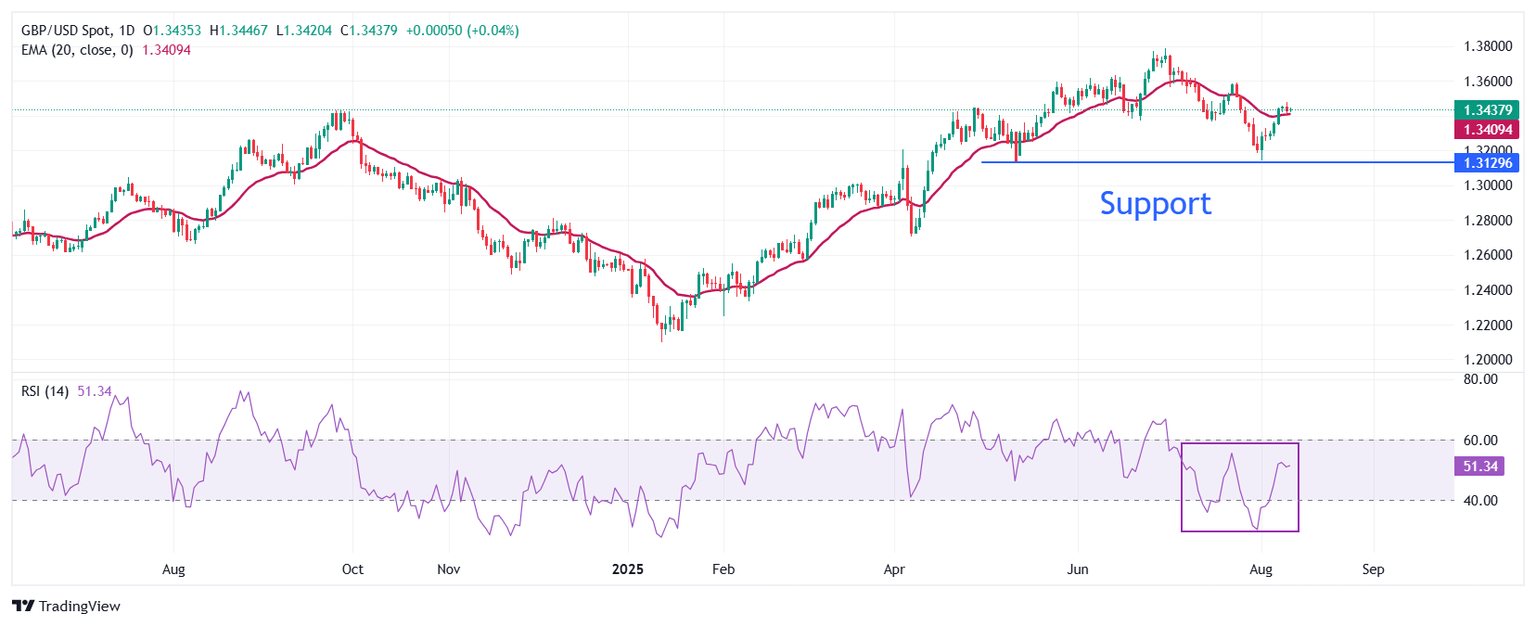

Technical Analysis: Pound Sterling sees more upside above 1.3500

The Pound Sterling trades flat around 1.3440 against the US Dollar on Tuesday. The GBP/USD pair holds the 20-day Exponential Moving Average (EMA), which trades around 1.3408, suggesting that the near-term trend favors the upside.

The 14-day Relative Strength Index (RSI) bounces back above 50.00 after oscillating inside the 20.00-40.00 range in the past few trading sessions, suggesting an attempt for bullish reversal.

Looking down, the August 1 low of 1.3140 will act as a key support zone. On the upside, the July 23 high near 1.3585 will act as a key barrier.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Tue Aug 12, 2025 12:30

Frequency: Monthly

Consensus: 2.8%

Previous: 2.7%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.