Pound Sterling Price News and Forecast: GBP/USD resumes rally as Retail Sales jump

British Pound resumes rally as Retail Sales jump

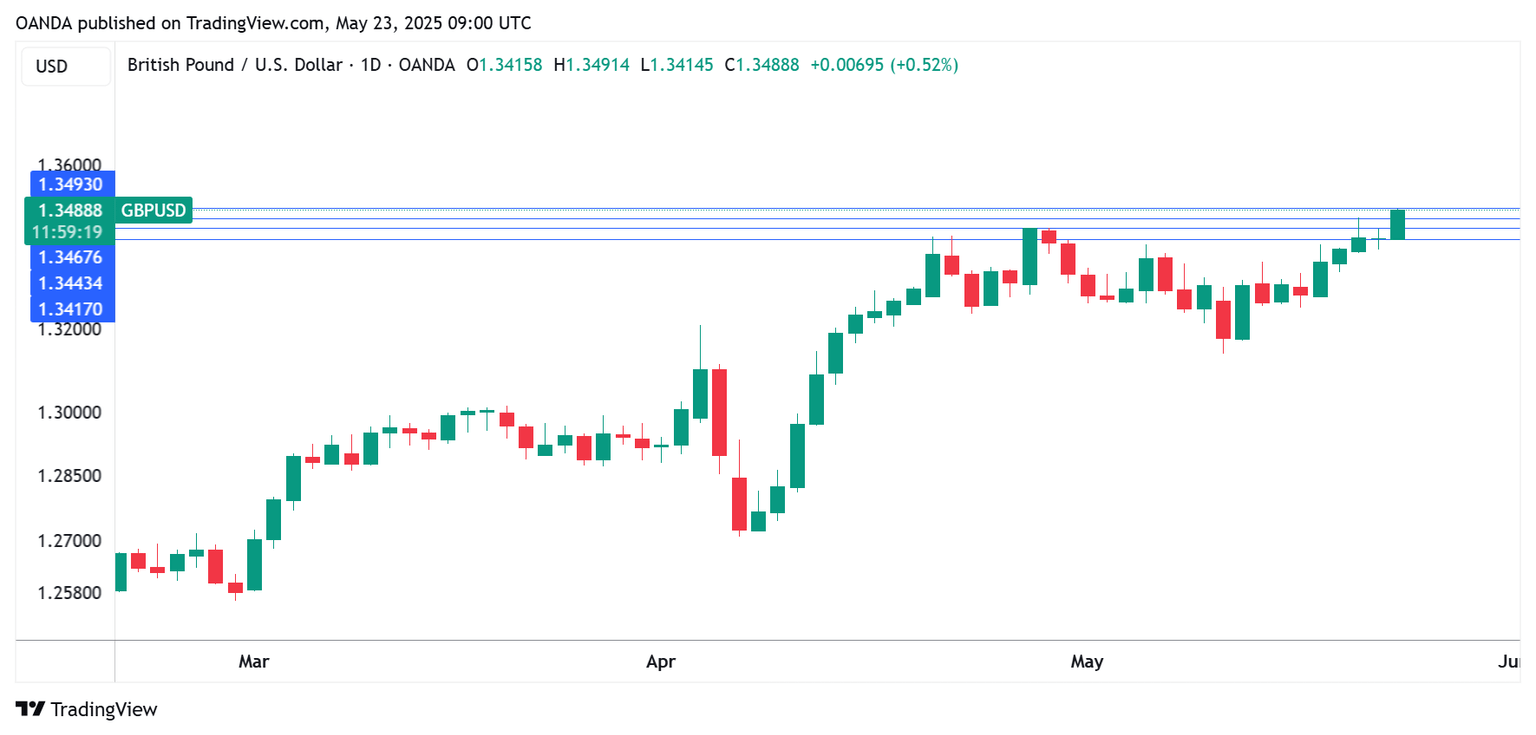

The British pound has posted gains on Friday. In the European session, GBP/USD is trading at 1.3484, up 0.49% on the day. The pound has gained 1.5% this week and is trading at levels not seen since Feb. 2022.

The markets were expecting a banner reading from April retail sales but the actual numbers crushed the forecast. Annual retail sales surged 5%, up from a downwardly revised 1.9% and above the market estimate of 4.5%. This marked the fastest pace of growth since Feb. 2022. Read more...

GBP/USD Forecast: Pound Sterling shows no signs of slowing down

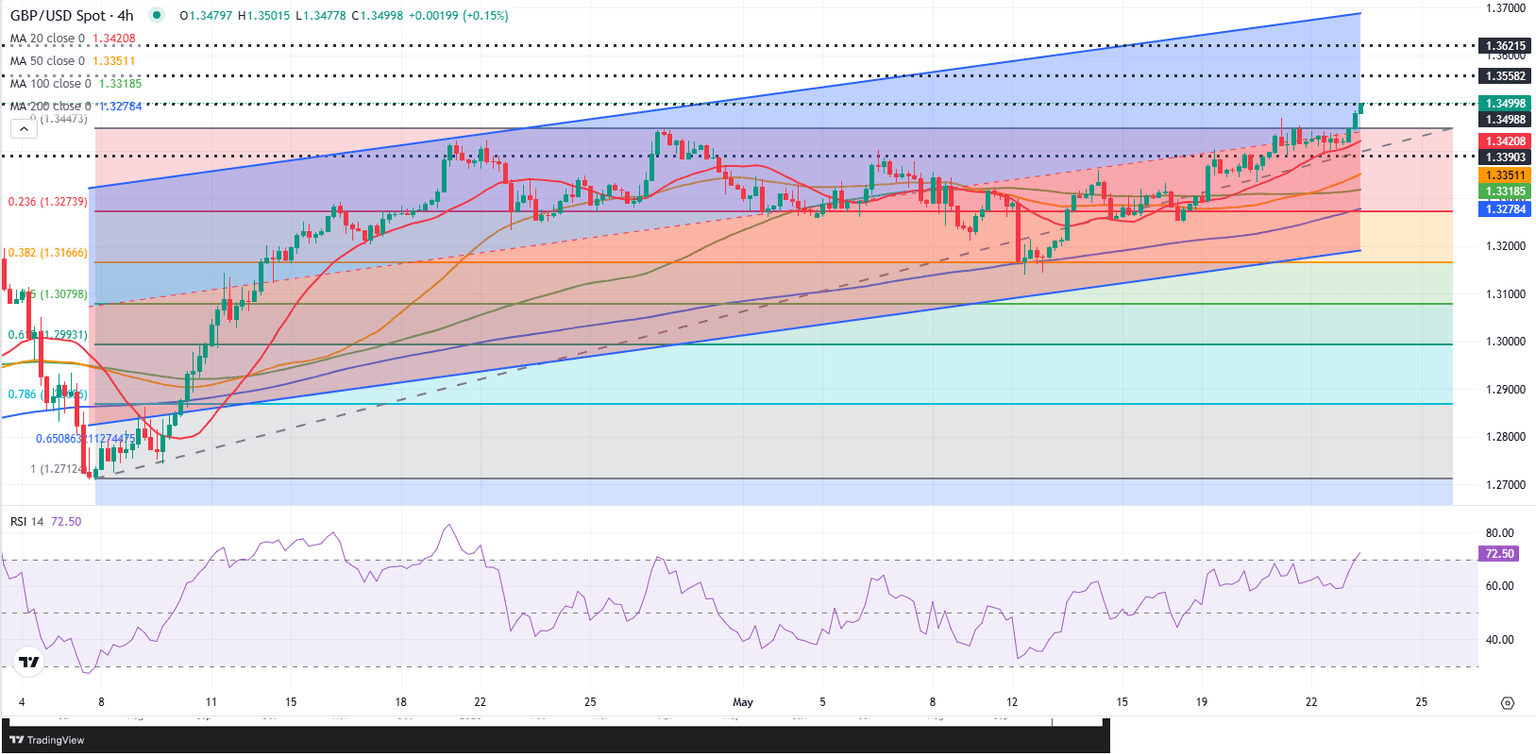

After struggling to find direction on Thursday, GBP/USD extends its weekly uptrend and trades at its highest level since February 2022 near 1.3500 in the European morning on Friday. The technical outlook points to overbought conditions but the pair's correction attempts could remain short-lived.

The UK's Office for National Statistics reported early Friday that Retail Sales rose by 1.2% on a monthly basis in April, following the 0.1% increase recorded in March. This print came in better than the market expectation of 0.2% and boosted Pound Sterling to begin the European session. Read more...

GBP/USD outlook: Cracks 1.3500 barrier and hits a multi-month high on upbeat UK economic data

Cable rose 0.5% on Friday morning and cracked psychological 1.3500, hitting the highest since February 2022. Fresh acceleration higher was sparked by upbeat UK retail sales, which strongly beat forecasts in April and boosted risk sentiment.

Bullish continuation pattern is developing on weekly chart as cable broke through key resistances at 1.3434/44 (2024/2025 tops), with weekly close above these levels to validate the signal. Read more...

-1748007023435.png&w=1536&q=95)

Author

FXStreet Team

FXStreet