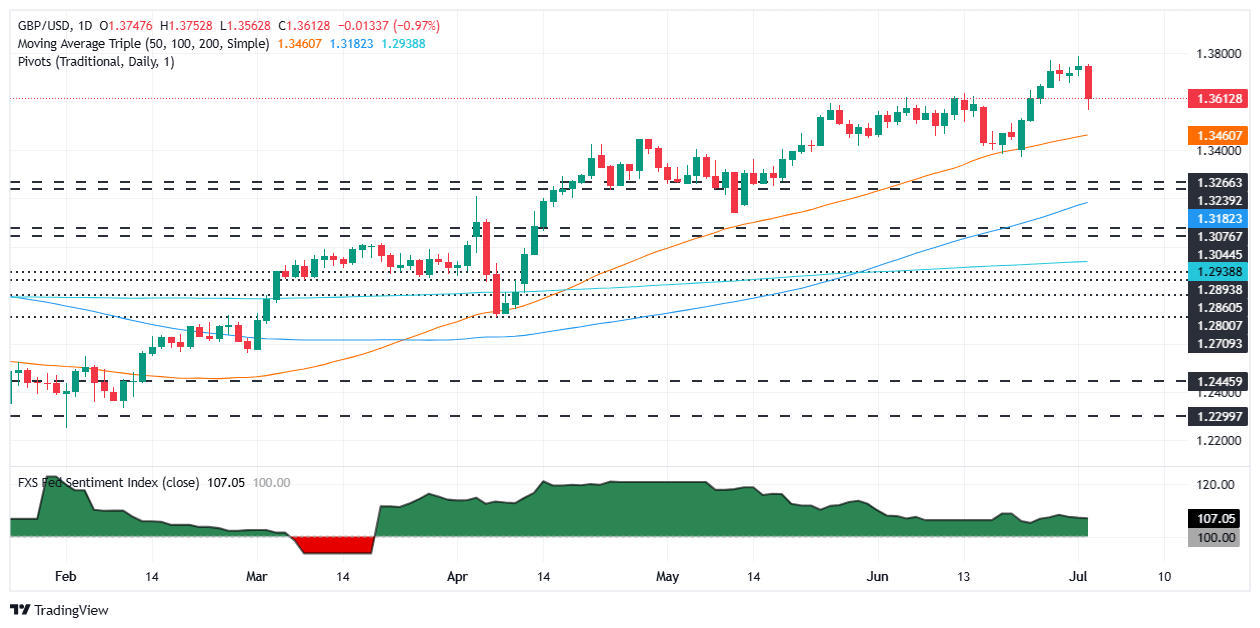

Pound Sterling Price News and Forecast: GBP/USD remains under selling pressure around 1.3625 on Thursday

GBP/USD weakens below 1.3650 amid concerns over the UK debt position, US NFP data in focus

The GBP/USD pair extends the decline to near 1.3625 during the Asian trading hours on Thursday. The Pound Sterling (GBP) faces some selling pressure amid a selloff in British government bonds. Traders will closely watch the US June employment data later on Thursday, including Nonfarm Payrolls (NFP), Unemployment Rate and Average Hourly Earnings.

The British bonds had their biggest selloff since October 2022, after the UK government decided to cut benefits and concerns arose over the finance minister's future. Rising market anxieties over the UK's debt position could exert some selling pressure on the Cable in the near term. Read more...

GBP/USD struggles to regain balance ahead of key labor data

GBP/USD tumbled on Wednesday, falling back below the 1.3600 handle in a sharp plunge fueled by a sharp increase in UK bond yields. Intraday bidding action managed to shave off the worst of the lows, but Cable price action is still poised for further downside as the Pound Sterling and US Dollar race to the bottom.

UK Prime Minister Kier Starmer and his government failed to deliver on welfare cuts, a key principle of his budget proposals to bring UK government financing back under control. PM Starmer also left the possibility of tax hikes on the table, drawing the ire of markets and political critics. Further government instability is on the cards for the UK, as PM Starmer is expected to begin shuffling his cabinet in a move to consolidate and maintain his party’s control in the face of a mucky economic outlook. Read more...

GBP/USD plunges as UK political turmoil rattles markets, Reeves’ future in doubt

GBP/USD plunges as UK political turmoil rattles markets, Reeves’ future in doubt

The Pound Sterling (GBP) plummets sharply, close to over 1% or 170 pips, on Wednesday against the US Dollar (USD) amid growing speculation that the Chancellor of Exchequer, Rachel Reeves, could be replaced by the Prime Minister, Keir Starmer. GBP/USD trades at 1.3610, after hitting a daily low of 1.3562.

Political turmoil is shaping Cable’s path as 50 Labor MPs voted against the government’s welfare reform plan, erasing nearly £5 billion of savings by 2030. According to Reuters, “a rebellion in his own party forced him to strip out a clause that toughened the eligibility criteria for the main disability benefit, eroding all of the bill’s anticipated savings.” Read more...

Author

FXStreet Team

FXStreet