GBP/USD plunges as UK political turmoil rattles markets, Reeves’ future in doubt

- GBP/USD drops 170 pips amid speculation that PM Starmer could replace Chancellor Reeves.

- Labour MP rebellion forces welfare bill changes, erasing £5B in savings; 10-year Gilt yield jumps to 4.68%.

- US ADP shows surprise 33K jobs loss; Trump’s tax bill faces delay, Vietnam trade deal announced.

The Pound Sterling (GBP) plummets sharply, close to over 1% or 170 pips, on Wednesday against the US Dollar (USD) amid growing speculation that the Chancellor of Exchequer, Rachel Reeves, could be replaced by the Prime Minister, Keir Starmer. GBP/USD trades at 1.3610, after hitting a daily low of 1.3562.

Sterling sinks to 1.3562 as rebellion within the Labour Party sparks fiscal concerns

Political turmoil is shaping Cable’s path as 50 Labor MPs voted against the government’s welfare reform plan, erasing nearly £5 billion of savings by 2030. According to Reuters, “a rebellion in his own party forced him to strip out a clause that toughened the eligibility criteria for the main disability benefit, eroding all of the bill’s anticipated savings.”

Speculation that Starmer could sack Reeves sent yields of the 10-year soaring to 4.681%, a 25-basis-point increase, reaching its highest level since October 2022, following Liz Truss's mini-budget. In the meantime, there is growing speculation that Reeves will need to increase taxes at the Autumn Budget or cut spending plans.

Aside from this, data in the United States (US) showed that private companies decreased hiring by 33K in June, according to the ADP National Employment Change report. Meanwhile, investors' eyes turned to the approval of the US President Donald Trump's “One Big Beautiful Bill.”

Bloomberg’s headline, “House Republican Hardliners Warn of a Delay to Tax Vote,” revealed that the leader of a hardline conservative caucus is casting doubts on Trump’s bill. House Freedom Caucus Chairman Andy Harris said, “We could take another week to get this thing right,” adding, “I don’t think it’s going to be ready by July 4.”

The White House revealed that Trump will reunite with members of the Freedom Caucus and multiple groups of House Republicans, a senior administration official said.

In the meantime, Trump announced a trade deal with Vietnam, under which US products could be exported with 0% tariffs, while the US imposed a 20% tariff on Vietnam's goods and 40% duties on transshipment.

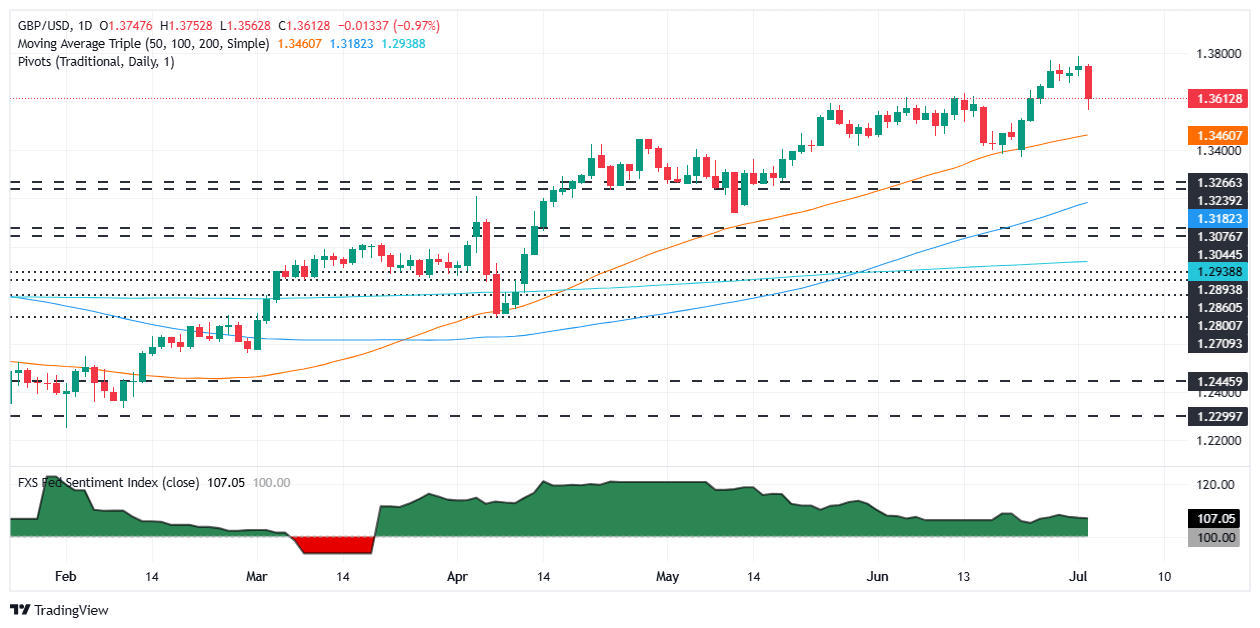

GBP/USD Price Forecast: Technical Outlook

Although the GBP/USD plunged below the 20-day SMA of 1.3590 and hit a six-day low of 1.3562, the pair recovered some ground, trading back above 1.3600. It should be said that the Relative Strength Index (RSI) dropped from around 65 to 54 during the day, but the uptrend remains intact.

If GBP/USD climbs back above 1.3650, expect a recovery to the 1.3700 figure. Otherwise, the pair could be trapped within the 1.3600 – 1.3650 figure in the near term.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.45% | 0.71% | -0.37% | -0.44% | -0.51% | -0.35% | -0.78% | |

| EUR | 0.45% | 1.14% | 0.10% | -0.03% | -0.08% | 0.10% | -0.34% | |

| GBP | -0.71% | -1.14% | -1.23% | -1.16% | -1.21% | -1.04% | -1.46% | |

| JPY | 0.37% | -0.10% | 1.23% | -0.10% | -0.09% | 0.05% | -0.37% | |

| CAD | 0.44% | 0.03% | 1.16% | 0.10% | -0.10% | 0.09% | -0.33% | |

| AUD | 0.51% | 0.08% | 1.21% | 0.09% | 0.10% | 0.17% | -0.26% | |

| NZD | 0.35% | -0.10% | 1.04% | -0.05% | -0.09% | -0.17% | -0.42% | |

| CHF | 0.78% | 0.34% | 1.46% | 0.37% | 0.33% | 0.26% | 0.42% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.