Pound Sterling Price News and Forecast: GBP/USD remains under pressure near a three-month low of around 1.2390

GBP/USD Price Analysis: Remains on the defensive below the 1.2400 mark, UK inflation, Fed rate decision eyed

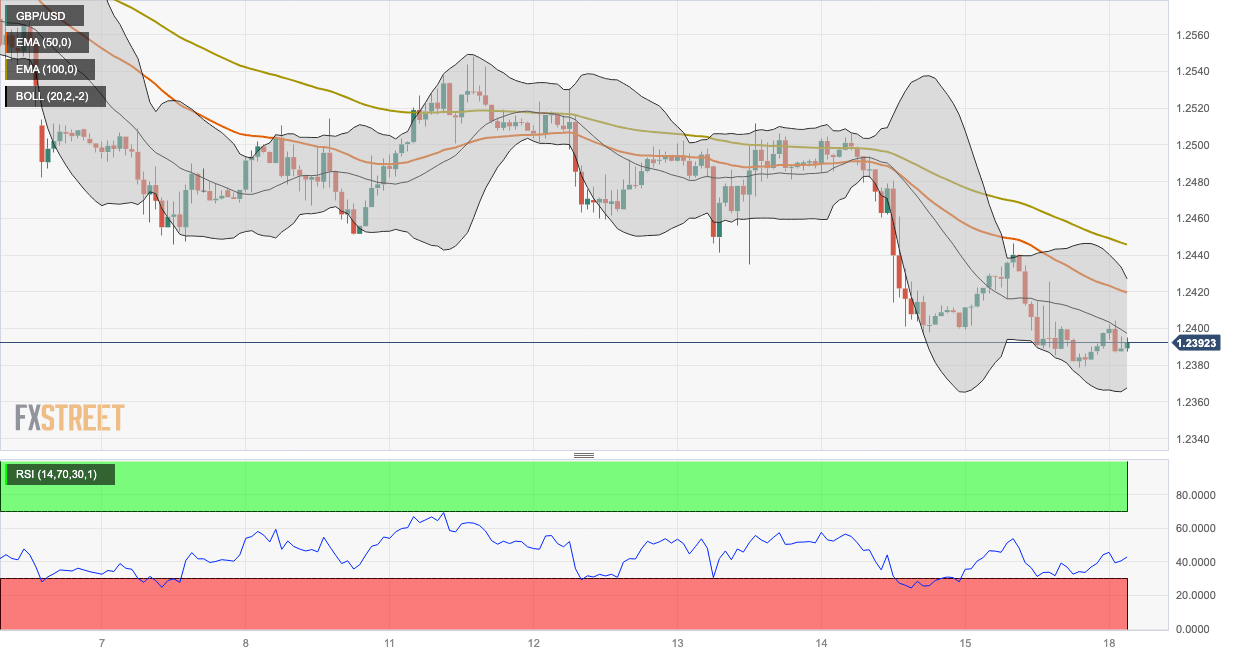

The GBP/USD pair remains on the defensive below the 1.2400 mark during the early Asian trading hours on Monday. The major pair currently trades near 1.2390, up 0.06% on the day. Market players prefer to wait on the sidelines ahead of the key event from this week. On Wednesday, the Federal Reserve (Fed) interest rate decision and the UK Consumer Price Index for August will be due. These events could trigger the volatility in the pair.

From the technical perspective, GBP/USD holds below the 50- and 100-hour Exponential Moving Averages (EMAs) with a downward slope on the one-hour chart, which means further downside looks favorable. Meanwhile, the Relative Strength Index (RSI) stands below 50, within bearish territory, suggesting that sellers are likely to retain control in the near term. Read more...

GBP/USD rebounds from multi-month low on softer USD, lacks follow-through beyond 1.2400

The GBP/USD pair attracts some buying on the first day of a new week and reverses a part of Friday's slide to the 1.2380-1.2375 area, or its lowest level since June. Spot prices currently trade around the 12400 round figure and draw some support from a softer US Dollar (USD), though any meaningful appreciating move still seems elusive.

A generally positive tone around the US equity future fails to assist the safe-haven Greenback to capitalize on its longest weekly winning streak since 2014. The USD downtick could further be attributed to some repositioning trade ahead of this week's key central bank event risk – the outcome of the highly-anticipated two-day FOMC monetary policy meeting starting on Tuesday. The Fed is scheduled to announce its decision on Wednesday and is widely expected to leave interest rates unchanged. Read more...

Author

FXStreet Team

FXStreet