GBP/USD Price Analysis: Remains on the defensive below the 1.2400 mark, UK inflation, Fed rate decision eyed

- GBP/USD remains under pressure near a three-month low of around 1.2390 on Monday.

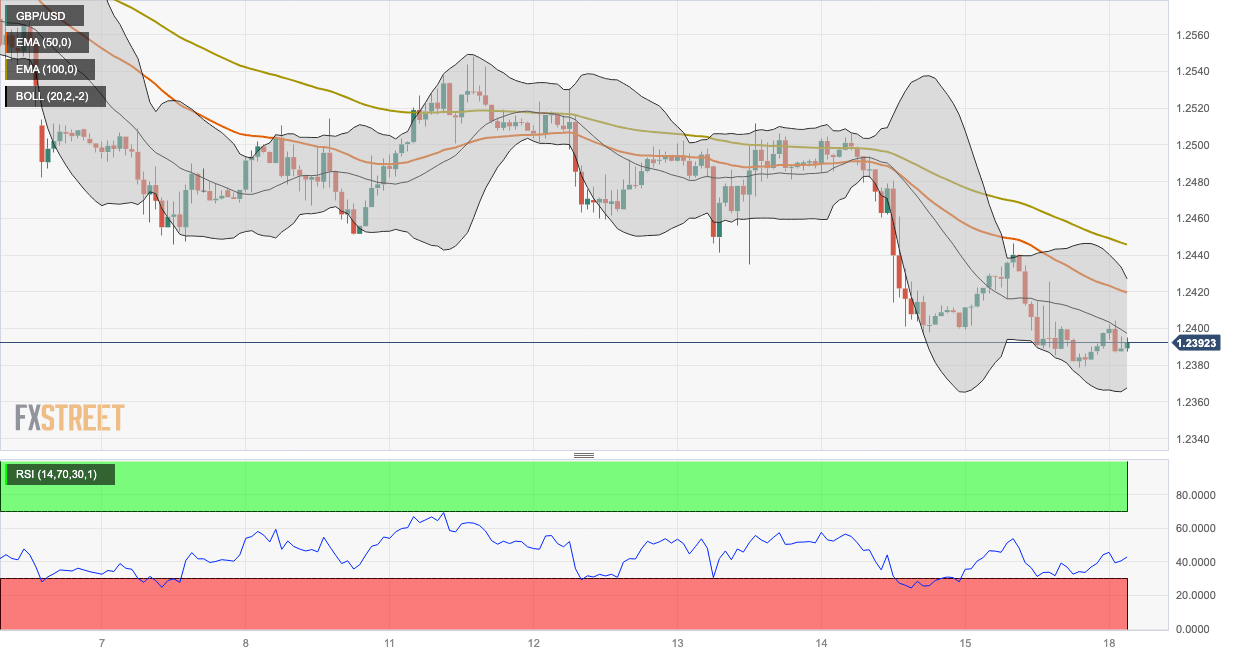

- The pair holds below the 50- and 100-hour EMAs; Relative Strength Index (RSI) stands below 50, within bearish territory.

- The key resistance level is seen near the 1.2420-1.2430 zone; 1.2367 acts as an initial support level.

The GBP/USD pair remains on the defensive below the 1.2400 mark during the early Asian trading hours on Monday. The major pair currently trades near 1.2390, up 0.06% on the day. Market players prefer to wait on the sidelines ahead of the key event from this week. On Wednesday, the Federal Reserve (Fed) interest rate decision and the UK Consumer Price Index for August will be due. These events could trigger the volatility in the pair.

From the technical perspective, GBP/USD holds below the 50- and 100-hour Exponential Moving Averages (EMAs) with a downward slope on the one-hour chart, which means further downside looks favorable. Meanwhile, the Relative Strength Index (RSI) stands below 50, within bearish territory, suggesting that sellers are likely to retain control in the near term.

The key resistance level for GBP/USD is seen near the confluence of the upper boundary of the Bollinger Band and the 50-hour EMA at the 1.2420-1.2430 region. The additional upside filter is located at 1.2445 (the 100-hour EMA). Further north, a psychological round figure at 1.2500 will be the next barrier for the pair, followed by 1.2530 (a high of September 12).

On the downside, any follow-through selling below the lower limit of the Bollinger Band at 1.2367 will see a drop to 1.2350 (a low of May 31). The next contention for the pair emerges near a round mark and a low of May 25 at 1.2300.

GBP/USD one-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.