Pound Sterling Price News and Forecast: GBP/USD remains under bearish pressure

GBP/USD Forecast: Sellers could ignore oversold conditions if US jobs data beat expectations

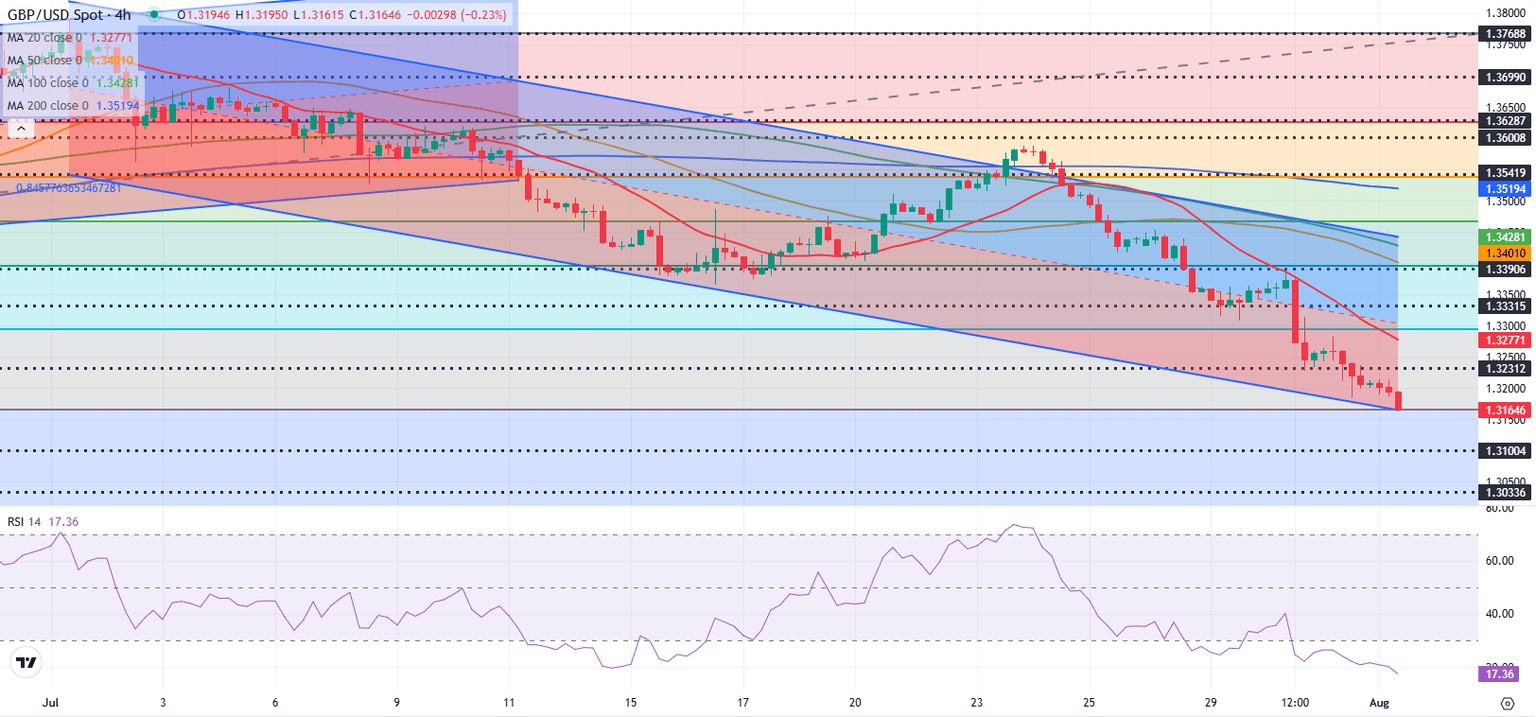

GBP/USD remains under bearish pressure and trades at its weakest level since mid-May below 1.3200 after closing the previous six trading days in negative territory. Although the pair remains oversold in the short term, investors could ignore technical conditions when assessing the July labor market data from the US.

Although the US Dollar (USD) lost its bullish momentum after the strong rally seen on Wednesday, GBP/USD failed to stage a rebound as markets turned risk-averse. US President Donald Trump announced that they raised the tariff rate on Canadian imports to 35% from 25% late Thursday, causing investors to adopt a cautious stance. Early Friday, US stock index futures lose about 1%, suggesting that safe-haven flows continue to dominate the action in financial markets in the European session. Read more...

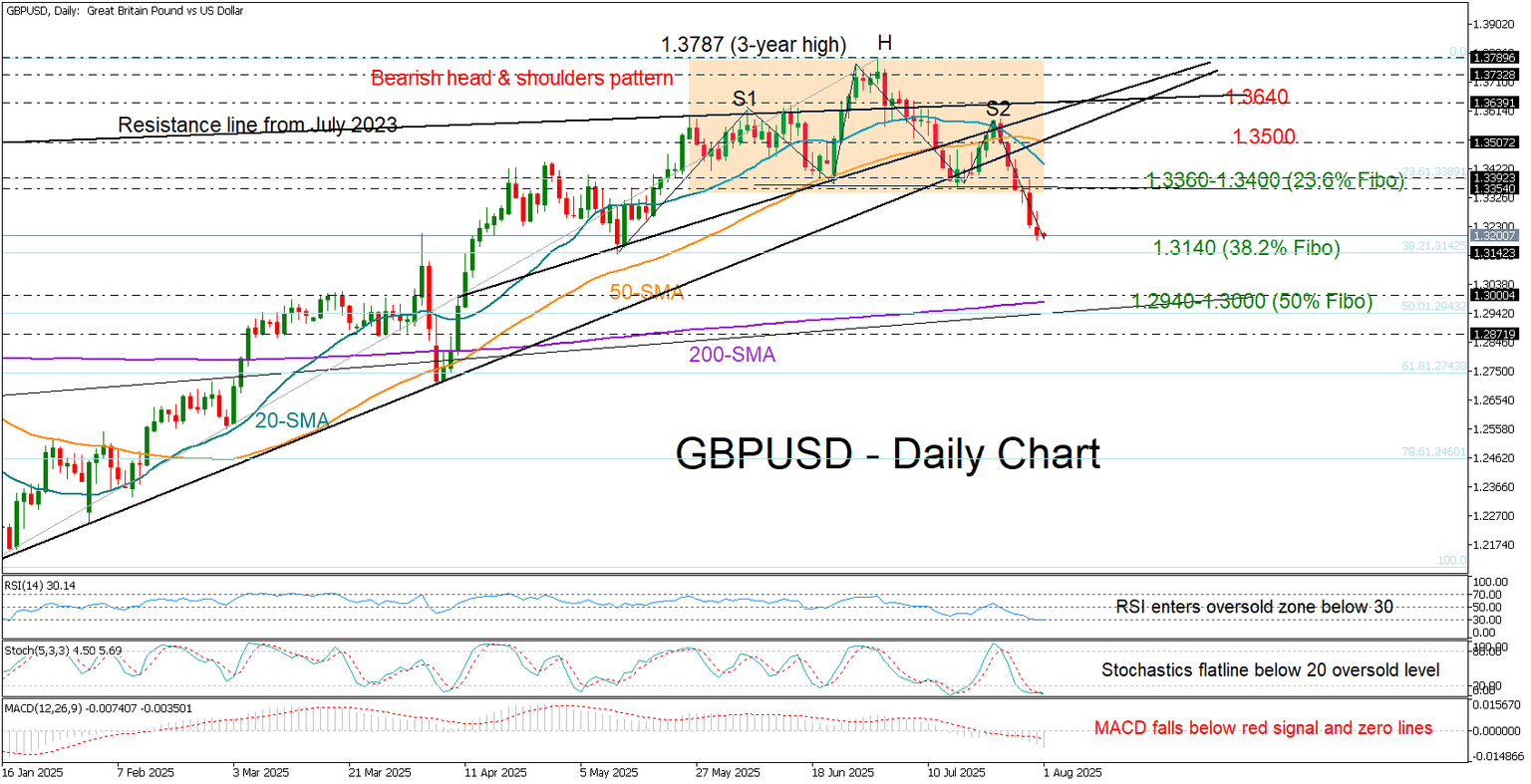

GBP/USD confirms bearish trend reversal

GBP/USD raised alarms over a negative trend reversal after its slide below the 1.3360–1.3400 region confirmed a bearish head and shoulders pattern and cemented a bearish crossover between the 20- and 50-day simple moving averages (SMAs).

With the US dollar roaring back – bolstered by President Trump’s apparent success in recent trade deals and stronger-than-expected US economic data – the British pound succumbed to bearish pressure. Read more...

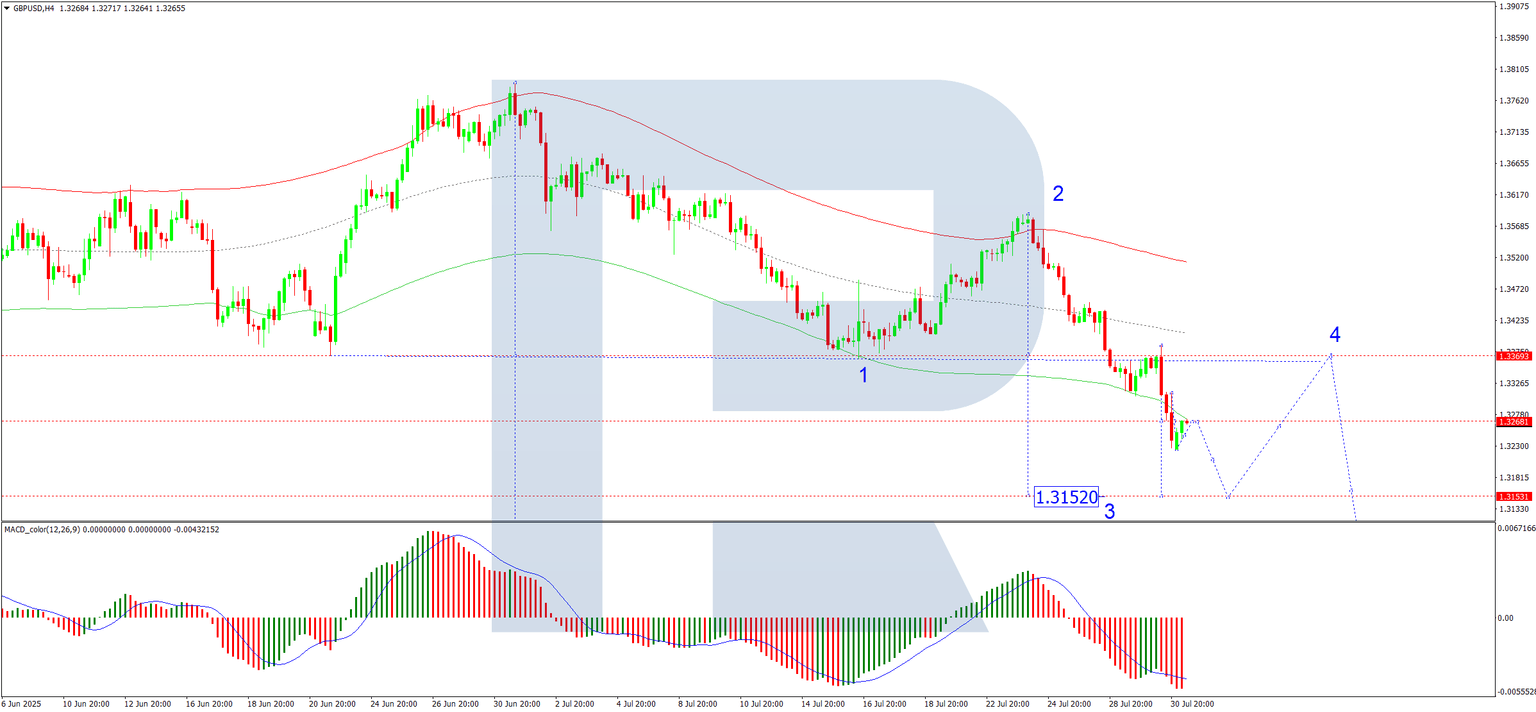

GBP/USD hits lows: Weak UK data and a strong Dollar weigh on the Pound

The GBP/USD pair dropped to 1.3252, its lowest level since 11 May 2025, as a resurgent US dollar and disappointing UK economic data weighed on the pound.

Market sentiment has shifted from concerns about inflation to fears of an economic slowdown, while optimism surrounding new trade agreements has bolstered the dollar. Read more...

Author

FXStreet Team

FXStreet