Pound Sterling Price News and Forecast: GBP/USD remains fragile despite recent rebound

GBP/USD Forecast: Pound Sterling remains fragile despite recent rebound

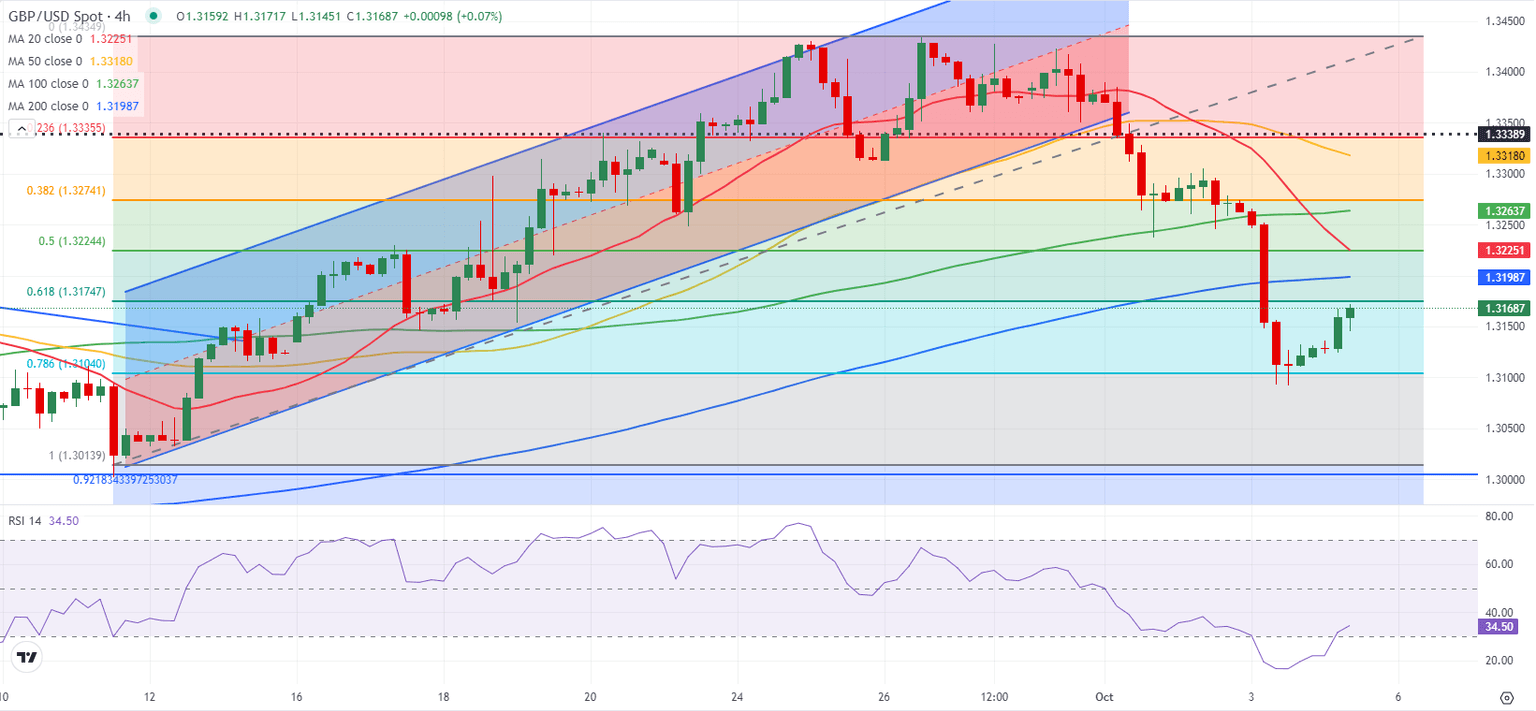

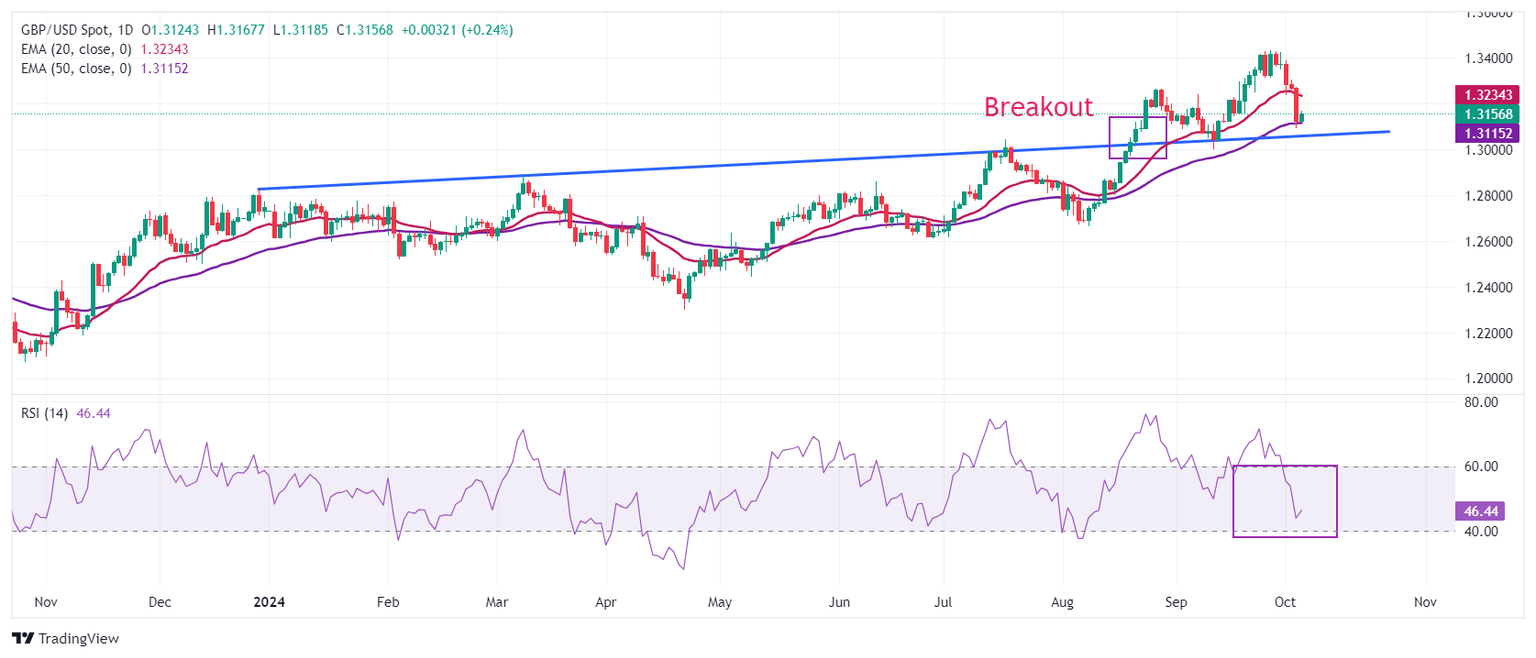

After losing more than 1% on Thursday, GBP/USD stages a rebound and trades in positive territory above 1.3150 in the European session on Friday. The pair's technical picture highlights that the bearish bias remains intact as market focus shifts to the US labor market data.

Dovish comments from Bank of England (BoE) Governor Andrew Bailey triggered a Pound Sterling selloff early Thursday. In the second half of the day, the US Dollar (USD) preserved its strength and didn't allow GBP/USD to stage a rebound after the September ISM Services PMI came in at 54.9, surpassing the market expectation of 51.7. Read more...

Pound Sterling gains with US NFP on the horizon

The Pound Sterling (GBP) outperforms against its major peers on Friday. However, it is expected to face pressure due to tensions between Iran and Israel having converted into a full-fledged war after the assassination of Hezbollah leader Hassan Nasrallah. Oil prices have rallied amid tensions in the Middle East. Historically, a sharp rise in energy prices weighs on the currencies of those economies that rely heavily on imported oil, as it results in higher foreign outflows for them.

Besides that, BoE Governor Andrew Bailey’s commentary on the interest rate outlook on Thursday has also dampened Sterling’s outlook. The comments from Baily in an interview with the Guardian newspaper appeared dovish as he stressed the need to cut interest rates aggressively if price pressures continue to ease. Bailey said the BoE could become "a bit more activist" and "a bit more aggressive" in its approach to lowering rates if there was further welcome news on inflation for the central bank, Reuters reported. Read more...

Author

FXStreet Team

FXStreet