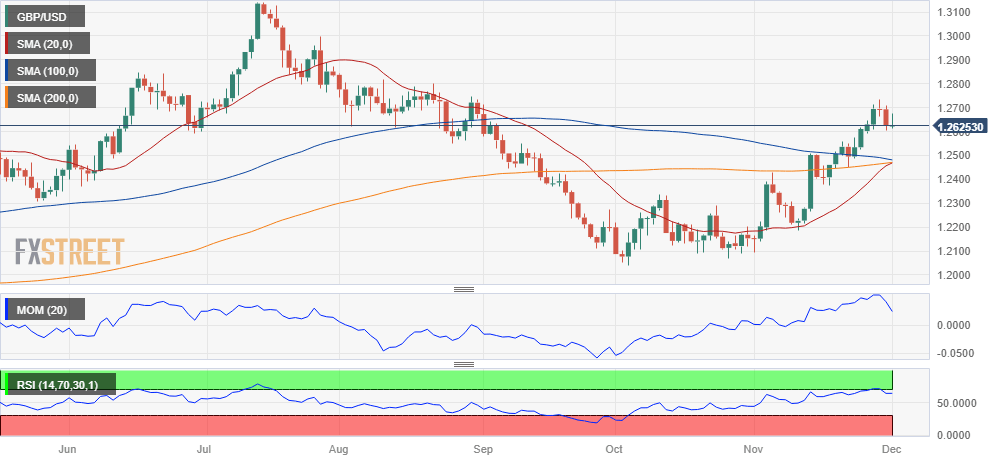

Pound Sterling Price News and Forecast: GBP/USD remains capped below 1.2700, US Services PMI eyed

GBP/USD Weekly Forecast: Pound Sterling set to reach higher highs

The Pound Sterling extended its reigns over the United States Dollar (USD) this week, pushing GBP/USD to the highest level in three months above 1.2700. Traders brace for the US Nonfarm Payrolls (NFP) in the upcoming week, keeping the sentiment around GBP/USD underpinned.

Divergent interest rate outlook between the US Federal Reserve (Fed) and the Bank of England (BoE) helped the Pound Sterling maintain its bullish momentum, as the US Dollar registered its worst month in a year in November. Read more...

GBP/USD remains capped below 1.2700, US Services PMI eyed

The GBP/USD pair holds below the 1.2700 mark during the Asian session on Monday. However, the downside of the pair seems limited as the speculation that the Federal Reserve (Fed) is done with its tightening cycle exerts pressure on the US Dollar (USD) and creates a tailwind for the GBP/USD pair. The major currently trades around 1.2680, down 0.23% on the day.

The markets turned cautious following dovish comments from Fed Chair Jerome Powell on Friday. Traders prefer to wait on the sidelines ahead of the highly-anticipated employment report on Friday that could influence the outlook for US interest rates. Powell stated that it was clear that US monetary policy was slowing the economy as expected, with the benchmark overnight interest rate well into restrictive territory. Read more...

Author

FXStreet Team

FXStreet