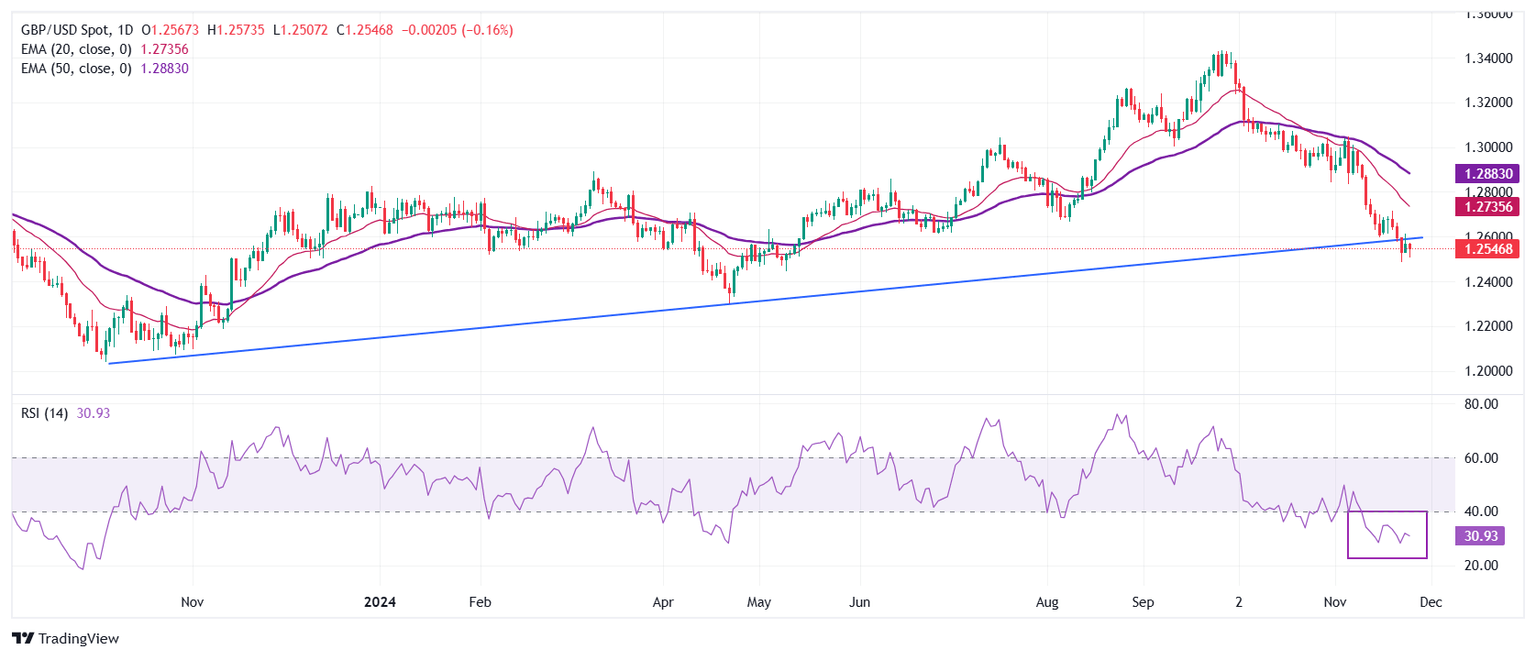

GBP/USD Price Forecast: Recovers after diving to 1.2500 on Trump’s remarks

The Pound Sterling recovered some ground following remarks of US President-Elect Donald Trump late on Monday afternoon, in which he said that once he takes office on January 20, he would impose 25% tariffs on Canada and Mexico and 10% on all Chinese products. This boosted the Greenback against most G8 FX currencies, the Mexican Peso and the Chinese Yuan. As of late, the GBP/USD turned positive in the day after hitting a low of 1.2506, trading at 1.2573.

Read More...

Pound Sterling gains against USD as BoE supports gradual rate-cut approach

The Pound Sterling (GBP) recovers intraday losses and turns positive against the US Dollar (USD) in Tuesday’s North American session after diving near the psychological support of 1.2500 in Asian trading hours. The GBP/USD pair rebounds as the US Dollar surrenders its entire intraday gains after a strong opening.

Read More...

GBP/USD recovers a major part of its intraday losses, climbs back above mid-1.2500s

The GBP/USD pair attracted fresh sellers on Tuesday and dropped to the 1.2500 neighborhood, closer to its lowest level since May 2024 during the Asian session. Spot prices, however, manage to rebound a few pips from the daily trough and currently trade around mid-1.2500s, down just over 0.10% for the day.

Read More...