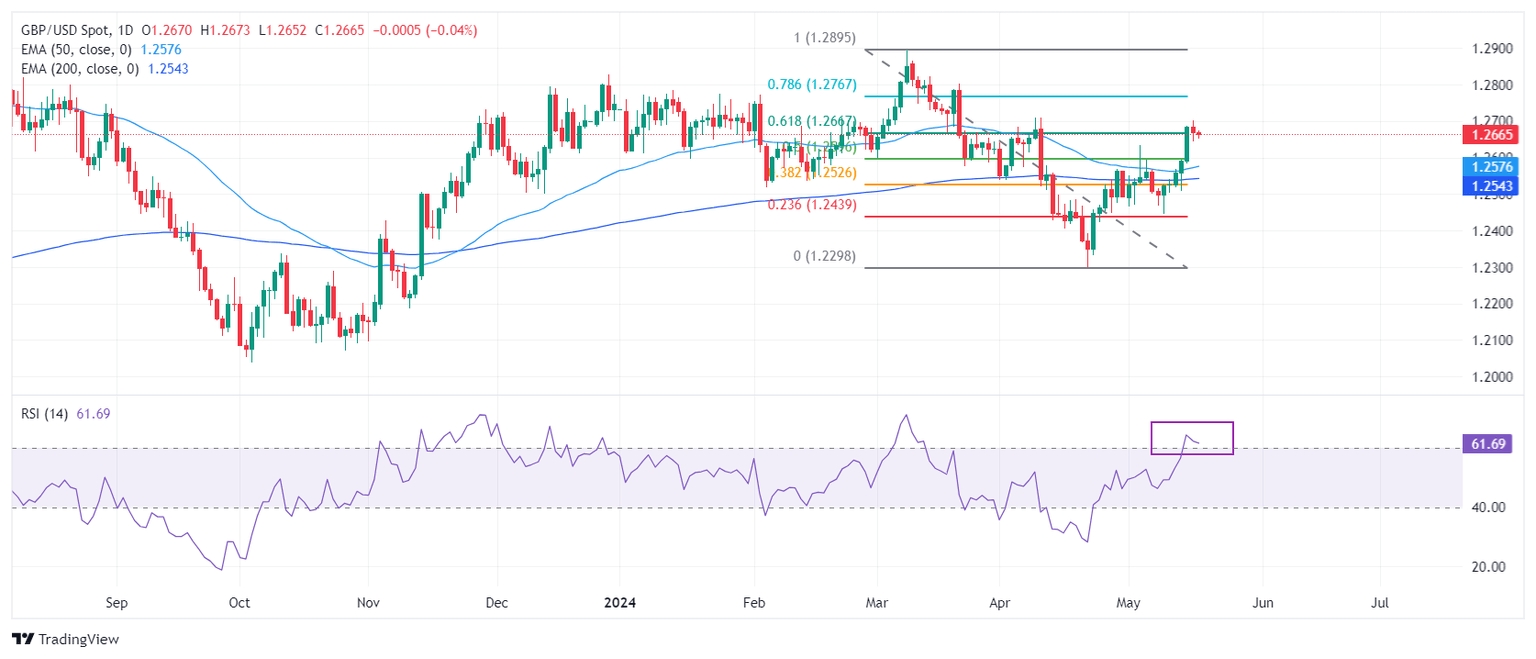

GBP/USD Price Analysis: Rallies toward 1.2700, bulls’ target YTD high

The British Pound registers gains of 0.21% against the US Dollar, although higher US Treasury yields failed to underpin the Greenback. At the time of writing, the

GBP/USD pair trades at 1.2703 after bouncing off a daily low of 1.2644.

Read More...

Pound Sterling clings to gains near 1.2700 although US Dollar stabilizes

The Pound Sterling (GBP) turns sideways in Friday’s American session after posting a fresh monthly high at 1.2700 on Thursday. The GBP/USD pair struggles to extend upside as investors shift focus to the United Kingdom Consumer Price Index (CPI) data for April, which will be published on Wednesday.

Read More...

GBP/USD posts modest gains above 1.2650, focus on the Fedspeak

The

GBP/USD pair posts modest gains near 1.2670 during the early Asian session on Friday. Meanwhile, the USD Index (DXY) recovers some lost ground after retracing to multi-week lows near 104.00 in the previous session. The Federal Reserve (Fed) sticks to cautious tones regarding inflation and the chance of rate cuts this year. Investors will take more cues from the Fed’s Kashkari, Waller, and Daly speeches later in the day.

Read More...