Pound Sterling clings to gains near 1.2700 although US Dollar stabilizes

- The Pound Sterling retraces from 1.2700 as the focus shifts to UK inflation data.

- Investors expect that the BoE could start reducing interest rates in the June or August meeting.

- Fed’s hawkish stance on interest rates boosts US Dollar’s recovery.

The Pound Sterling (GBP) turns sideways in Friday’s American session after posting a fresh monthly high at 1.2700 on Thursday. The GBP/USD pair struggles to extend upside as investors shift focus to the United Kingdom Consumer Price Index (CPI) data for April, which will be published on Wednesday.

The UK inflation data will provide fresh cues about the interest rate outlook. Investors remain divided between the June and the August meeting about when the Bank of England (BoE) could start reducing interest rates.

April’s inflation data is expected to significantly influence the next move in the Pound Sterling as BoE Governor Andrew Bailey said after the release of the March’s CPI data on April 17, “Inflation in the UK will fall near its 2% target next month” and has declined roughly in step with the BOE’s forecast in February. Bailey added, “I expect that next month's number will show quite a strong drop because we have a particularly unique energy to household energy pricing system in the UK,” Bloomberg reported.

Daily digest market movers: Pound Sterling upside stalls as US Dollar rebounds

- The Pound Sterling’s rally to near the round-level resistance of 1.2700 stalls as the market sentiment turns slightly cautious. Federal Reserve (Fed) policymakers push back market expectations for rate cuts despite an expected decline in the United States (US) inflation data for April.

- A slew of Fed policymakers lined up to speak on the interest rate outlook on Thursday. Their commentary suggested that the current interest rate framework is optimal in the present scenario. Policymakers suggested that a one-time decline in inflation figures is insufficient to give them confidence that the disinflation process has continued again after stalling in the first quarter of this year.

- Hawkish commentaries from Fed policymakers have negatively impacted speculation for Fed rate cuts, for which investors expect that the central bank will choose the September meeting as the earliest point. The CME FedWatch tool shows that the probability of interest rates declining from their current levels in September has come down to 68% from 73% recorded after the release of the inflation data.

- The Fed maintaining a stance of higher interest rates for longer has offered some relief to the US Dollar. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, rebounds to 104.66 after posting a fresh monthly low near 104.00 on Thursday but is still on track to close the week in negative.

- Meanwhile, investors’ concerns over US labor market strength deepened further after the Department of Labor showed on Thursday that Initial Jobless Claims for the week ending May 10 were higher-than-expected. The number of individuals claiming jobless benefits for the first time was 222K, above estimates of 220K but lower than the prior reading of 232K, the highest level in eight months.

Technical Analysis: Pound Sterling faces pressure near 1.2700

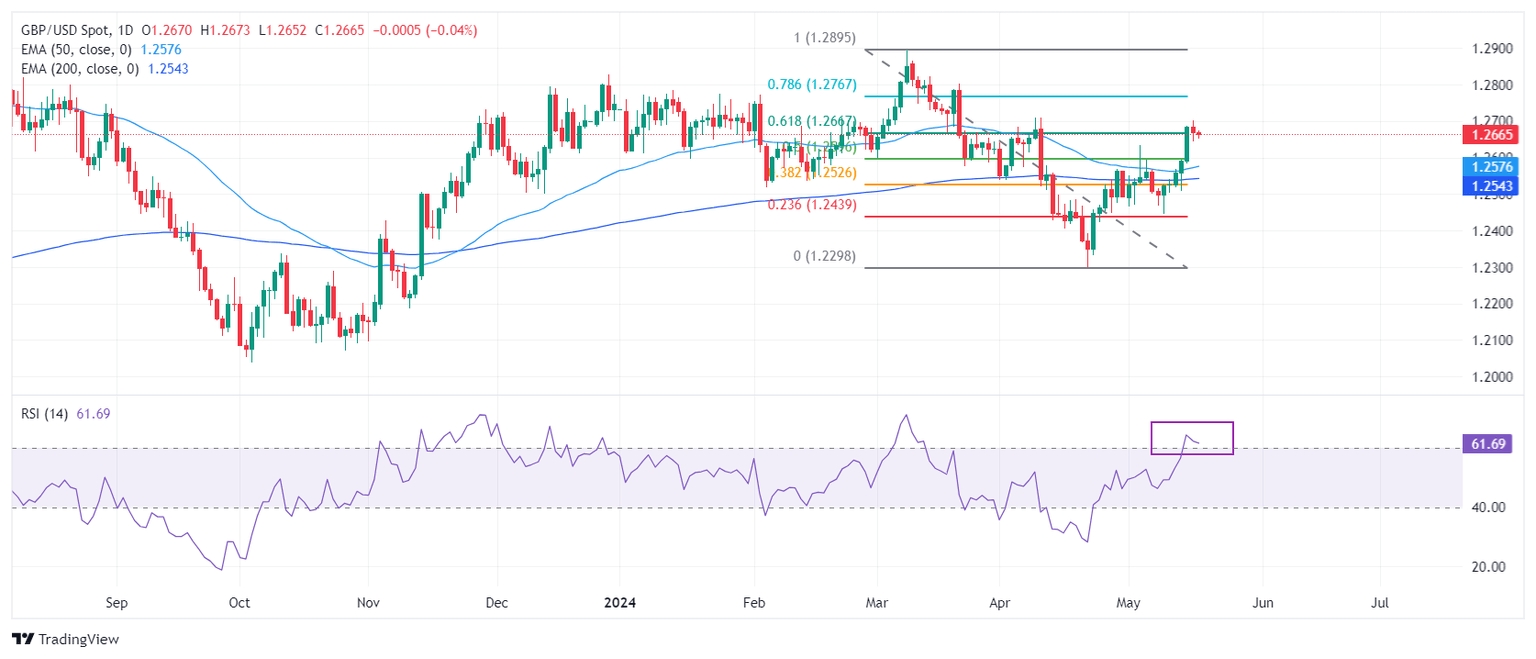

The Pound Sterling advances to the 61.8% Fibonacci retracement (plotted from the March high at around 1.2900 to the April low at 1.2300) at 1.2670 on a daily timeframe. The GBP/USD pair could extend its upside after a decisive break above the round-level resistance of 1.2700.

On the downside, 50-day and 200-day Exponential Moving Averages (EMAs), which trade around 1.2565 and 1.2536, respectively, will be the major support zones for the Pound Sterling

The 14-period Relative Strength Index (RSI) has shifted into the bullish range of 60.00-80.00, suggesting that the momentum has leaned toward the upside.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.