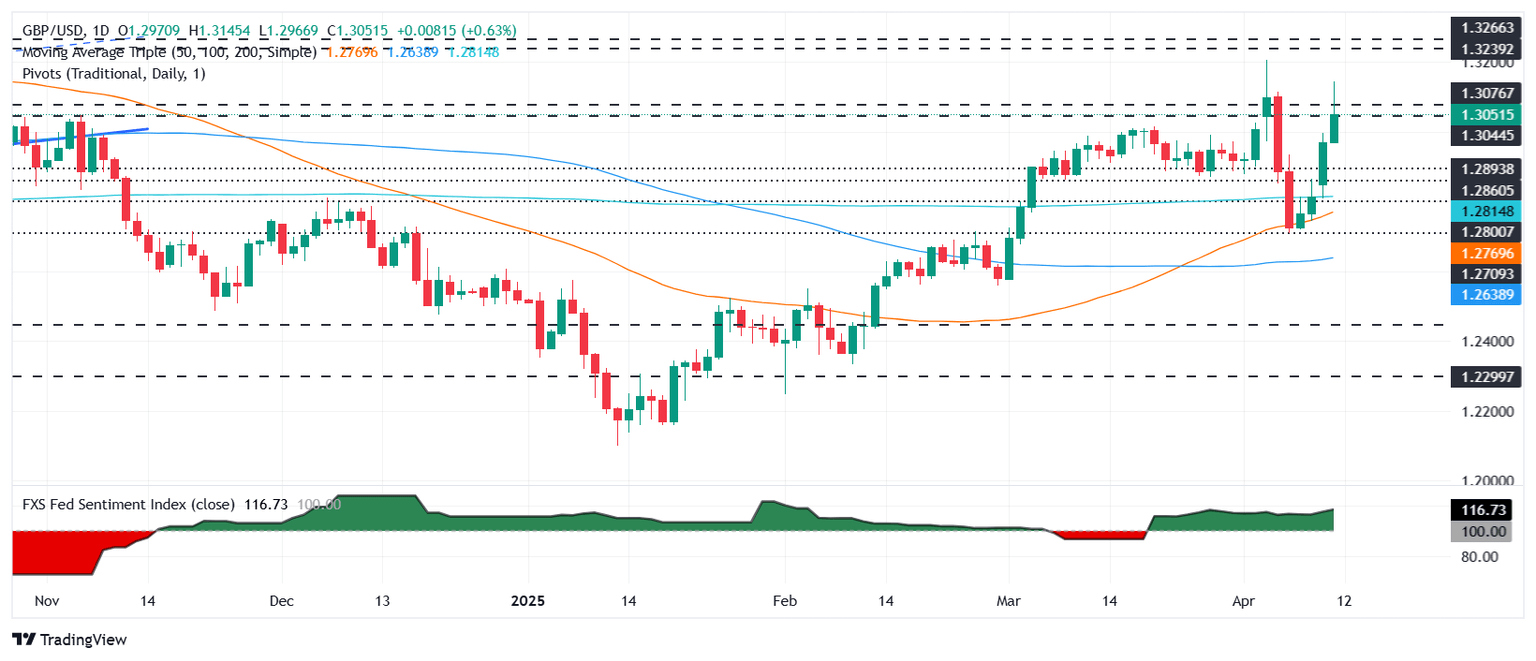

Pound Sterling Price News and Forecast: GBP/USD rallies past 1.3000 as China escalates trade-war with US

GBP/USD rallies past 1.3000 as China escalates trade-war with US

The Pound Sterling (GBP) extends its gains versus the US Dollar (USD) as the US-China trade war escalates, with Beijing imposing 125% tariffs on US goods. Trade policies continue to drive price action, with economic data taking a backseat. At the time of writing, GBP/USD trades at 1.3067, up 0.77%. Read More...

GBP/USD climbs above 1.3100 on persistent USD weakness

After closing the third consecutive day in positive territory on Wednesday, GBP/USD preserves its bullish momentum and rises about 1% on the day at around 1.3100. Read More...

UK GDP rebounds 0.5% MoM in February vs. 0.1% expected

The UK economy expanded in February, with the Gross Domestic Product (GDP) rebounding 0.5% after recording no growth in January, the latest data published by the Office for National Statistics (ONS) showed on Friday. The market forecast was for a 0.1% growth in the reported period.

Meanwhile, the Index of services (February) came in at 0.6% 3M/3M versus January’s 0.4%.

Other data from the UK showed that monthly Industrial and Manufacturing Production jumped by 1.5% and 2.2%, respectively, in February. Both readings better market expectations. Read More...

Author

FXStreet Team

FXStreet