GBP/USD rallies past 1.3000 as China escalates trade-war with US

- China retaliates with 125% tariffs after the US hikes duties to 145%; Beijing calls the move “a joke.”

- US consumer sentiment plunges to 50.8, while short and long-term inflation expectations surge.

- UK GDP beats forecasts with 0.5% February growth, helping offset global uncertainty and bolster the Sterling.

The Pound Sterling (GBP) extends its gains versus the US Dollar (USD) as the US-China trade war escalates, with Beijing imposing 125% tariffs on US goods. Trade policies continue to drive price action, with economic data taking a backseat. At the time of writing, GBP/USD trades at 1.3067, up 0.77%.

GBP/USD jumps 0.77% amid deepening trade war and weak US data; UK growth surprise offers Sterling support

Breaking news revealed that China retaliated against US President Donald Trump's decision to increase duties to 145% on Chinese products. Beijing called the move a “joke” and said it no longer considers them worth matching.

The economic docket revealed that US Consumer Sentiment deteriorated, according to the University of Michigan. The Index dipped from 57.0 to 50.8 in April. Inflation expectations for one year rose from 5% to 6.7%, and for a five-year period, they increased from 4.1% to 4.4%.

The US Producer Price Index (PPI) fell from 3.2% to 2.7% YoY in March, below estimates of 3.3%. Despite this, Core PPI remained above the 3% threshold at 3.3% YoY, below February's 3.5% and lower than forecasts of 3.6%.

Meanwhile, Federal Reserve (Fed) speakers crossed the wires. Minneapolis Neel Kashkari said the CPI report contained good news, though he reaffirmed that inflation remains elevated. Boston Fed Susan Collins said her outlook for the year is higher inflation and slower growth, while St. Louis Fed Alberto Musalem said inflation could climb even as the labor market softens.

Across the pond, the UK economy grew above estimates, rising 0.5% in February, beating economists' estimates and providing some relief for Chancellor Rachel Reeves.

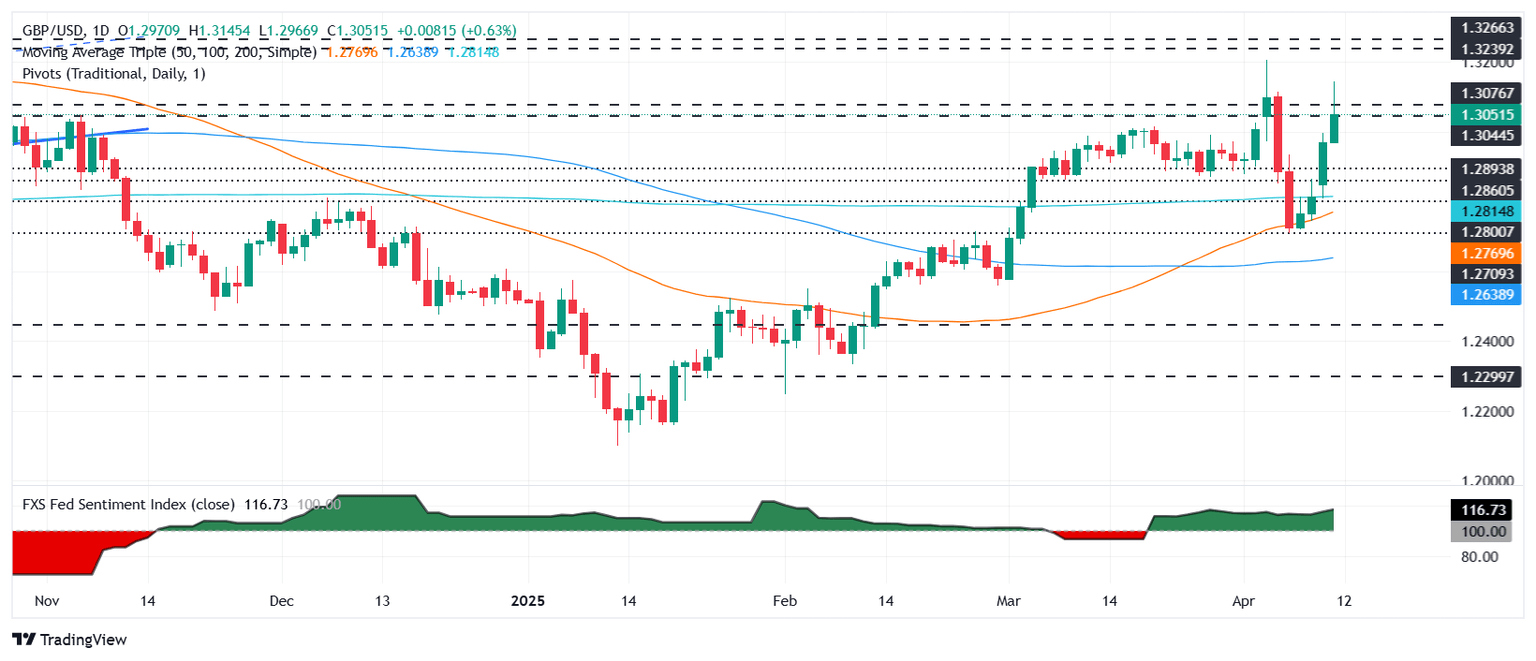

GBP/USD Price Forecast: Technical outlook

Given the backdrop, uncertainty about trade keeps GBP/USD trading above the 1.30 figure. This opens the door to re-testing six-month peaks reached on April 3 at 1.3207, which, once cleared, puts the 1.3300 figure up for grabs. The Relative Strength Index (RSI) shows that buyers are gathering momentum.

On the other hand, if GBP/USD retreats below 1.30, immediate support emerges at April 11 daily low of 1.2968. A breach of the latter will expose 1.2900 and the 200-day Simple Moving Average (SMA) at 1.2815.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -3.23% | -1.27% | -1.38% | -2.44% | -3.04% | -3.57% | -4.63% | |

| EUR | 3.23% | 2.32% | 2.57% | 1.45% | 0.12% | 0.26% | -0.84% | |

| GBP | 1.27% | -2.32% | -1.05% | -0.85% | -2.12% | -2.01% | -3.09% | |

| JPY | 1.38% | -2.57% | 1.05% | -1.06% | -0.74% | -1.03% | -2.98% | |

| CAD | 2.44% | -1.45% | 0.85% | 1.06% | -0.95% | -1.15% | -2.51% | |

| AUD | 3.04% | -0.12% | 2.12% | 0.74% | 0.95% | 0.12% | -0.98% | |

| NZD | 3.57% | -0.26% | 2.01% | 1.03% | 1.15% | -0.12% | -1.10% | |

| CHF | 4.63% | 0.84% | 3.09% | 2.98% | 2.51% | 0.98% | 1.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.