Pound Sterling Price News and Forecast: GBP/USD plunges as UK political turmoil rattles markets

GBP/USD plunges as UK political turmoil rattles markets, Reeves’ future in doubt

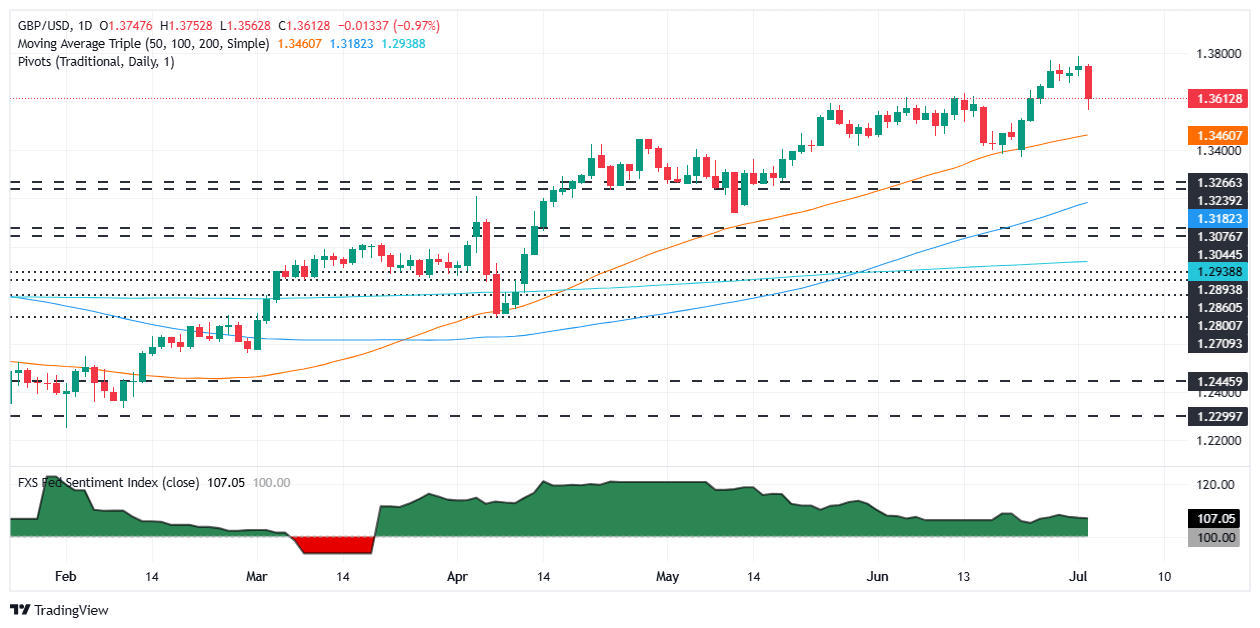

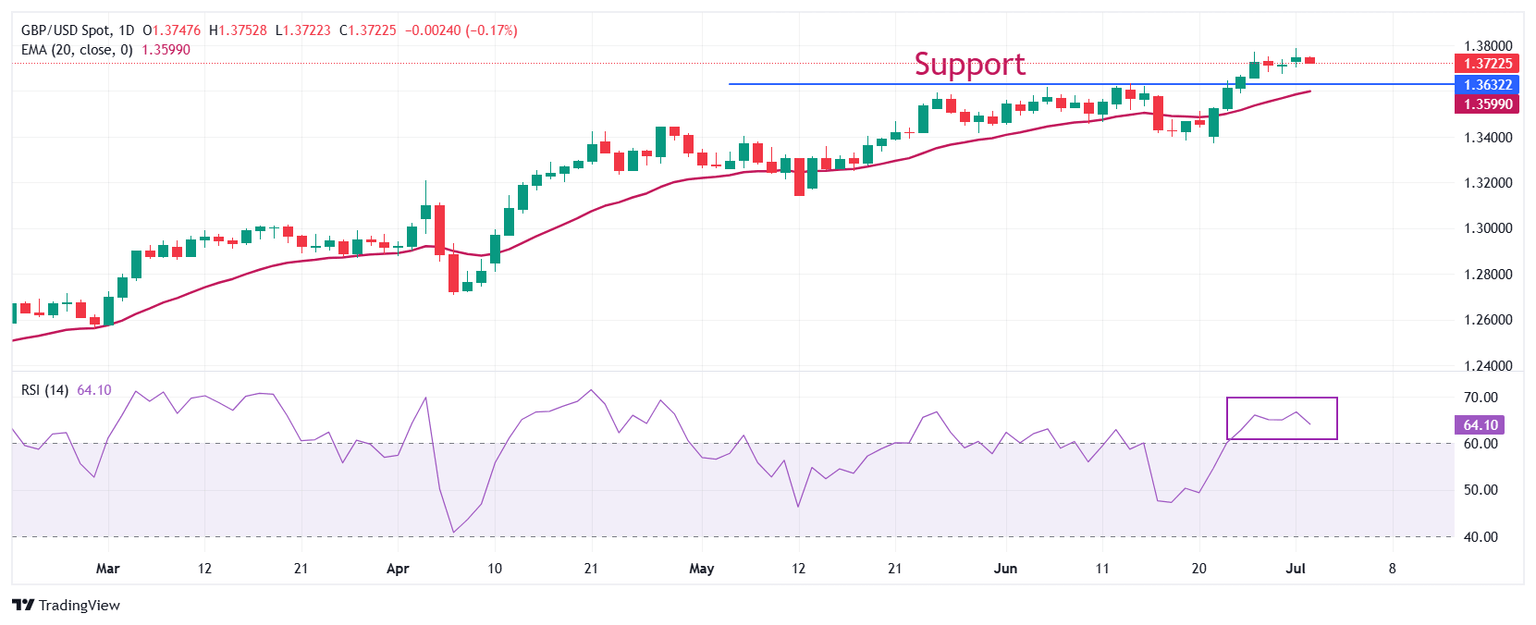

The Pound Sterling (GBP) plummets sharply, close to over 1% or 170 pips, on Wednesday against the US Dollar (USD) amid growing speculation that the Chancellor of Exchequer, Rachel Reeves, could be replaced by the Prime Minister, Keir Starmer. GBP/USD trades at 1.3610, after hitting a daily low of 1.3562. Read More...

GBP/USD slumps over 1% as UK political turmoil triggers market sell-off

The British Pound (GBP) weakens against the US Dollar (USD) on Wednesday, with GBP/USD sliding over 1% on the day from its highest level since October 2021. The pair is trading near 1.3593 during the American session, as political and fiscal jitters weigh on Sterling sentiment. Read More...

Pound Sterling trades lower against US Dollar ahead of US ADP Employment data

The Pound Sterling (GBP) corrects to near 1.3700 against the US Dollar (USD) during the European trading session on Wednesday from the fresh three-and-a-half-year high around 1.3800 posted the previous day. The GBP/USD pair faces selling pressure as the United States (US) currency gains ground, following upbeat JOLTS Job Openings data for May. Read More...

Author

FXStreet Team

FXStreet