Pound Sterling Price News and Forecast: GBP/USD pauses after last week’s hawkish-BoE-inspired strong move up

GBP/USD Weekly Forecast: Pound Sterling stages comeback ahead of key US/ UK data

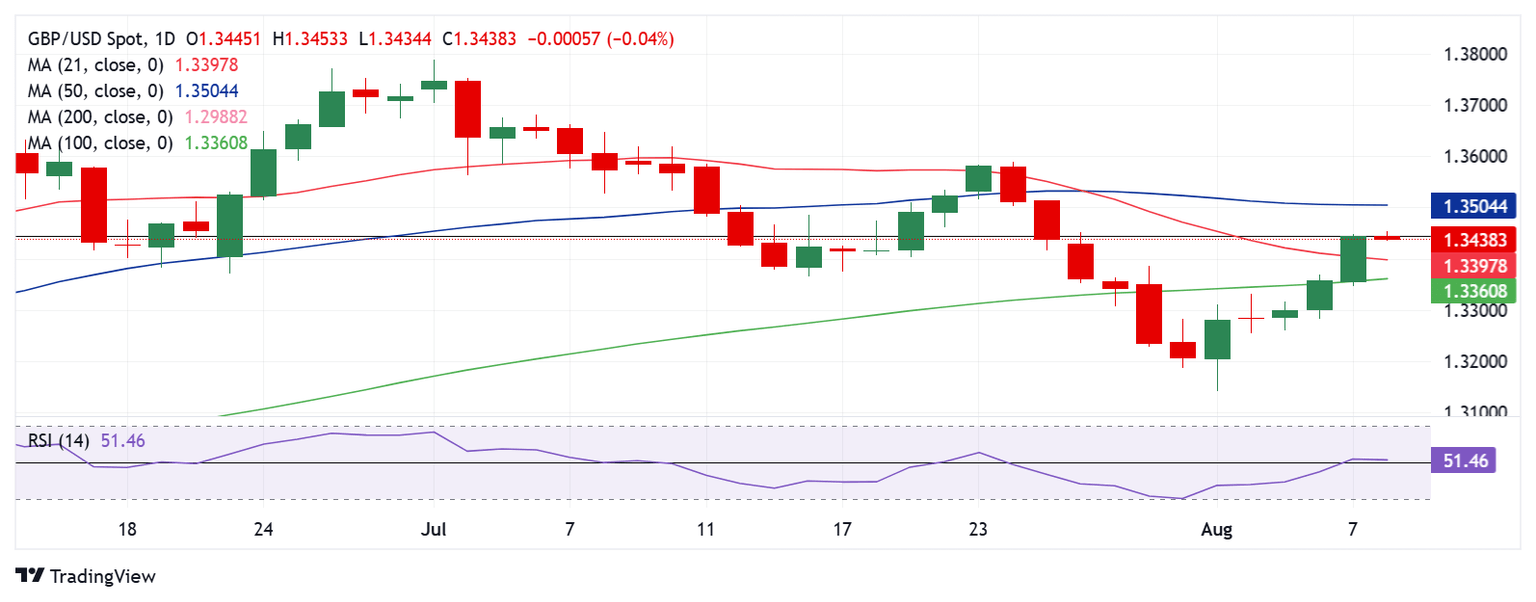

The Pound Sterling (GBP) gradually recovered ground against the US Dollar (USD), lifting GBP/USD from three-month lows to ten-day highs near 1.3500. The GBP/USD pair received a double-booster shot in the past week, which helped it to stage a decent comeback, recording its best weekly performance since late June.

The July American labor data disappointment and a slowdown in the services sector intensified concerns over US economic prospects, doubling down on expectations that the Fed will lower interest rates in September. Traders are pricing in a 93% chance of a rate cut in September, with at least two rate cuts priced in by the end of the year, the CME Group’s Fed Watch Tool showed. Read more...

GBP/USD consolidates just below mid-1.3400s; bullish potential seems intact

The GBP/USD pair kicks off the new week on a subdued note and consolidates its recent goodish recovery gains from the 1.3140 area, or the lowest level since April 14, touched earlier this month. Spot prices trade just below mid-1.3400s during the Asian session, nearly unchanged for the day, though the fundamental backdrop seems tilted in favor of bullish traders.

The Bank of England (BoE), as was widely expected, delivered a 25-basis-point (bps) rate cut last week, bringing the benchmark interest rate down to 4%, its lowest level since 2023. However, the narrow 5–4 vote split suggested more resistance to rate cuts than markets had expected and forced traders to scale back their bets on aggressive BoE easing. This might continue to underpin the British Pound (GBP), which, along with subdued US Dollar (USD) price action, acts as a tailwind for the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet