GBP/USD Weekly Forecast: Pound Sterling stages comeback ahead of key US/ UK data

- The Pound Sterling rebounded firmly from three-month lows against the US Dollar.

- GBP/USD buyers await the US CPI inflation, UK jobs, and GDP data for fresh impetus.

- The daily technical setup shows the tide has turned in favor of the major.

The Pound Sterling (GBP) gradually recovered ground against the US Dollar (USD), lifting GBP/USD from three-month lows to ten-day highs near 1.3500.

Pound Sterling witnessed a bullish reversal

The GBP/USD pair received a double-booster shot in the past week, which helped it to stage a decent comeback, recording its best weekly performance since late June.

The July American labor data disappointment and a slowdown in the services sector intensified concerns over US economic prospects, doubling down on expectations that the Fed will lower interest rates in September.

Traders are pricing in a 93% chance of a rate cut in September, with at least two rate cuts priced in by the end of the year, the CME Group’s Fed Watch Tool showed.

This dovish narrative remained a drag on the US Dollar, while the latest tariff announced by US President Donald Trump on its major trading partners accentuated economic worries and the Greenback’s weakness.

A Financial Times (FT) report on Thursday, citing a letter from Customs and Border Protection, stated that the United States (US) has imposed tariffs on imports of one-kilo Gold bars.

Earlier on Thursday, Trump's higher reciprocal tariffs on imports from dozens of countries took effect, with heavy levies on Switzerland, Brazil, and India. The US president also threatened additional tariffs on China and Japan against their oil imports from Russia after charging India with an extra 25% tariff.

Mounting tensions over the Fed’s appointments and, therefore, its independence exacerbated the USD’s pain, aiding the pair’s recovery.

Trump nominated Council of Economic Advisers Chairman Stephen Miran to replace Fed Governor Adriana Kugler. Miran is also seen replacing Jerome Powell when his term ends in May 2026, according to some industry experts.

On the Pound Sterling side of the equation, buyers capitalized on the hawkish Bank of England’s (BoE) split vote of 5:4 in favor of a rate cut on Thursday instead of a 7:2 composition expected.

The BoE delivered on the expected 25 bps rate cut from 4.25% to 4% on ‘Super Thursday, with the vote split showing policymakers remained concerned about still high inflation, even as it cut rates.

According to Goldman Sachs, the vote split in the BoE meeting "implies one of the most hawkish versions of a 25 bps cut that reasonably could have been expected.”

Expectations of the divergence in the monetary policy outlooks between the Fed and the BoE provided legs to the GBP/USD recovery rally.

Watch out for top-tier US and UK economic data

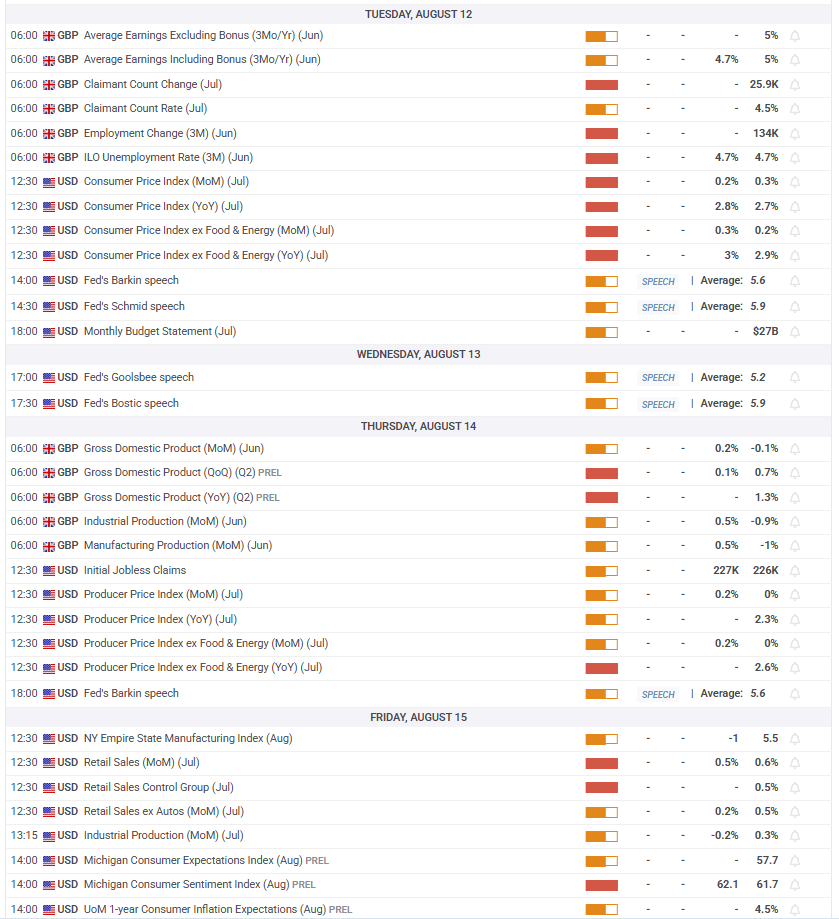

With the BoE event risk out of the way and Trump’s tariff on almost all US trading partners in effect, attention turns to high-impact economic data releases from both sides of the Atlantic.

Monday is a quiet one, setting the stage for a terrific Tuesday as volatility will likely ramp on the UK jobs report and the US Consumer Price Index (CPI) data publications.

On Wednesday, speeches from a bunch of Fed policymakers will fill in an otherwise light data docket.

Traders will eagerly await the preliminary second-quarter Gross Domestic Product (GDP) data of the British economy alongside Industrial Production and Trade figures.

Later that day, the US calendar will feature the Producer Price Index (PPI) inflation data and the usual weekly Jobless Claims.

The Chinese Retail Sales and Industrial Production data will garner some attention early Friday before the release of the US Retail volumes data. The preliminary Michigan Consumer Sentiment and Inflation Expectations data will also be closely scrutinized.

Even as the focus returns to fundamentals, trade headlines will continue to play a pivotal role in driving the GBP/USD price action.

GBP/USD: Technical Outlook

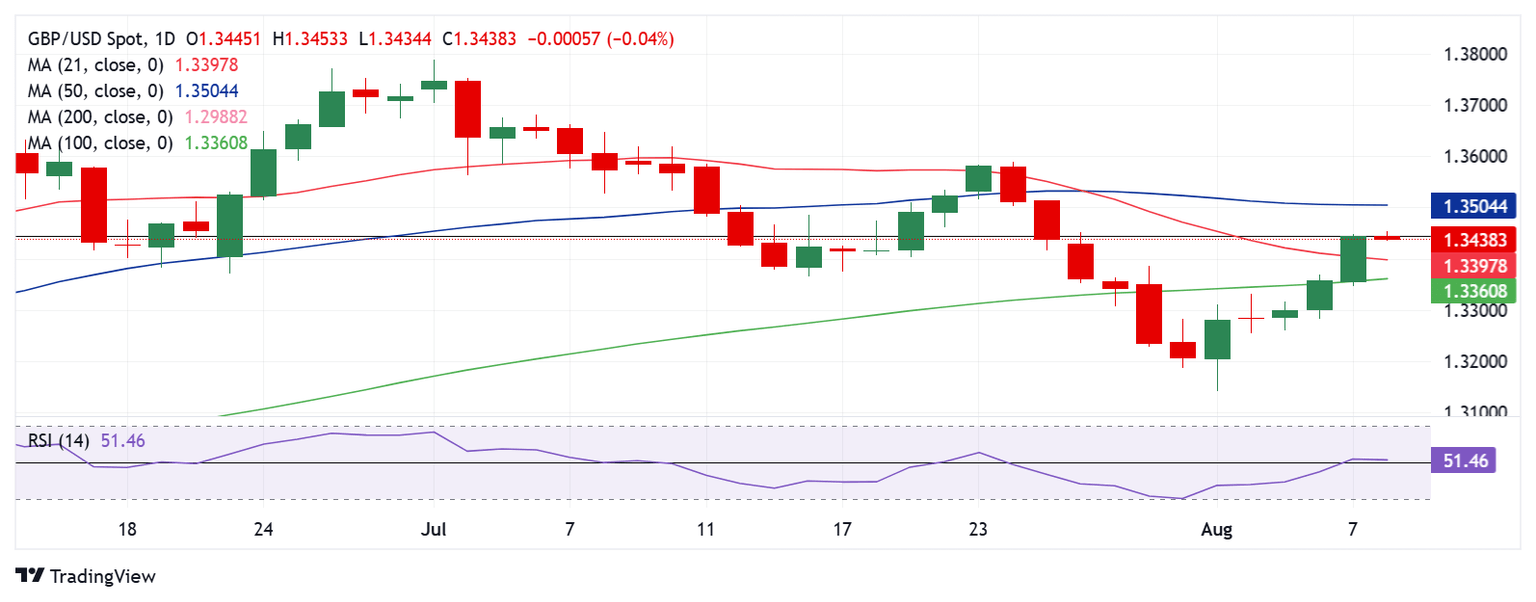

GBP/USD’s daily chart shows that the late July sell-off from the 21-day Simple Moving Average (SMA) lost momentum as dip-buying emerged near the 1.3200 region.

Amid renewed buying interest, the pair recaptured the 100-day SMA and 21-day SMA supports-turned-resistances, now at 1.3360 and 1.3398, respectively.

However, buyers are battling the April 29 high of 1.3445, at the moment, yearning for acceptance above that level on a weekly closing basis.

If that happens, a run back above the 50-day SMA at 1.3504 cannot be ruled out.

Further north, the July 24 high of 1.3589 will be put to the test, above which the next bullish target is located at the 1.3700 round level.

The 14-day Relative Strength Index (RSI) is sitting listlessly above the midline, suggesting that the pair's recovery will likely have legs in the near term.

In case sellers fight back control, strong support is seen at 1.3360, the 100-day SMA.

A breach of the latter will refuel the downside toward the multi-month lows of 1.3141.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.