Pound Sterling Price News and Forecast: GBP/USD – Minor degree wave four may be unfolding

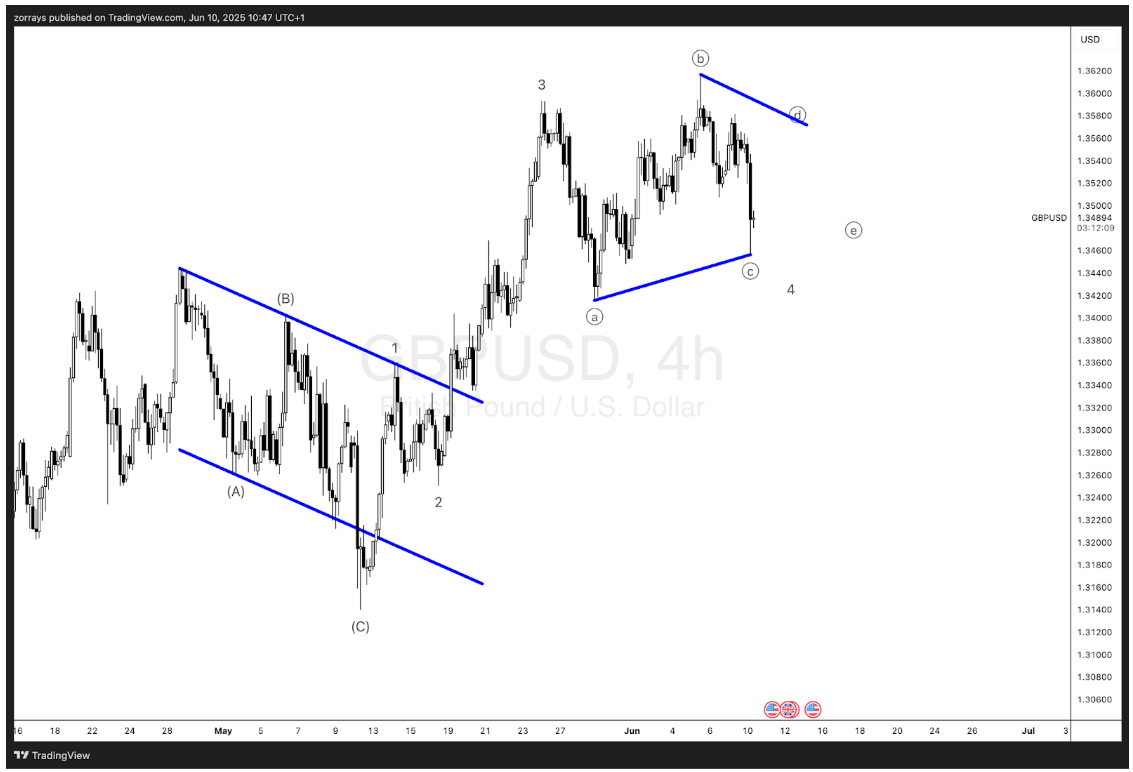

GBP/USD: Minor degree wave four may be unfolding as a triangle

After reviewing the latest price action in GBP/USD, it's clear that I initially got one degree ahead of myself. What appeared to be a higher-degree move now looks more like price action unfolding within a minor degree wave 4 of the larger impulsive wave (1).

The wave count has become clearer following a clean five-wave advance up to wave 3, which has been followed by a notable slowdown in momentum. This slowdown is typical of wave 4 behavior—particularly in the form of a running triangle, as we may be seeing right now. Read more...

GBP/USD Forecast: Pound Sterling turns fragile after UK employment data

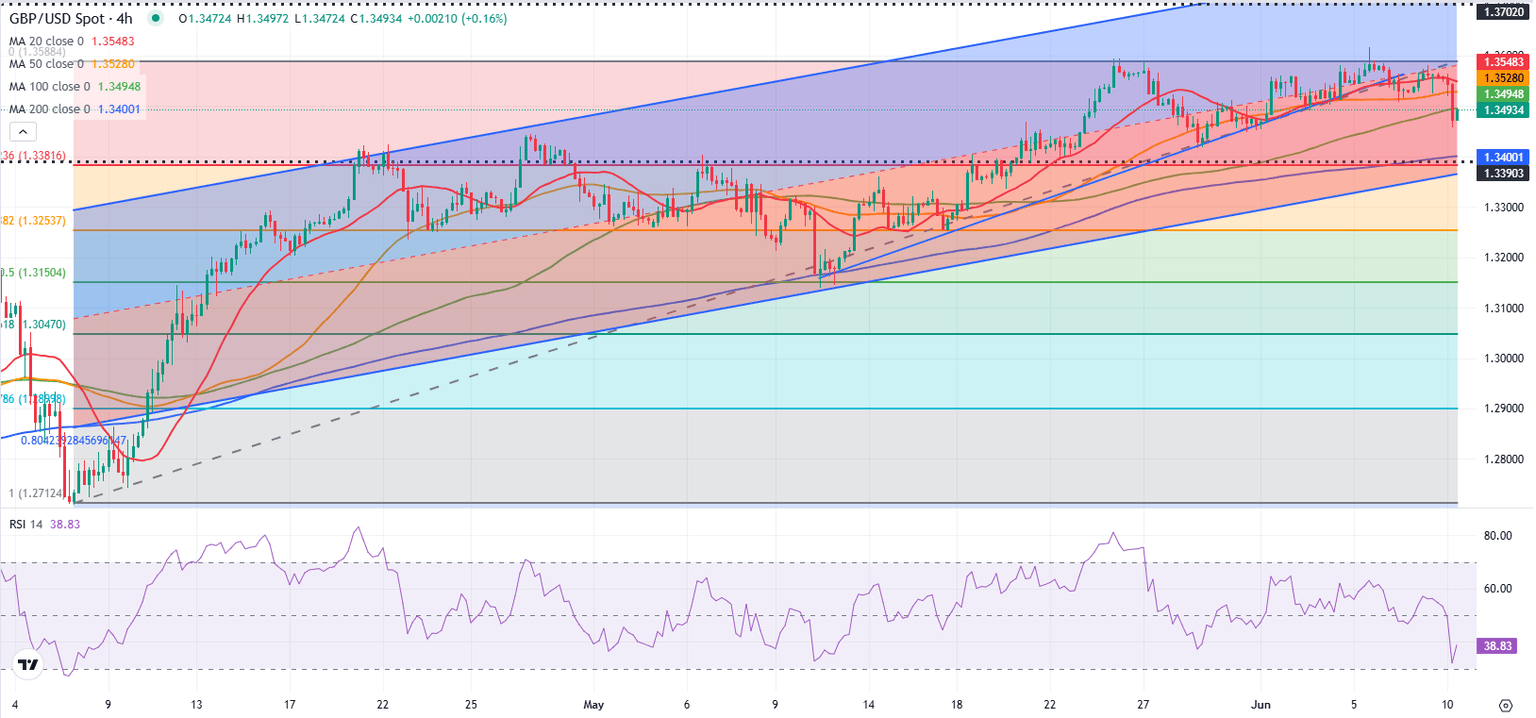

GBP/USD stays under heavy bearish pressure on Tuesday and trades below 1.3500 as Pound Sterling struggles to find demand after the April employment report. The technical outlook suggests that the pair could extend its slide in the near term.

The UK's Office for National Statistics reported on Tuesday that the ILO Unemployment Rate rose to 4.6% in the three months to April. This marked the highest reading since June 2021. Other details of the report showed that the annual wage inflation, as measured by the change in the Average Earnings Excluding Bonus, softened to 5.2% from 5.5%. This print came in below the market expectation of 5.4%. Pound Sterling struggles to find demand as investors assess the rising unemployment level and softer wage inflation as important factors that could lead to more Bank of England (BoE) rate cuts later this year. Read more...

Author

FXStreet Team

FXStreet