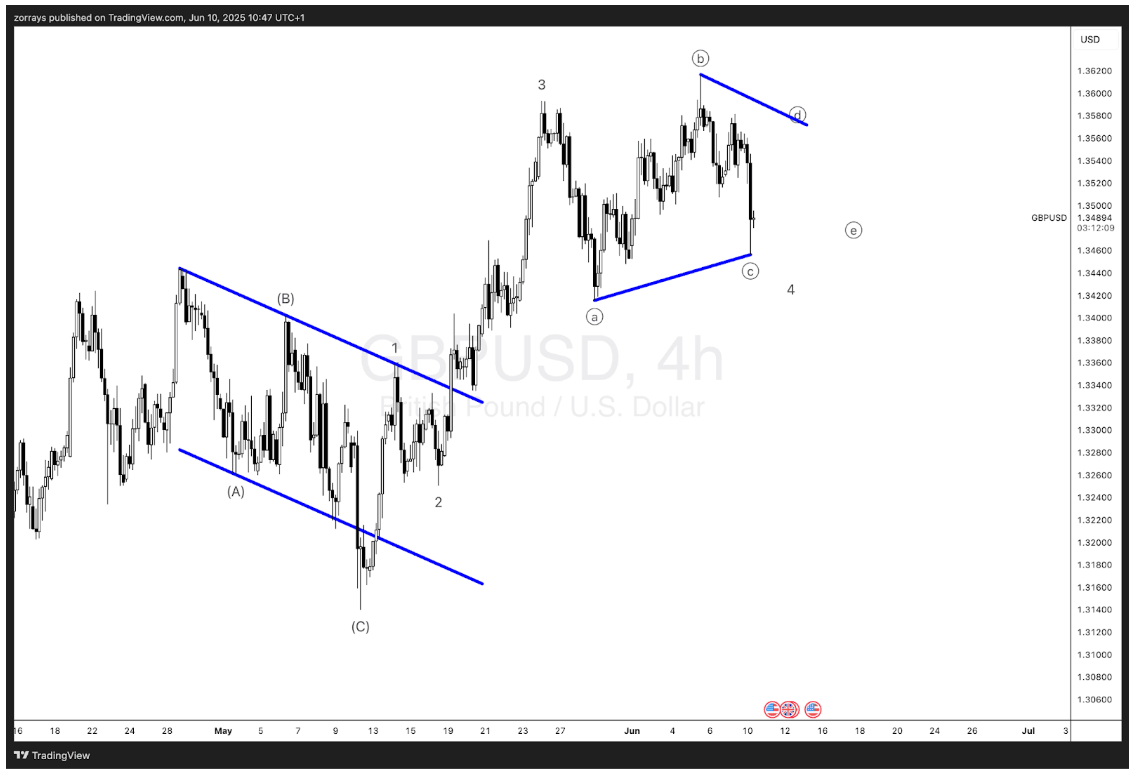

GBP/USD: Minor degree wave four may be unfolding as a triangle

After reviewing the latest price action in GBP/USD, it's clear that I initially got one degree ahead of myself. What appeared to be a higher-degree move now looks more like price action unfolding within a minor degree wave 4 of the larger impulsive wave (1).

The wave count has become clearer following a clean five-wave advance up to wave 3, which has been followed by a notable slowdown in momentum. This slowdown is typical of wave 4 behavior—particularly in the form of a running triangle, as we may be seeing right now.

Wave 4 triangle structure in play

Triangles are common in wave 4 positions, acting as consolidation phases before the final thrust in wave 5. In this case, price action appears to be carving out a classic A-B-C-D-E triangle structure, with wave c currently completing or nearing its low. If this plays out as expected:

- Wave d could bounce modestly within the narrowing structure.

- Wave e would complete the triangle, potentially paving the way for an impulsive wave 5 to the upside.

This pattern also aligns well with typical Elliott Wave guidelines—wave 4 often retraces into the territory of wave 2 but doesn’t violate wave 1, and triangles frequently occur before a terminal move in a sequence.

What to watch for

- A break above the triangle's upper boundary (wave b/d line) would signal a likely start to wave 5.

- Failure to hold triangle support could invalidate the pattern, prompting a reassessment.

In summary, although I initially overcounted the degree of the trend, GBP/USD still appears to be within minor wave 4 of wave (1), with a triangle structure unfolding as a consolidation phase. A breakout from this pattern should set the stage for wave 5’s advance.

Keep your eyes on the triangle boundaries and manage risk accordingly.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.