Pound Sterling Price News and Forecast: GBP/USD may regain its ground amid less further rate cuts by the BoE

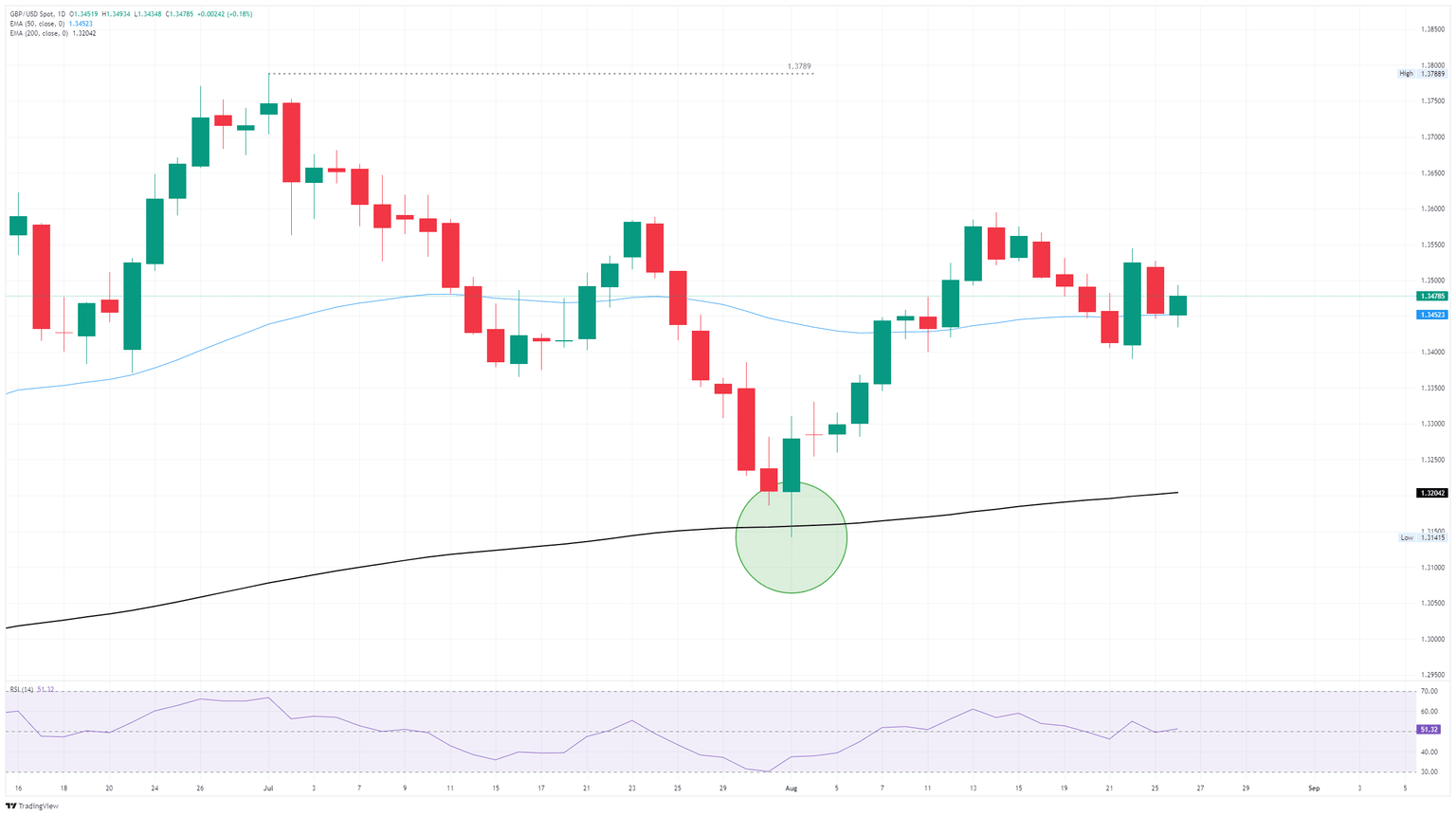

GBP/USD falls to near 1.3450, upside appears on fading BoE rate cut bets

GBP/USD retraces its recent gains from the previous session, trading around 1.3450 during the Asian hours on Wednesday. The pair may regain its ground as the Pound Sterling (GBP) receives support from the dampened likelihood of further Bank of England (BoE) rate cuts, driven by persistent inflationary pressures. Inflation in the UK economy has been accelerating at a faster pace in recent months.

Catherine Mann, a member of the BoE Monetary Policy Committee (MPC), said on Tuesday that the bank rate should be held persistently to lean against inflation risks. She also stated, “I stand ready for a forceful policy action, in the form of larger, more rapid Bank Rate cuts, should the downside risks to domestic demand start materializing.” Read more...

GBP/USD churns chart paper near key figures ahead of quiet session

GBP/USD rebounded from early-week losses on Tuesday, bouncing back up from a fresh technical floor near the 1.3450 level. Cable has been drifting within familiar technical levels as broad-market investor sentiment grinds to a halt ahead of key US economic figures.

It’ll be a quiet market session on Wednesday; meaningful economic data is functionally absent on both sides of the Atlantic. Investors will be on the lookout for further political headlines from the Trump administration as traders await results from President Donald Trump’s attempt to directly “fire” Dr. Lisa Cook from the Federal Reserve (Fed) Board of Governors on Monday. Read more...

GBP/USD recovers toward 1.3500 ahead of US consumer sentiment data

Following Monday's bearish action, GBP/USD stages a rebound on Tuesday. At the time of press, the pair was up 0.25% on the day at 1.3485. The risk-averse market atmosphere caused GBP/USD to edge lower on Monday. Growing concerns over the Federal Reserve's (Fed) independence, however, makes it difficult for the US Dollar (USD) to gather strength and helps the pair gain traction on Tuesday.

United States (US) President Donald Trump announced on Truth Social late Monday that he has fired Fed Governor Lisa Cook. In response, Cook released a statement via her attorneys, noting that Trump has no authority to fire her and that she will carry out her duties. Read more...

Author

FXStreet Team

FXStreet