Pound Sterling Price News and Forecast: GBP/USD may find the initial support around 1.3180.

GBP/USD Price Forecast: Resistance appears at 1.3300, near nine-day EMA

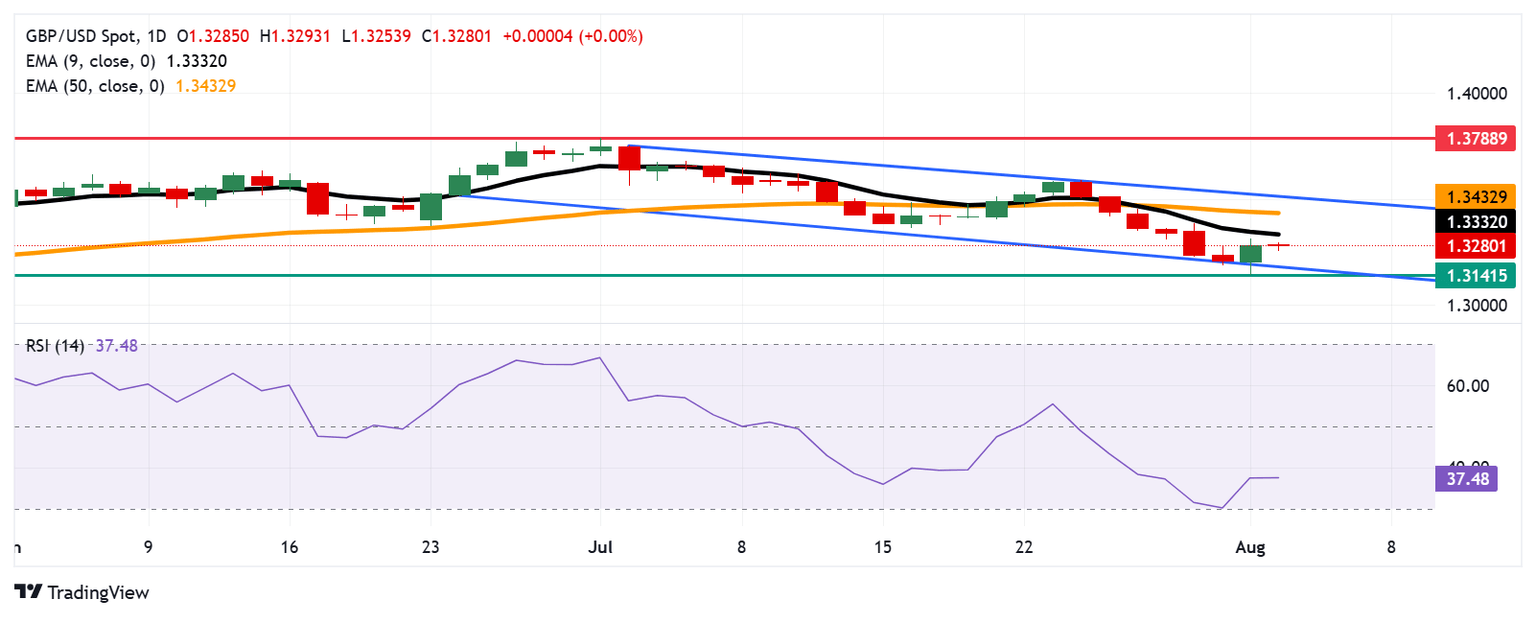

The GBP/USD pair moves sideways after registering more than 0.5% gains in the previous day, trading around 1.3280 during the Asian hours on Monday. The bearish bias prevails as the daily chart’s technical analysis suggests that the pair moves downwards within the descending channel pattern.

The 14-day Relative Strength Index (RSI) remains below the 50 level, strengthening the bearish bias. However, the GBP/USD pair is positioned below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is weakening. Read more...

GBP/USD Weekly Outlook: Pound Sterling appears ‘sell-the-bounce’ trade ahead of BoE decision

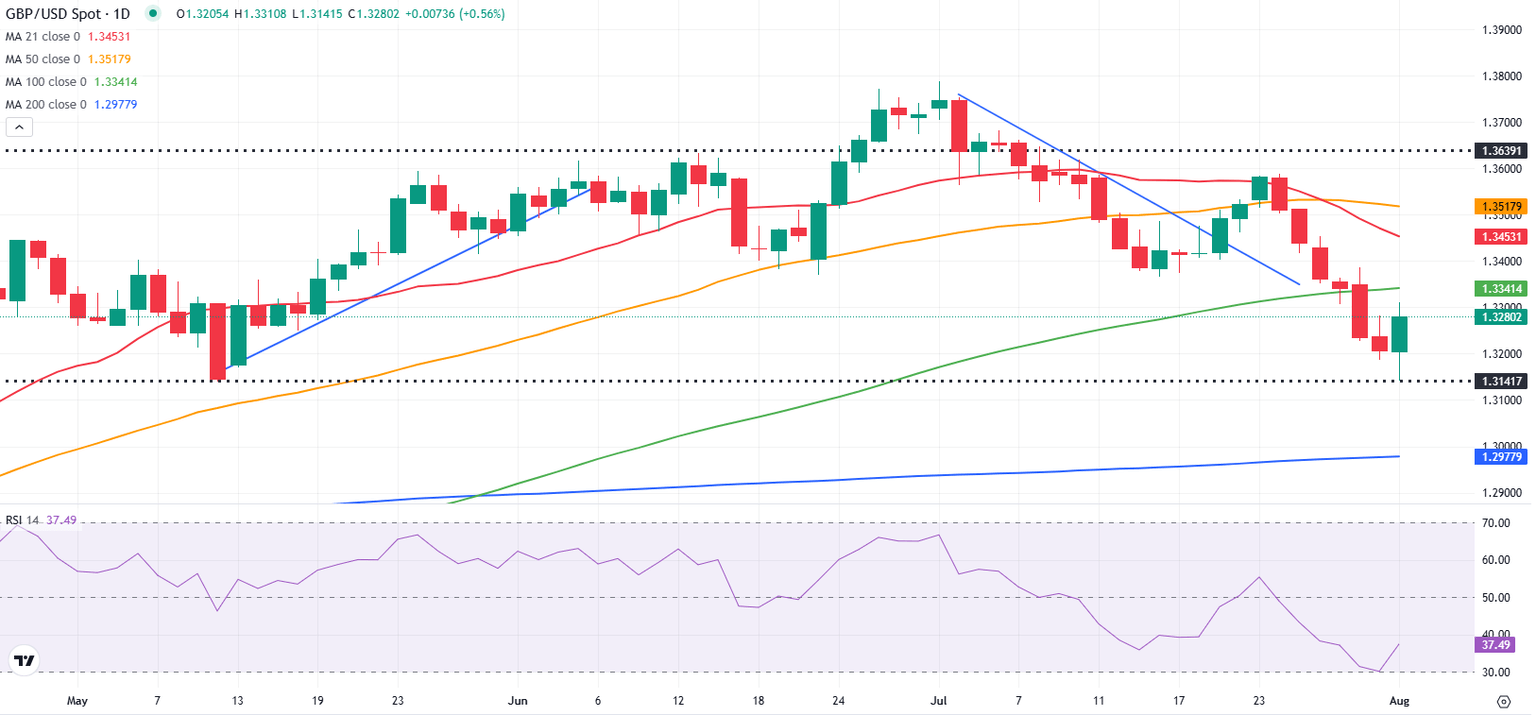

The Pound Sterling (GBP) resumed its downside against the US Dollar (USD), smashing GBP/USD to the lowest level in two months below 1.3200. Although the pair recovered sharply on Friday, it ended the week in negative territory.

Snapping the previous week’s downtrend, the USD embarked on an impressive recovery rally against its major currency rivals as some major fundamental factors turned in its favor. Read more...

GBP/USD slides closer to mid-1.3200s, downside seems limited ahead of BoE this week

The GBP/USD pair struggles to capitalize on Friday's solid bounce from the 1.3140 area, or its lowest level since May 12, and kicks off the new week on a softer note. Spot prices currently trade around the 1.3265-1.3260 region, though the downside seems limited as traders might refrain from placing aggressive directional bets ahead of the Bank of England (BoE) meeting later this week.

The UK central bank is widely expected to cut interest rates by 25 basis points (bps) to 4% on Thursday amid concerns around job market prospects. In fact, the UK labour market has weakened recently, and pay growth has cooled more quickly than the BoE's May forecast. However, signs of still sticky inflation suggest that the committee is likely to remain cautious. Nevertheless, the outlook will play a key role in influencing the British Pound (GBP) and provide some meaningful impetus to the GBP/USD pair. Read more...

Author

FXStreet Team

FXStreet