Pound Sterling Price News and Forecast: GBP/USD may find initial resistance at the nine-day EMA of 1.3501

GBP/USD Price Forecast: Tests 1.3500, nine-day EMA barrier ahead of UK Retail Sales data

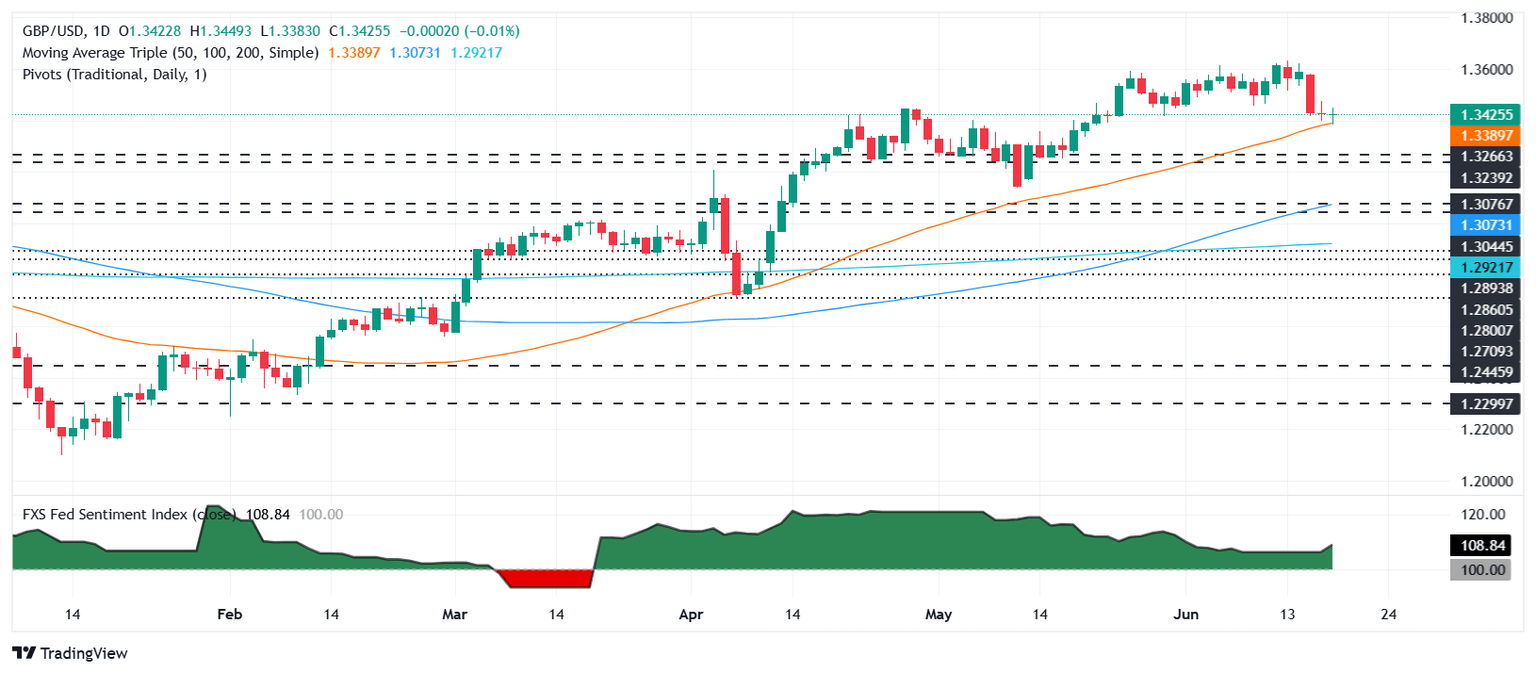

The GBP/USD pair continues to gain ground for the second successive session, trading around 1.3500 during the Asian hours on Friday. The bullish bias persists as the daily chart’s technical analysis indicates that the pair remains within the ascending channel pattern.

Additionally, the 14-day Relative Strength Index (RSI) is positioned above 50, indicating strengthening of the bullish bias. However, the GBP/USD pair remains below the nine-day Exponential Moving Average (EMA), suggesting the short-term price momentum is still weaker. Read more...

GBP/USD rebounds as Greenback pressure eases

GBP/USD found some room on the high side on Thursday, climbing back above the 1.3450 level after catching an early technical bounce from the 1.3400 handle. Broad-market flows have favored the US Dollar recently as Middle East tensions continue to rise, but US markets were dark for a national holiday on Thursday, giving Cable some room to breathe and easing off of USD bidding.

According to a CBS reporter posting on the X (nee Twitter) social media platform, President Donald Trump may be considering an order for American military assets to target an Iranian nuclear production facility. If the Trump administration decides to go ahead with the reported proposal, it will be the first time the US has deployed military assets in a pre-emptive manner since the 2003 invasion of Iraq. Citing an Israeli government official, The Times of Israel reported that the Israeli government expects a final decision from the Trump administration within the next 24 to 48 hours. Read more...

GBP/USD stabilizes after BoE holds rates, geopolitical risks support US Dollar

The Pound Sterling (GBP) trades within familiar levels after hitting a four-week low of 1.3383, recovers and posts gains of over 0.03% against the US Dollar (USD) following the Bank of England's (BoE) decision to keep rates unchanged. Rising geopolitical risks continued to cap GBP/USD, as the US Dollar extended its recovery.

Earlier, the BoE decision to hold rates on a 6-3 split vote, which was sparked by the sudden jump in Oil prices, related to the Israel–Iran conflict. The bank acknowledged that the UK labor market is weakening, which, according to investors, suggests further easing is likely ahead. Read more...

Author

FXStreet Team

FXStreet