GBP/USD stabilizes after BoE holds rates, geopolitical risks support US Dollar

- GBP/USD trades near 1.3382 as Fed and geopolitical risks boost the appeal of the safe-haven US Dollar.

- BoE holds on 6–3 vote; Bailey hints at gradual rate-cut path amid weak UK labor data.

- Traders eye UK Retail Sales and Philly Fed data amid thin US holiday trading.

The Pound Sterling (GBP) trades within familiar levels after hitting a four-week low of 1.3383, recovers and posts gains of over 0.03% against the US Dollar (USD) following the Bank of England's (BoE) decision to keep rates unchanged. Rising geopolitical risks continued to cap GBP/USD, as the US Dollar extended its recovery.

Sterling rebounds from four-week low as BoE signals August cut; US Dollar stays bid on Middle East tension

Earlier, the BoE decision to hold rates on a 6-3 split vote, which was sparked by the sudden jump in Oil prices, related to the Israel–Iran conflict. The bank acknowledged that the UK labor market is weakening, which, according to investors, suggests further easing is likely ahead.

The Bank of England minutes showed that there is a growing consensus among Monetary Policy Committee (MPC) members to reduce rates at the August meeting. BoE's Governor Andrew Bailey reinforced the bank's dovish stance, saying that “Interest rates remain on a gradual downward path,” even though “The world is highly unpredictable.”

Across the pond, US markets are closed in observance of the Juneteenth holiday, but news related to a possible involvement of the US in the Middle East conflict to attack Iran's nuclear facilities keeps investors leaning towards the US Dollar's safe-haven appeal.

On Wednesday, the Federal Reserve (Fed) held rates at the 4.25 – 4.50% range, remaining reluctant to cut rates despite US President Donald Trump's demands. The Fed stated that the policy is moderately restrictive but in a good position, and that the labor market remains solid. Powell added that the Fed is assessing the impact of tariffs on the economy, while repeating that uncertainty remains elevated.

Given the backdrop, the GBP/USD pair consolidates as traders await a tranche of data. The UK economic docket will feature Retail Sales for May. In the US, the schedule will be light, as the Philadelphia Fed updates the status of business activity in its region.

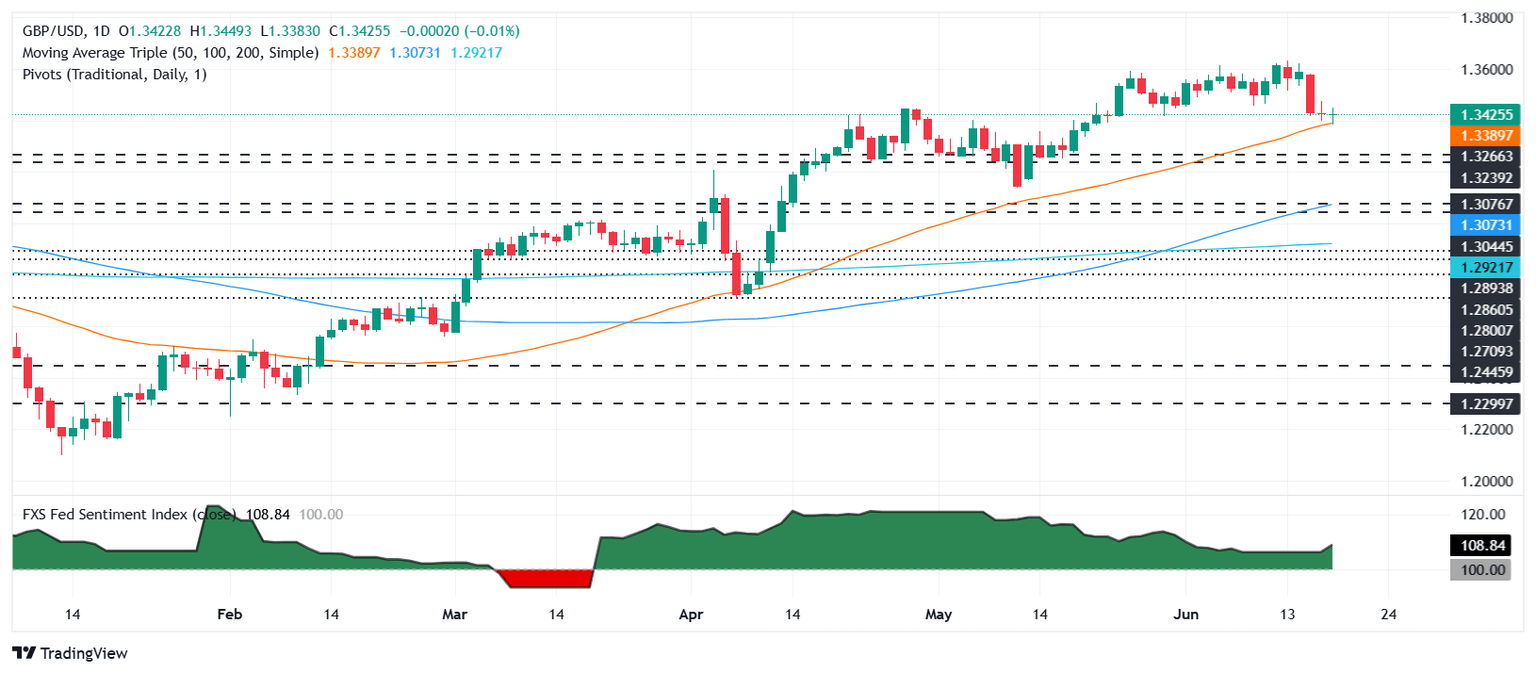

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend is at risk as the pair fell below 1.3400 and tested the 50-day SMA at 1.3385. Although buyers lifted the exchange rate back above 1.3400, the Relative Strength Index (RSI) suggests traders are shifting slightly bearish. Therefore, downside risks remain, unless the RSI climbs above its 50 neutral line.

On the upside, key resistance levels lie at 1.3450, at 1.3476, the June 18 peak, followed by the 20-day SMA at 1.3519. On the downside, the GBP/USD first support is 1.3400, the day’s low of 1.3382, and the 1.3300 figure.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.65% | 1.03% | 0.80% | 1.09% | 0.45% | 0.84% | 0.89% | |

| EUR | -0.65% | 0.26% | 0.15% | 0.48% | -0.07% | 0.20% | 0.25% | |

| GBP | -1.03% | -0.26% | -0.10% | 0.18% | -0.33% | -0.06% | -0.01% | |

| JPY | -0.80% | -0.15% | 0.10% | 0.27% | -0.66% | -0.32% | -0.32% | |

| CAD | -1.09% | -0.48% | -0.18% | -0.27% | -0.55% | -0.25% | -0.19% | |

| AUD | -0.45% | 0.07% | 0.33% | 0.66% | 0.55% | 0.28% | 0.33% | |

| NZD | -0.84% | -0.20% | 0.06% | 0.32% | 0.25% | -0.28% | 0.05% | |

| CHF | -0.89% | -0.25% | 0.00% | 0.32% | 0.19% | -0.33% | -0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.