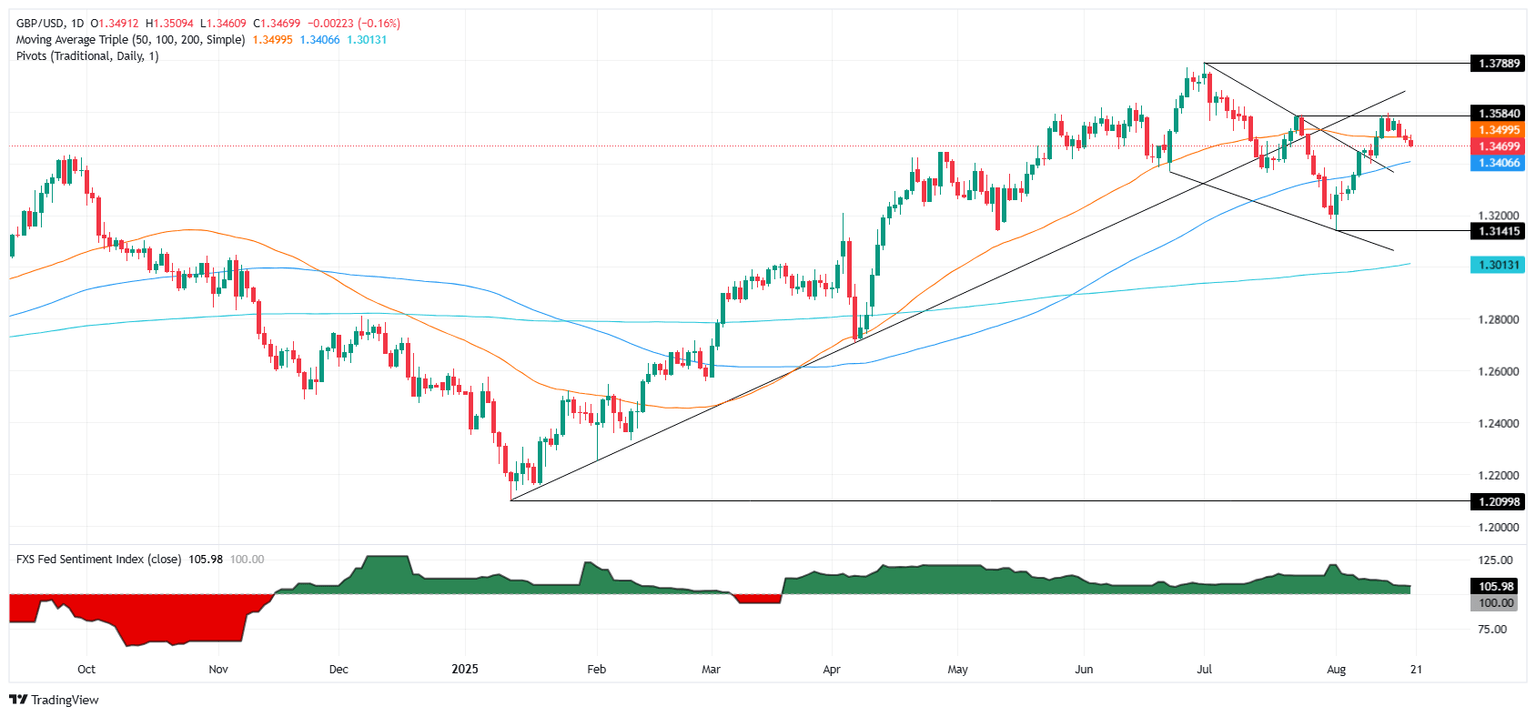

Pound Sterling Price News and Forecast: GBP/USD loses momentum to around 1.3450 during Asian session.

GBP/USD softens to near 1.3450 ahead of UK/US PMI releases

The GBP/USD pair drifts lower to around 1.3450 during the Asian trading hours on Thursday, pressured by a modest rebound in the US Dollar (USD). Traders await the preliminary reading of S&P Global Purchasing Managers Index (PMI) reports for August from the United Kingdom (UK) and the United States (US), which are due later on Thursday. On Friday, all eyes will be on the Fed’s annual Jackson Hole symposium.

The Greenback strengthens against the Pound Sterling (GBP) on diminishing odds of a Fed rate cut in the September meeting after a jump in US wholesale prices last month. Markets expect the Fed to deliver rate cuts at the next policy meeting, with chance estimates nearly 80% and priced in a total of 52 basis points (bps) of easing over the rest of the year, according to the CME FedWatch tool. Read more...

GBP/USD extends backslide into a third straight day

GBP/USD took another leg lower on Tuesday, falling around three-tenths of one percent and skidding into key moving averages. Key Consumer Price Index (CPI) inflation data from the United Kingdom (UK) sent Cable bidders reeling, as market bets of another Bank of England (BoE) rate cut before the end of the year slipped below 50%.

Cable traders now pivot to Thursday, where the latest batch of Purchasing Managers Index (PMI) survey results are due on both sides of the Atlantic. The Federal Reserve (Fed) Bank of Kansas also kicks off this year’s annual economic symposium on Thursday in Jackson Hole. UK PMI figures are expected to tick slightly higher, while US PMI aggregated survey results are expected to show a slight decline. Read more...

GBP/USD slides as Fed Governor Cook faces fraud allegations, UK inflation surges

GBP/USD tumbles during the North American session, with traders shrugging off high inflation in the United Kingdom (UK) as the White House pressures Federal Reserve (Fed) Governor Lisa Cook to step aside from the board. The pair trades at 1.3469, down 0.15%.

Earlier, breaking news emerged that Fed Governor Lisa Cook lied about a pair of mortgages, according to the Federal Housing Finance Agency (FHFA) Director Bill Pulte. According to Bloomberg, “he alleges that Cook falsified bank documents and property records to acquire more favorable loan terms, potentially committing mortgage fraud under the criminal statute.” Read more...

Author

FXStreet Team

FXStreet