GBP/USD slides as Fed Governor Cook faces fraud allegations, UK inflation surges

- GBP/USD falls as traders cut risk after Fed Governor Cook accused of mortgage fraud.

- Trump mulls firing Fed Governor Cook, raising uncertainty over policy and weighing US Dollar–Pound flows.

- UK CPI jumps 3.8% YoY; Services CPI at 5% trims BoE rate cut expectations for 2025.

GBP/USD tumbles during the North American session, with traders shrugging off high inflation in the United Kingdom (UK) as the White House pressures Federal Reserve (Fed) Governor Lisa Cook to step aside from the board. The pair trades at 1.3469, down 0.15%.

Sterling weakens despite hotter UK CPI as political drama at the Fed rattles markets

Earlier, breaking news emerged that Fed Governor Lisa Cook lied about a pair of mortgages, according to the Federal Housing Finance Agency (FHFA) Director Bill Pulte. According to Bloomberg, “he alleges that Cook falsified bank documents and property records to acquire more favorable loan terms, potentially committing mortgage fraud under the criminal statute.”

Sources by the Wall Street Journal (WSJ) revealed that Trump told aides that he is considering attempting to fire Cook in response to the mortgage fraud accusation.

Consequently, traders seeking safety sold the GBP/USD, which initially tested the 1.3500 figure on British economic-related data.

In the UK, inflation rose sharply in July, according to the Office of National Statistics (ONS). The Consumer Price Index (CPI) rose by 3.8% YoY, up from 3.6%. Core CPI also hit the 3.8% mark in year-over-year readings, and Services CPI hit the 5% threshold.

The data puts pressure on the Bank of England (BoE), which recently reduced rates to 4% on a 5-4 vote split. The central bank foresaw inflation to slow to 3.6% by December 2025, 2.5% in 2026, and return to 2% by the end of the first half of 2027.

Hence, market participants reduced the odds for further easing by the BoE throughout the rest of the year. The chances for another rate cut in December moved down from 50% to 42% after the data.

Ahead, the US economic docket will feature the Federal Reserve’s last meeting minutes, ahead of jobs data on Thursday and Fed Chair Jerome Powell's speech at Jackson Hole.

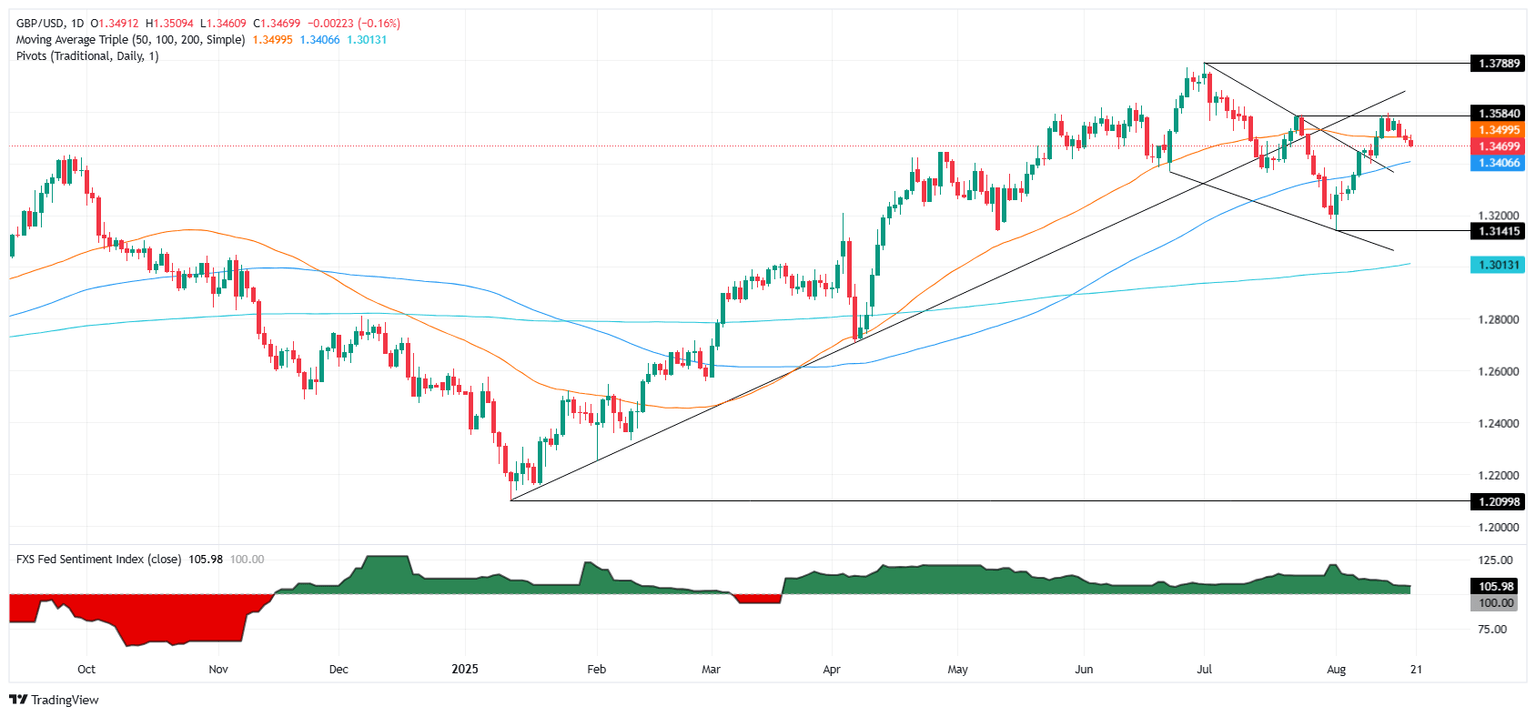

GBP/USD Price Forecast: Technical outlook

The downtrend resumed after reaching 1.3500 on the UK inflation report. Nevertheless, threats to Fed independence triggered a reaction for traders, which booked profits as the GBP/USD cleared the 50-day Simple Moving Average (SMA) at 1.3495, before it retreated towards the 1.3450 area.

The Relative Strength Index (RSI) remains bullish, but its slope seems close to piercing its neutral line. Therefore, further downside is seen in the near term.

If GBP/USD extends its lows below 1.3450, sellers could drive the exchange rate toward the 20-day SMA at 1.3409, followed by the 100-day SMA at 1.3403. On the other hand, if the pair climbs back above 1.3500, buyers can test the August 14 high of 1.3594, ahead of 1.3600.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | 0.61% | -0.06% | 0.33% | 1.17% | 1.60% | -0.16% | |

| EUR | -0.45% | 0.16% | -0.50% | -0.08% | 0.73% | 1.11% | -0.61% | |

| GBP | -0.61% | -0.16% | -0.75% | -0.28% | 0.57% | 0.95% | -0.81% | |

| JPY | 0.06% | 0.50% | 0.75% | 0.40% | 1.24% | 1.67% | -0.11% | |

| CAD | -0.33% | 0.08% | 0.28% | -0.40% | 0.81% | 1.26% | -0.53% | |

| AUD | -1.17% | -0.73% | -0.57% | -1.24% | -0.81% | 0.37% | -1.37% | |

| NZD | -1.60% | -1.11% | -0.95% | -1.67% | -1.26% | -0.37% | -1.76% | |

| CHF | 0.16% | 0.61% | 0.81% | 0.11% | 0.53% | 1.37% | 1.76% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.