Pound Sterling Price News and Forecast: GBP/USD holds in corrective territory ahead of key events

GBP/USD holds in corrective territory ahead of key events later in the week

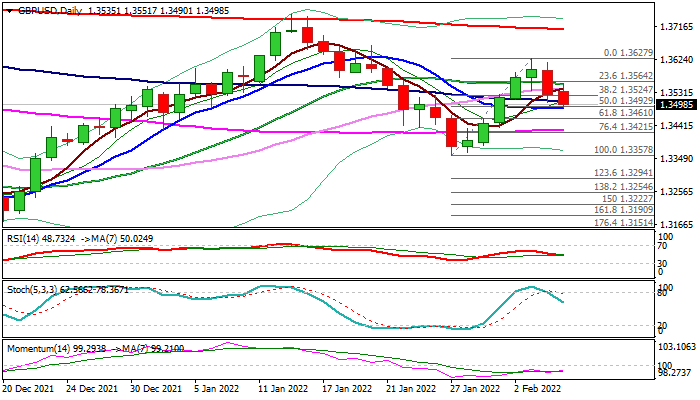

GBP/USD is flat on the session and has moved within a range of 1.3520 and 1.3539 on the session so far after it dipped under 1.3500 in European markets before returning to 1.3535 thereafter. It's been one of those starts to the week where there is no momentum one way or the other as the markets digest the events of the prior week and await the next catalyst.

GBP/USD outlook: Sterling remains in red for the second day following upbeat US NFP

Cable remains under pressure on Monday and probes again through 100DMA (1.3508) which contained Friday’s drop (the pair was down 0.5% for the day) as pound came under increased pressure from better than expected US jobs data which inflated dollar.

Author

FXStreet Team

FXStreet