Pound Sterling Price News and Forecast: GBP/USD holds ground after mixed UK data

GBP/USD Forecast: Pound Sterling holds ground after mixed UK data

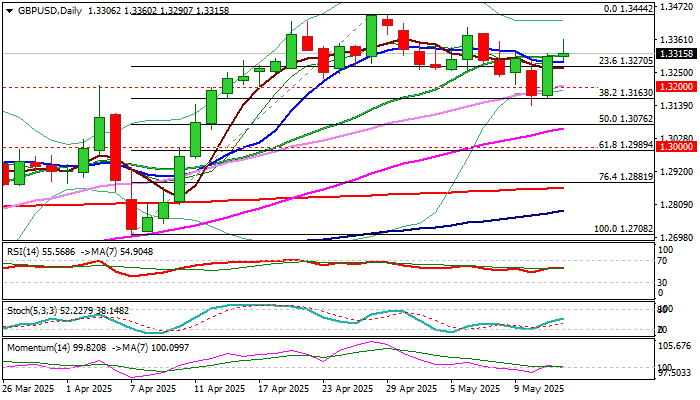

After climbing to a weekly high above 1.3350 in the European session on Wednesday, GBP/USD reversed its direction and ended the day in negative territory. The pair holds its ground in the European session on Thursday and trades slightly below 1.3300.

The UK's Office for National Statistics (ONS) reported early Thursday that the Gross Domestic Product (GDP) expanded at an annual rate of 1.3% in the first quarter. This reading followed the 1.5% growth recorded in the previous quarter but came in above the market expectation of 1.2%. On a negative note, the ONS said that Manufacturing Production and Industrial Production contracted by 0.8% and 0.7%, respectively, on a monthly basis in March. Read more...

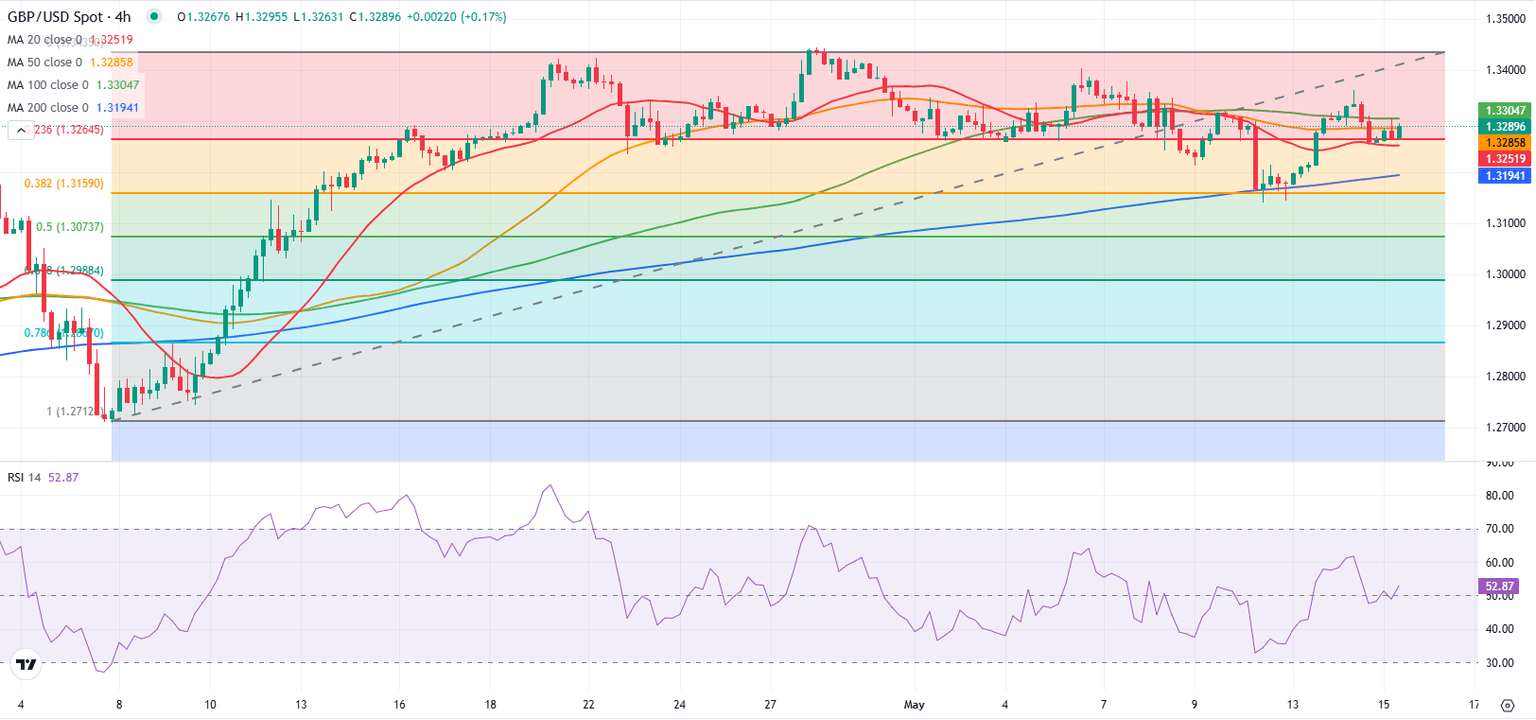

GBP/USD outlook: Bulls hold grip ahead of UK GDP data

Cable keeps firm near term tone and extends recovery after Tuesday’s 1% rally generated positive signal on over 50% retracement of 1.3444/1.3139 pullback and completion of bullish engulfing pattern on daily chart.

Fresh extension higher on Wednesday rose above Fibo 61.8% retracement that adds to development of reversal signal, after strong bounce on Tuesday signaled that corrective phase from new 2025 high (1.3444) is likely over. Read more...

Author

FXStreet Team

FXStreet