Pound Sterling Price News and Forecast: GBP/USD holds above key level

GBP/USD holds above key level despite rate divergence and trade war jitters

The Pound Sterling (GBP) is virtually unchanged during the North American session, but it remains above a key technical level, following a solid US jobs report in the United States (US) last week. This, along with the likelihood of further tax hikes by the UK government, is exerting pressure on Cable. At the time of writing, the GBP/USD exchange rate is 1.3638. Read More...

Pound Sterling declines against US Dollar ahead of US tariff deadline

The Pound Sterling (GBP) slumps to near 1.3580 against the US Dollar (USD) during European trading hours on Monday. The GBP/USD pair declines as the US Dollar trades calmly, with investors awaiting trade-related headlines in the countdown to the United States (US) tariff deadline on July 9. Read More...

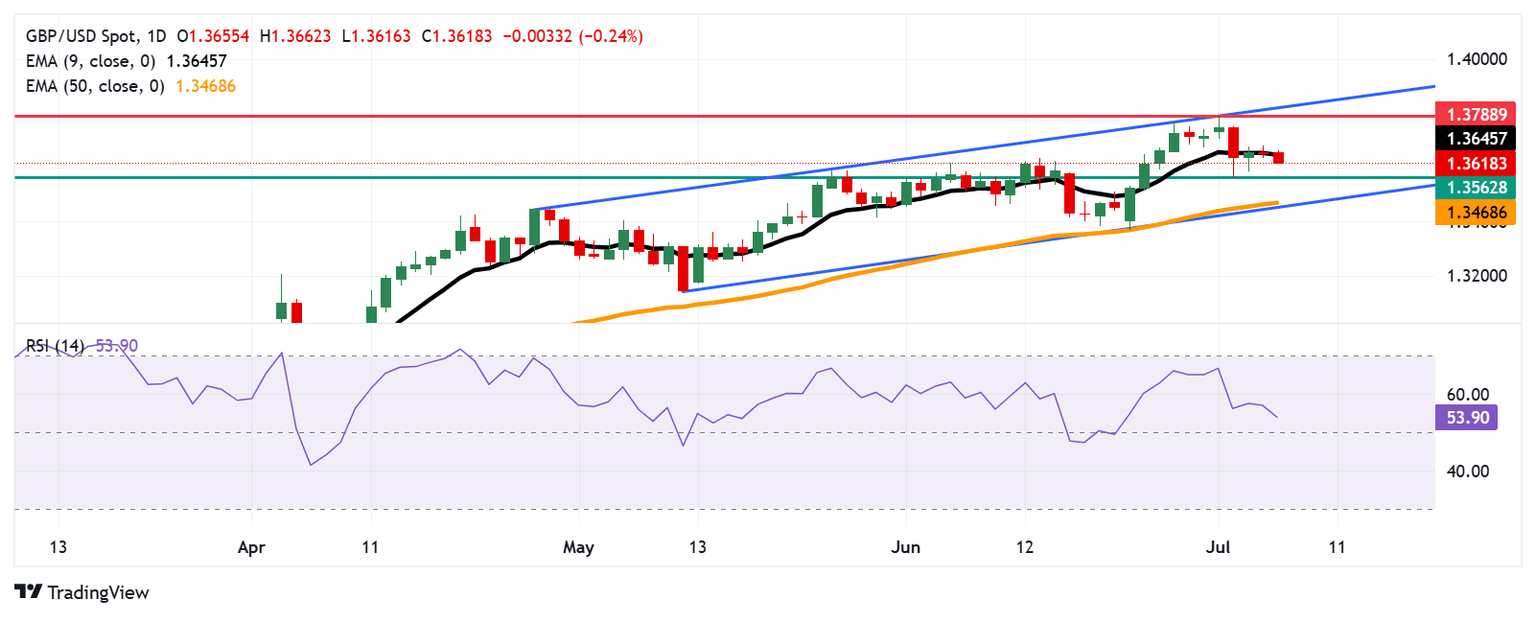

GBP/USD Price Forecast: Falls toward 1.3600 after breaking below nine-day EMA

The GBP/USD pair extends its losses for the second successive session, trading around 1.3620 during the Asian hours on Monday. The bullish bias persists as the daily chart’s technical analysis indicates that the pair remains within the ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet