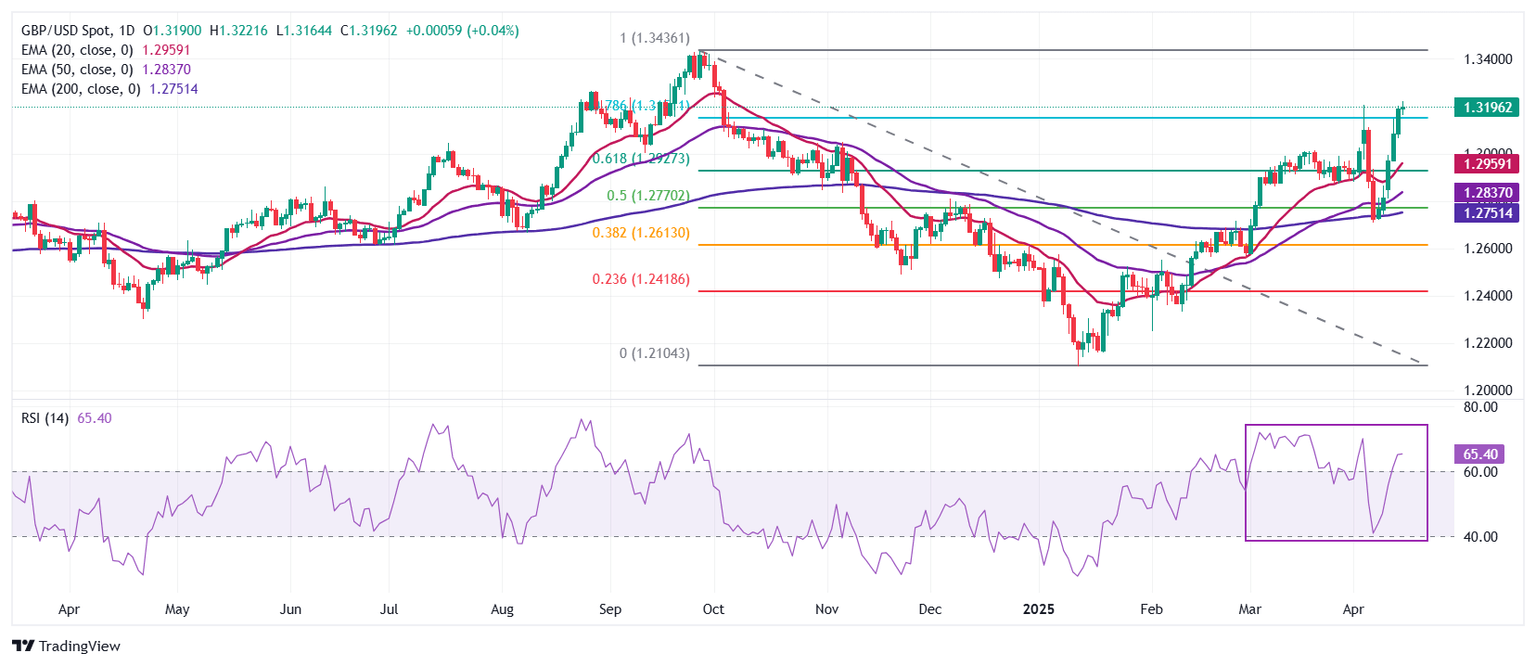

Pound Sterling Price News and Forecast: GBP/USD hits 6-month high above 1.3200

GBP/USD hits 6-month high above 1.3200 as markets shun USD amid tariff turmoil

The Pound Sterling rose and refreshed six-month highs against the US Dollar on Tuesday as the financial markets' narrative remains linked to the US imposing tariffs. Cable shrugged off soft UK jobs data; hence, the GBP/USD rallied 0.36% and traded at 1.3233. Read More...

Pound Sterling outperforms on strong UK employment data

The Pound Sterling (GBP) advances against its major peers, except antipodeans, on Tuesday after the release of the United Kingdom (UK) labor market data for three months ending February. The Office for National Statistics (ONS) reported that the economy added 206K fresh workers, significantly higher than the 144K recorded in three months ending January. Read More...

UK Unemployment Rate stays at 4.4% in the quarter to February as expected

The United Kingdom’s (UK) ILO Unemployment Rate held steady at 4.4% in the three months to February, data published by the Office for National Statistics (ONS) showed on Thursday. The market forecast was for a 4.4% reading in the reported period. Read More...

Author

FXStreet Team

FXStreet