Pound Sterling Price News and Forecast: GBP/USD – Hawkish BoE commentary could push Pound Sterling higher

GBP/USD accelerates to fresh two-month high [Video]

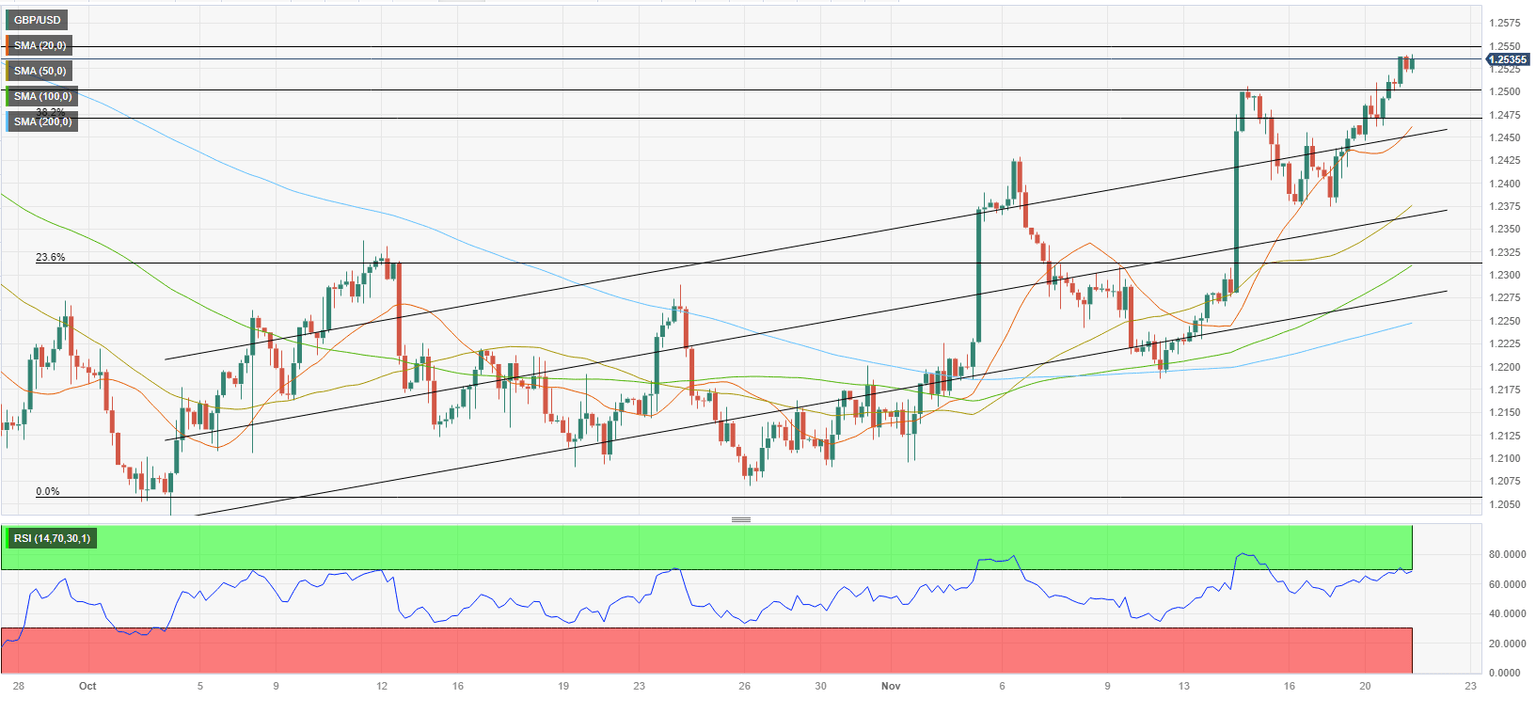

GBPUSD is looking to resume its bullish trend as the price is creating the third consecutive green day, surpassing the 200-day simple moving average (SMA) and the 1.2500 psychological mark. Also, the pair rose to its highest level of the last two months, with the technical oscillators suggesting strengthening upside momentum. Read more...

GBP/USD Forecast: Hawkish BoE commentary could push Pound Sterling higher

GBP/USD climbed above 1.2500 and reached its highest level since early September near 1.2550 on Tuesday. Bank of England (BoE) policymakers' comments on the policy outlook could drive the pair's action in the near term.

Late Monday, BoE Governor Andrew Bailey said that they must watch for signs of inflation persistence that may require interest rates to rise again. Bailey reiterated that the policy will need to be restrictive "for quite some time yet" and noted that it is far too early to be thinking about rate cuts. Read more...

GBP/USD sits near its highest level since September, just below mid-1.2500s ahead of FOMC minutes

The GBP/USD pair continues to gain positive traction for the third successive day and climbs to over a two-month peak during the first half of trading action on Tuesday. Spot prices maintain the bid tone around the 1.2530-1.2535 region through the early European session and seem poised to build on the ascending trend in the wake of the underlying bearish sentiment surrounding the US Dollar (USD).

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, dives to its lowest level since August 31 amid dovish Federal Reserve (Fed) expectations. Market participants now seem convinced that the US central bank is done with its policy-tightening campaign and have been pricing in the possibility of a series of rate cuts in 2024. Read more...

Author

FXStreet Team

FXStreet