Pound Sterling Price News and Forecast: GBP/USD grinds lower but stays around 1.2350s after upbeat NFP

GBP/USD grinds lower but stays around 1.2350s after upbeat US NFP report

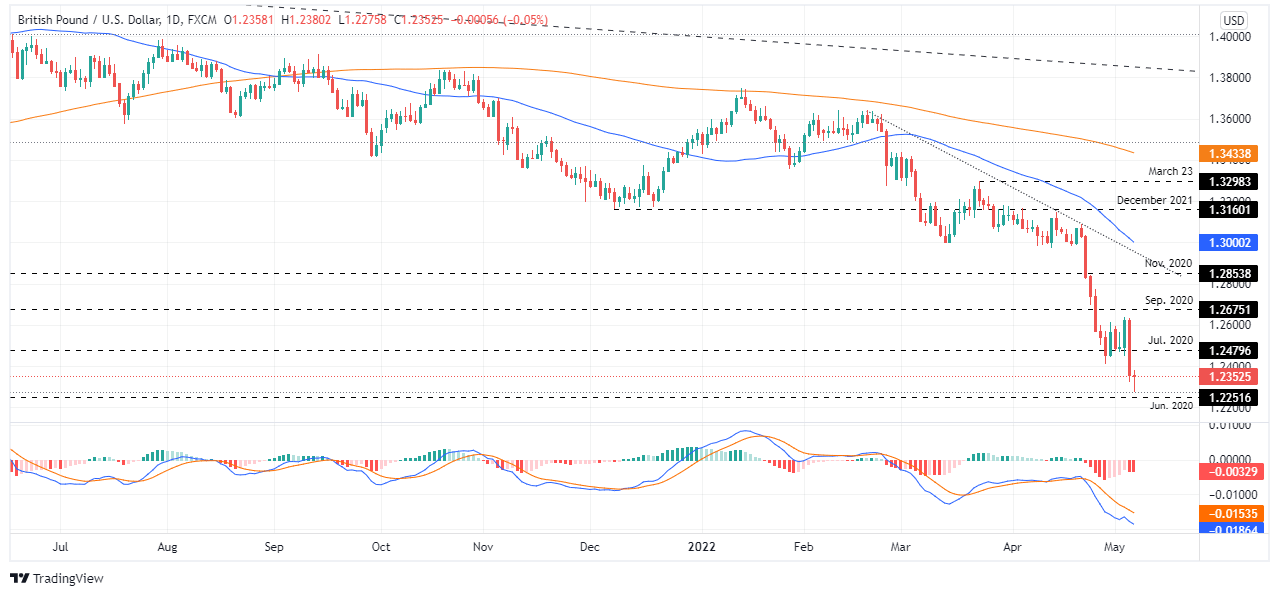

The British pound appears to regain composture but remains losing in the day, down 0.06%, after the Bank of England hiked rates by 25-bps on Thursday. At the time of writing, the GBP/USD is trading at 1.2352. The GBP/USD is still downward biased, though it faced solid support at June’s 2020 lows around 1.2251. Also, the MACD, as the histogram shows, is “forming” a positive divergence, which is usually a signal that the trend is about to shift. However, unless the MACD-line crosses above the signal line, GBP/USD traders should refrain from opening fresh long bets in the pair. Read more...

GBP/USD Weekly Forecast: The worst seems far from over, focus shifts to US inflation, UK GDP

The Fed-BOE contrast remained in play, despite the less aggressive Fed stance, as the dire UK economic outlook widened the economic divergence alongside the monetary. GBP/USD was fairly resilient throughout the week before crashing to fresh 22-month lows below the 1.2300 mark. The pair has recorded the third straight weekly loss, as attention turns towards the US inflation and the UK quarterly GDP. Read more...

GBP/USD Forecast: Pound a long way from a rebound on BOE's recession warning

GBP/USD has recovered modestly after having slumped to its weakest level in nearly two years below 1.2300 early Friday. The pair, however, is unlikely to stage a steady rebound in the near term after the Bank of England's dire recession warning on Thursday. Following its decision to hike the policy rate by 25 basis points (bps) to 1%, the BOE noted that the UK economy could go into recession in 2022 with inflation rising above 10% amid surging energy prices. The bank also refrained from providing any details on the quantitative tightening plan, saying that they would unveil a plan at the August meeting. Read more...

Author

FXStreet Team

FXStreet