Pound Sterling Price News and Forecast: GBP/USD flatlines near channel’s upper band

GBP/USD flatlines near channel’s upper band

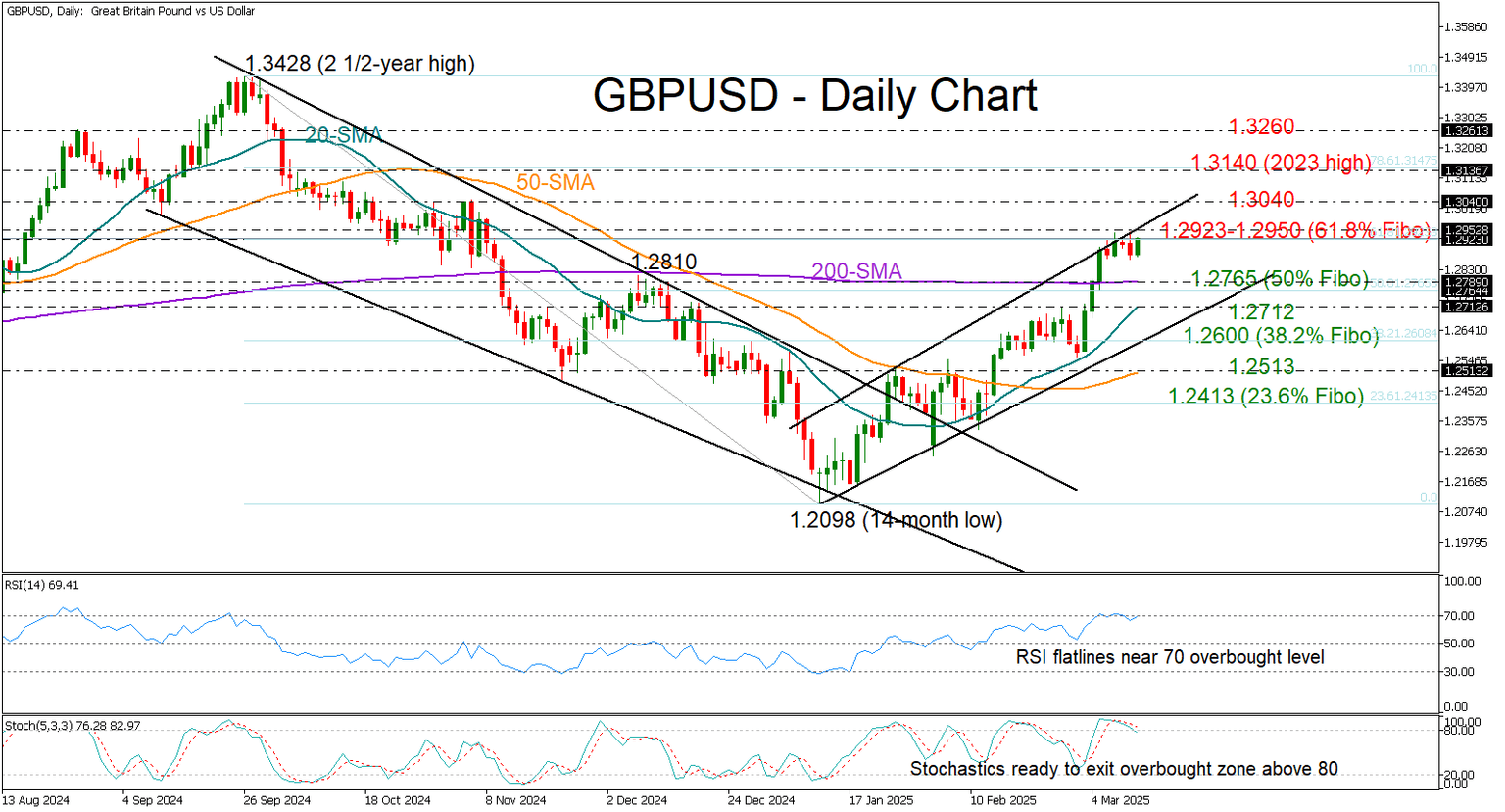

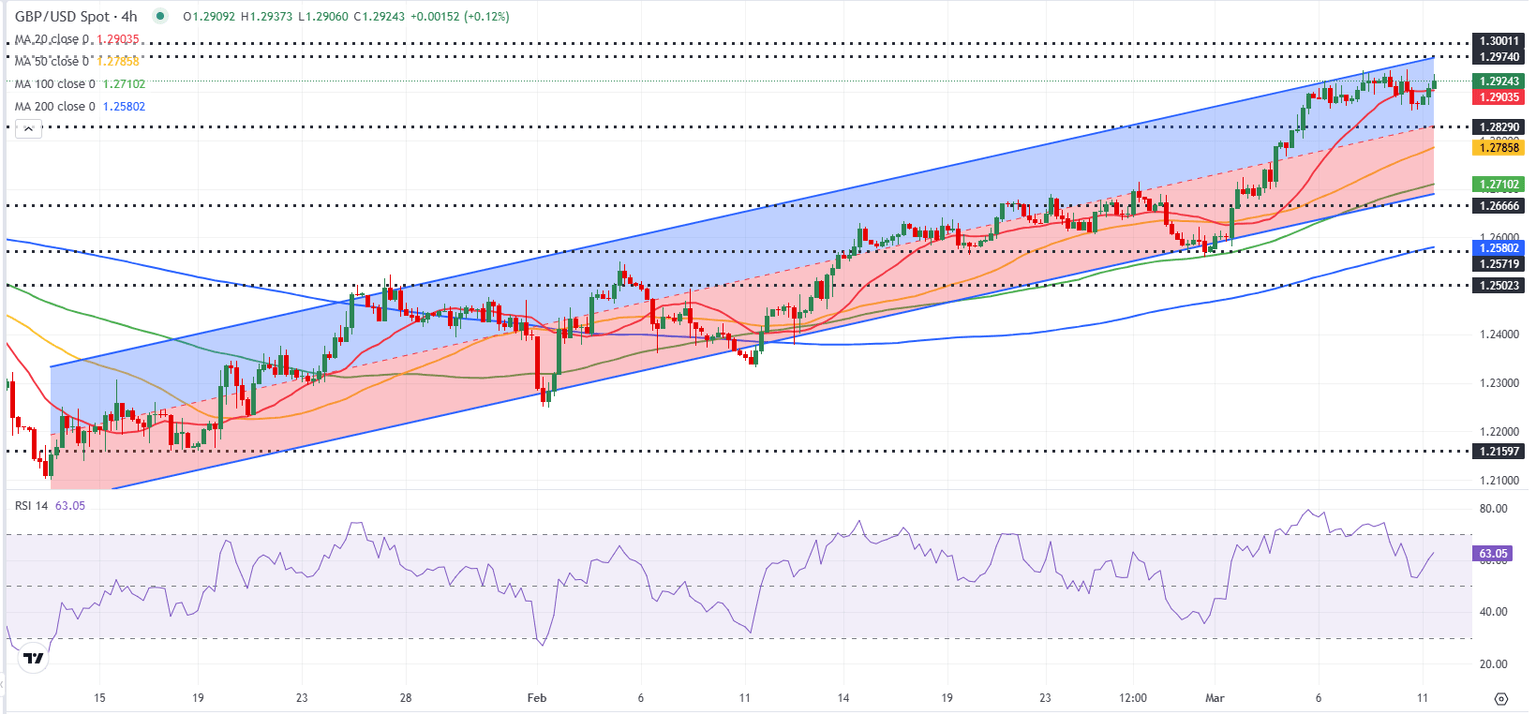

GBPUSD has been treading water around the 1.2923 level, struggling to gain further traction after its March bull run stalled near the upper boundary of its bullish channel.

The pair surged as high as 1.2945 last week, marking its highest level since November 2024. However, strengthening overbought signals suggest the recent rally may be losing steam, as the RSI and the stochastic oscillator seem to have peaked above 30 and 20, respectively. Read more...

GBP/USD Forecast: Pound Sterling could face stiff resistance before targeting 1.3000

After posting small losses on Monday, GBP/USD regains its traction on Tuesday and trades comfortably above 1.2900. The near-term technical suggests that the bullish bias remains intact but the pair could have a difficult time clearing the strong resistance at 1.2975.

GBP/USD failed to build on the previous week's impressive gains on Monday as safe-haven flows dominated the action in financial markets. After opening in negative territory, Wall Street's main indexes declined sharply, pressured by escalating fears over an economic downturn in the US. On Sunday, US President Donald Trump acknowledged that there will be a "period of transition" when asked whether his policy changes could potentially cause a recession. Read more...

Author

FXStreet Team

FXStreet