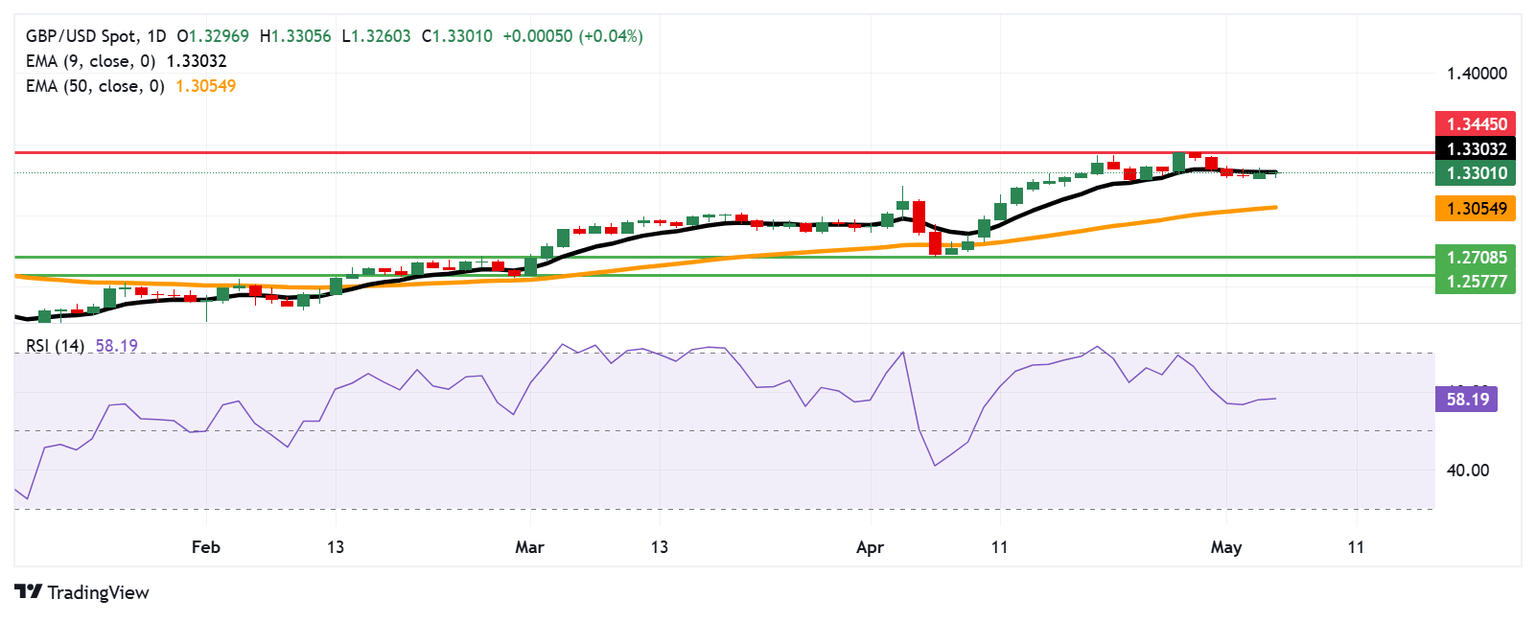

Pound Sterling Price News and Forecast: GBP/USD faces initial resistance at the nine-day EMA of 1.3303

GBP/USD Price Forecast: Hovers around 1.3300 as nine-day EMA caps upside

The GBP/USD pair attempts to maintain its position after registering gains in the previous session, trading around 1.3300 during the Asian trading hours on Tuesday. Technical analysis on the daily chart suggests a neutral short-term price momentum, as the pair is hovering around the nine-day Exponential Moving Average (EMA).

However, the GBP/USD pair continues to trade above the 14-day Relative Strength Index (RSI) holds above 50, suggesting a bullish bias is still in play. Further movements will offer a clear directional trend. Read more...

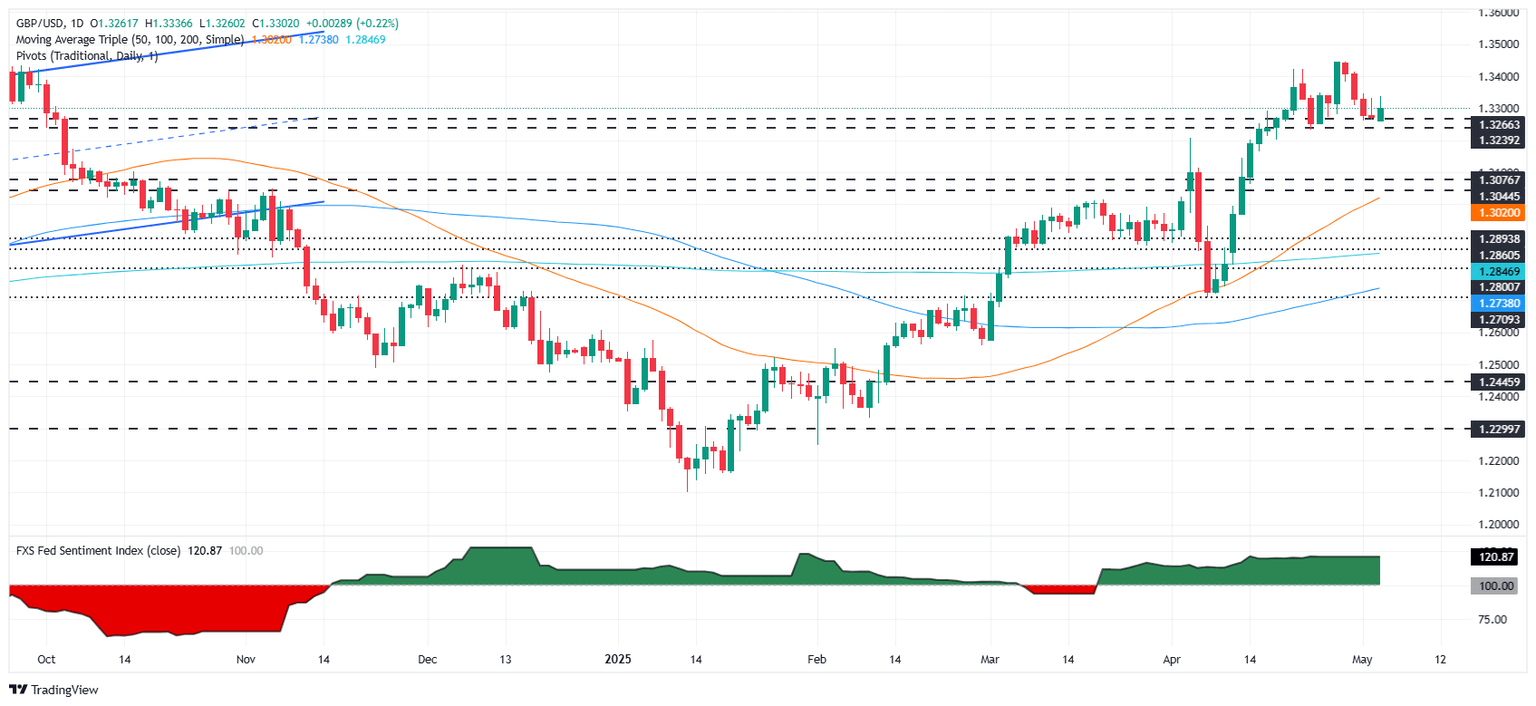

GBP/USD settles ahead of central bank double header

GBP/USD snapped a near-term losing streak, pumping the breaks and holding steady near the 1.3300 handle to kick off a fresh trading week. Cable remains down from recent multi-year highs, but price action has pushed into a holding pattern ahead of key showings from both the Federal Reserve (Fed) and the Bank of England (BoE).

The Fed is broadly expected to keep interest rates on hold for the time being, a move that is likely to draw more fire from the Trump administration which remains staunchly determined to try and squeeze early rate cuts out of Fed Chair Jerome Powell. Labor and inflation figures remain largely on-balance, with roughshod and opaque trade policies out of the White House shooting its own hopes for rate cuts in the foot as the Fed remains committed to its mandate of keeping unemployment and price volatility in check. Read more...

GBP/USD rises above 1.33 as US PMI data fails to lift USD

The Pound Sterling (GBP) advanced some 0.32% against the US Dollar (USD) on Monday, back above the 1.33 handle, as market participants digested data from the United States (US) portraying that business activity in the services sector is gathering some steam, yet fails to underpin the Greenback. At the time of writing, GBP/USD trades at 1.3300.

United Kingdom (UK) markets are closed as traders brace for the Bank of England's (BoE) monetary policy decision on Thursday. Most traders project a 0.25% interest rate cut by the central bank. Data across the pond failed to boost the Greenback, even though the Services PMI released by the Institute for Supply Management (ISM) showed an improvement in April. Read more...

Author

FXStreet Team

FXStreet