GBP/USD rises above 1.33 as US PMI data fails to lift USD

- ISM Services PMI beats forecasts, but inflationary pressures rise with Prices Paid at 14-month high.

- Markets expect the BoE to cut rates by 25 bps on Thursday, with 75 bps easing priced in for 2025.

- US trade deal rumors with Asia support sentiment; key BoE and Fed events in focus this week.

The Pound Sterling (GBP) advanced some 0.32% against the US Dollar (USD) on Monday, back above the 1.33 handle, as market participants digested data from the United States (US) portraying that business activity in the services sector is gathering some steam, yet fails to underpin the Greenback. At the time of writing, GBP/USD trades at 1.3300.

GBP/USD surges ahead of BoE rate decision, while Fed rate cut outlook narrows to three moves in 2025

United Kingdom (UK) markets are closed as traders brace for the Bank of England's (BoE) monetary policy decision on Thursday. Most traders project a 0.25% interest rate cut by the central bank. Data across the pond failed to boost the Greenback, even though the Services PMI released by the Institute for Supply Management (ISM) showed an improvement in April.

The ISM Services PMI expanded by 51.6, up from 50.8, and exceeded estimates of 50.6. A sub-component of the PMI suggested a reacceleration of inflation as Prices Paid by companies rose to their highest level since February 2023, jumping to 65.1 from 60.9.

Following the data and last Friday's solid US Nonfarm Payroll figures, traders had priced in three interest rate cuts instead of four, according to the fed funds rate December 2025 futures contract. Market players are pricing in 74.5 basis points (bps) of easing or three 25 bps rate cuts, providing an edge to the US Dollar as the BoE is projected to reduce rates by 75 bps, but it would move faster than the Federal Reserve (Fed).

Consequently, GBP/USD could be set for a pullback if traders fail to conquer the 1.3400 mark. Positive US trade news could provide a lifeline to Cable and pave the way for a re-test of the latter.

Fox Business Charles Gasparini revealed that sources on Wall Street suggest that Washington is near closing a deal with some Asian countries like India, South Korea, and Japan.

This week, the UK economic docket will feature Retail Sales, BoE’s Breeden Speech, and BoE’s decision. In the US, traders are eyeing Wednesday’s FOMC meeting and the Fed Chair Jerome Powell's press conference.

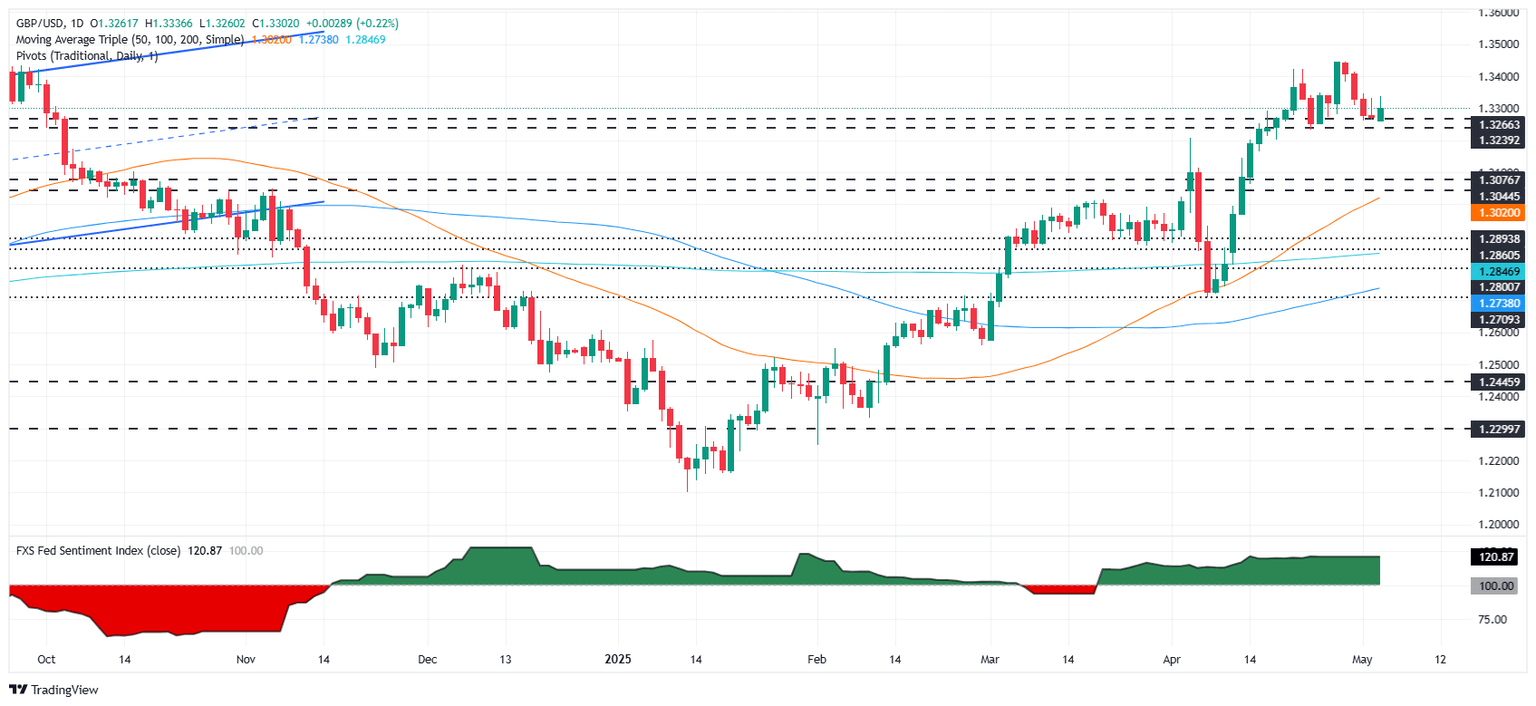

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair has consolidated near last week's lows, though it hovers near the 20-day Simple Moving Average (SMA) at 1.3324. If bulls would like to remain in charge, they need a daily close above 1.33 so they can challenge 1.3350 before launching an attack toward the year-to-date (YTD) high at 1.3443.

Conversely, if sellers move in and drag the exchange rate below 1.3300, this could pave the way for a fall to April 23’s daily low of 1.3233 before testing 1.3200.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.30% | -0.62% | 0.13% | -0.31% | -0.44% | -0.38% | |

| EUR | -0.02% | -0.05% | -0.37% | 0.38% | -0.06% | -0.19% | -0.13% | |

| GBP | 0.30% | 0.05% | -0.54% | 0.43% | -0.01% | -0.15% | -0.08% | |

| JPY | 0.62% | 0.37% | 0.54% | 0.75% | 0.31% | 0.25% | 0.34% | |

| CAD | -0.13% | -0.38% | -0.43% | -0.75% | -0.74% | -0.58% | -0.51% | |

| AUD | 0.31% | 0.06% | 0.01% | -0.31% | 0.74% | -0.14% | -0.06% | |

| NZD | 0.44% | 0.19% | 0.15% | -0.25% | 0.58% | 0.14% | 0.06% | |

| CHF | 0.38% | 0.13% | 0.08% | -0.34% | 0.51% | 0.06% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.