Pound Sterling Price News and Forecast: GBP/USD enters a bullish consolidation phase

GBP/USD consolidates near 15-month high, around 1.3130 area; bullish potential intact

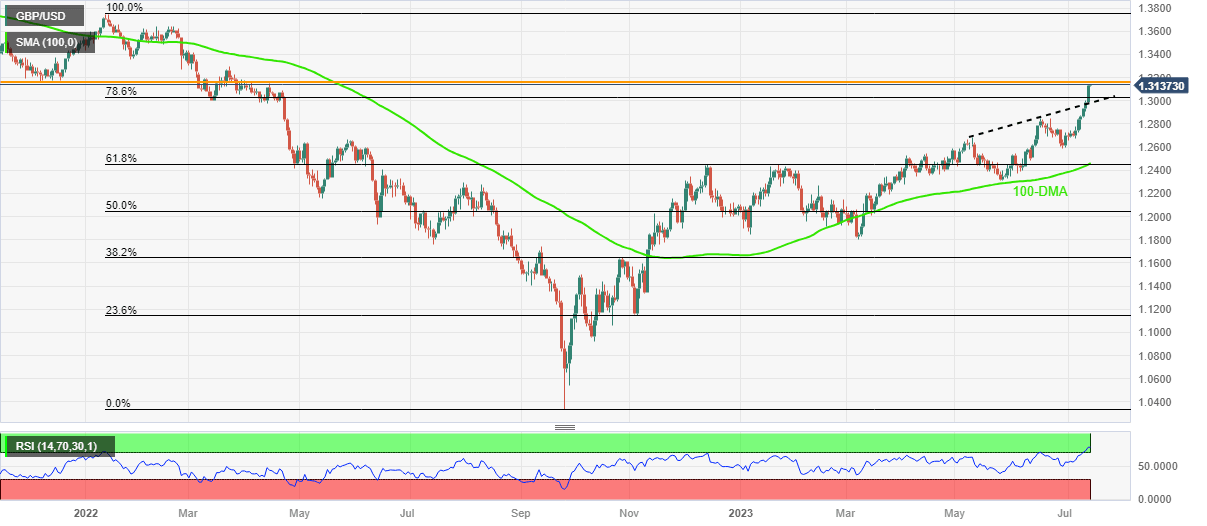

The GBP/USD pair oscillates in a narrow trading band during the Asian session on Friday and consolidates its recent strong gains registered over the past two weeks or so, to its highest level since April 2022. Spot prices currently trade around the 1.3130-1.3125 region and the fundamental backdrop still seems tilted firmly in favour of bullish traders.

The US Dollar (USD) remains under some selling pressure for the seventh straight day and hits a fresh 15-month low in the wake of firming expectations that the Federal Reserve (Fed) is nearly done with its policy tightening cycle. The British Pound (GBP), on the other hand, continues to draw support from rising bets that the Bank of England (BoE) may need to raise interest rates further to combat high inflation. This should act as a tailwind for the GBP/USD pair and support prospects for an extension of the near-term well-established uptrend. Read more...

GBP/USD Price Analysis: Cable bulls need acceptance from 1.3160 and US data to keep the reins

GBP/USD makes rounds to 1.3130-40 after refreshing a 15-month high as it awaits fresh clues during the early hours of Friday’s Asian session. In doing so, the Cable pair takes clues from the overbought RSI conditions while portraying the trader’s cautious mood at the key upside hurdle.

That said, December 2021 bottom surrounding 1.3160 restricts the immediate upside of the Pound Sterling pair at the multi-month high, amid the overbought RSI (14) line, suggesting a pullback toward the 78.6% Fibonacci retracement of the January-September 2022 downturn, near 1.3030. Read more...

Author

FXStreet Team

FXStreet