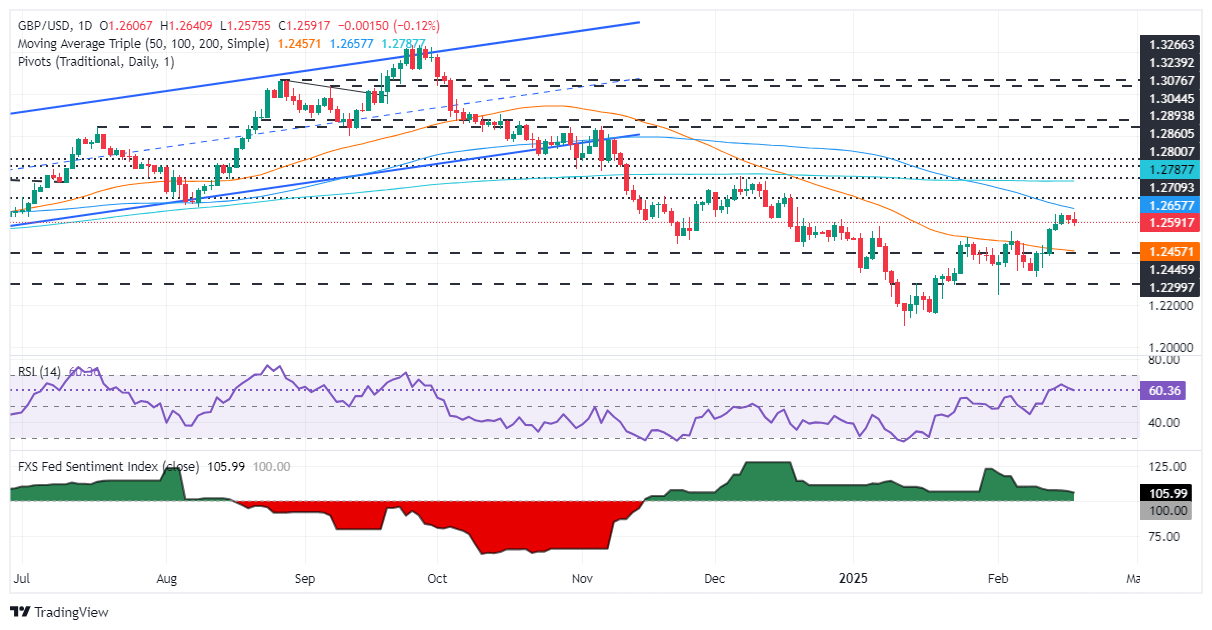

Pound Sterling Price News and Forecast: GBP/USD drops below 1.2600 as US Dollar gains on risk aversion

GBP/USD drops below 1.2600 as US Dollar gains on risk aversion

The Pound Sterling (GBP) retreated below 1.2600 during the North American session as housing data in the United States (US) was mixed, while inflation in the United Kingdom (UK) hit its highest level since March 2024. Despite this, the GBP/USD pair trades at 1.2585, down 0.21%. Read More...

Pound Sterling weakens against USD ahead of FOMC minutes

The Pound Sterling slides to near 1.2580 against the US Dollar (USD) in Wednesday’s North American session. The GBP/USD pair weakens as the US Dollar gains, with the US Dollar Index (DXY) rising to near 107.20, ahead of the release of the Federal Open Market Committee (FOMC) minutes for the January meeting, which will be published at 19:00 GMT. Read More...

GBP/USD holds ground above 1.2600 ahead of UK CPI data

GBP/USD remains firm after losses in the previous session, trading around 1.2610 during the Asian session on Wednesday. Traders await the release of January’s Consumer Price Index (CPI) data from the United Kingdom (UK) scheduled to be released later in the day. The Pound Sterling (GBP) could see significant movement in response to the inflation report, which may influence the Bank of England’s (BoE) interest rate-cut strategy amid ongoing inflationary pressures. Read More...

Author

FXStreet Team

FXStreet