Pound Sterling Price News and Forecast: GBP/USD drifts lower to around 1.3440 on Friday

GBP/USD softens to below 1.3450 on renewed US Dollar demand

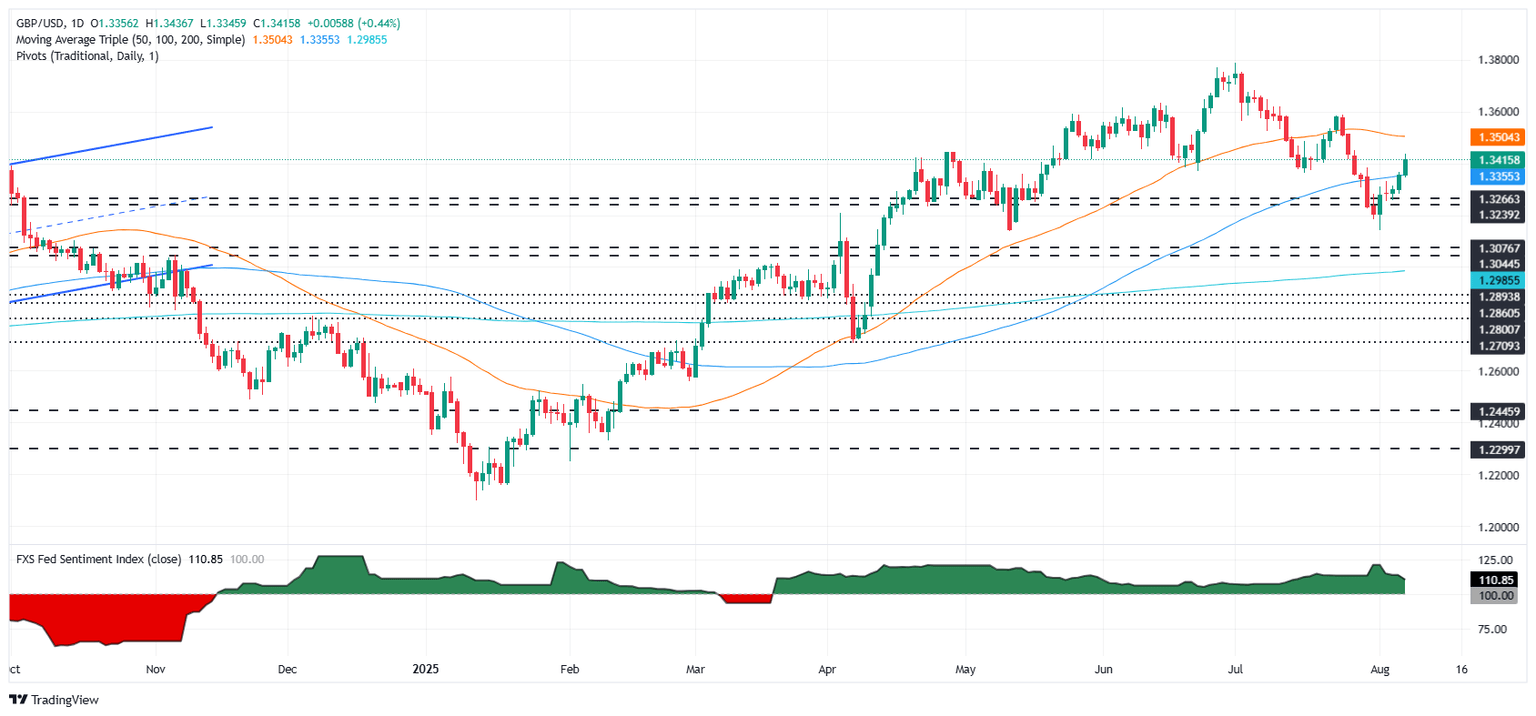

The GBP/USD pair posts modest losses near 1.3440 during the Asian trading hours on Friday. The US Dollar (USD) strengthens against the Pound Sterling (GBP) after Federal Reserve (Fed) Governor Christopher Waller has reportedly emerged as the top contender to succeed embattled Fed Chair Jerome Powell. The Fed’s Alberto Musalem is scheduled to speak later on Friday.

Bloomberg reported on Thursday that Fed Governor Christopher Waller is emerging as a top candidate to be the next Fed Chair. Waller favored a 25 basis point (bps) rate cut last week, while his colleagues voted to hold rates steady. Traders are now pricing in nearly a 93% odds of a rate reduction in September, with at least two rate cuts priced in by the end of the year. Read more...

GBP/USD: Greenback weakens and BoE rate cut bets decline

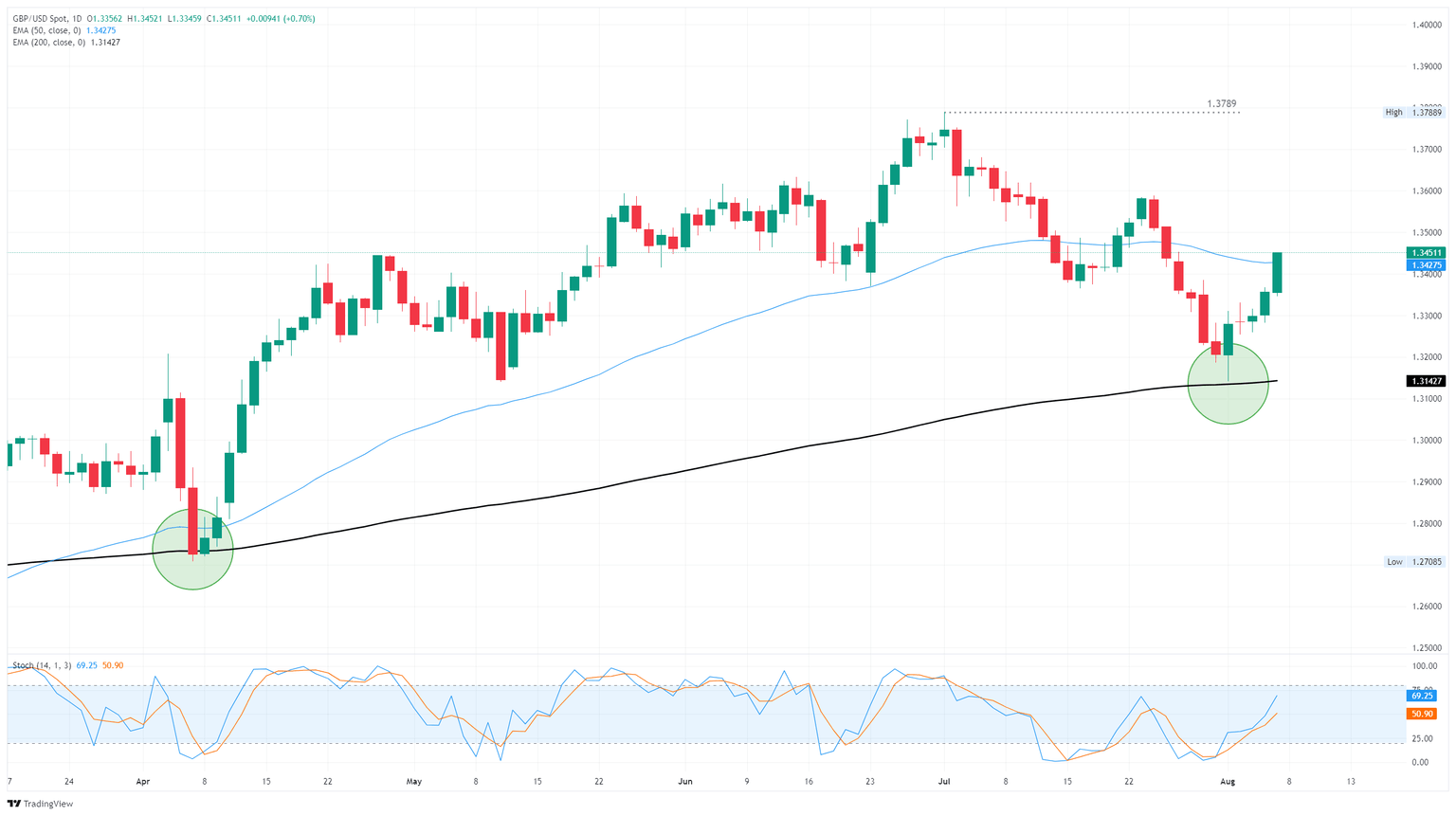

GBP/USD extended recent bullish momentum on Thursday, gaining over two-thirds of one percent on the day and climbing above key technical indicators as market rebalance both a weaker US Dollar (USD) and a stronger Pound Sterling (GBP). A new Federal Reserve (Fed) Board of Governors member selected by Donald Trump is bringing protectionist policy home to the Fed, and a rate cut barely squeezed through the Bank of England’s (BoE) Monetary Policy Committee (MPC), trimming expectations of follow-up rate cuts.

United States (US) President Donald Trump has selected Stephen Miran, the current Chair of the US Council of Economic Advisors, to replace recently resigned Federal Reserve (Fed) Board of Governors (BoG) member Adriana Kugler. Miran is a pro-protectionist who championed including trade deficits in tariff calculations and will likely be friendly to President Trump’s rate cut expectations. Adding on that Trump is expected to favor Fed Board member Christopher Waller for the Fed Chair position when Jerome Powell’s term ends in 2026, and the pool of Fed voters who will support arbitrarily dropping interest rates regardless of the state of the US economy will grow substantially. Read more...

GBP/USD jumps as BoE delivers hawkish cut, US jobless claims climb

The GBP/USD surges during the North American session, though trading below an eight-day high reached at 1.3436 after the Bank of England (BoE) decided to cut interest rates on a close vote split, signaling that policymakers remained worried about inflation. Also, a jump in unemployment claims in the United States (US) keeps the Dollar pressured. The pair trades at 1.3410, up 0.48%.

Earlier, the BoE cut rates on a 5-4 vote split to 4%, as four members of the BoE’s Monetary Policy Committee (MPC) voted to hold rates unchanged, while Taylor wanted a 50-bps rate cut. In its monetary policy statement, the BoE revealed that “a gradual and careful approach” to further cuts on the Bank Rate, but added that “The restrictiveness of monetary policy had fallen as Bank Rate had been reduced.” Read more...

Author

FXStreet Team

FXStreet