GBP/USD: Greenback weakens and BoE rate cut bets decline

- GBP/USD climbed above key technical levels on Thursday.

- Cable momentum is heading higher as the Greenback weakens.

- Trump pick for Fed board seat brings tariff-happy policymaker to key rate-setting table.

GBP/USD extended recent bullish momentum on Thursday, gaining over two-thirds of one percent on the day and climbing above key technical indicators as market rebalance both a weaker US Dollar (USD) and a stronger Pound Sterling (GBP). A new Federal Reserve (Fed) Board of Governors member selected by Donald Trump is bringing protectionist policy home to the Fed, and a rate cut barely squeezed through the Bank of England’s (BoE) Monetary Policy Committee (MPC), trimming expectations of follow-up rate cuts.

United States (US) President Donald Trump has selected Stephen Miran, the current Chair of the US Council of Economic Advisors, to replace recently resigned Federal Reserve (Fed) Board of Governors (BoG) member Adriana Kugler. Miran is a pro-protectionist who championed including trade deficits in tariff calculations and will likely be friendly to President Trump’s rate cut expectations. Adding on that Trump is expected to favor Fed Board member Christopher Waller for the Fed Chair position when Jerome Powell’s term ends in 2026, and the pool of Fed voters who will support arbitrarily dropping interest rates regardless of the state of the US economy will grow substantially.

Odds of a repeat rate cut from the BoE decline after a close vote

The BoE trimmed interest rates by a quarter-point on Thursday, as markets had broadly expected. What sent Cable traders for a loop was the vote count on the MPC: BoE policymakers voted five-to-four for a 25 bps interest rate cut, a much slimmer margin than the expected seven-to-two. With MPC votes running so close to even, market expectations of a follow-up interest rate cut have withered appreciably, putting a rate hold at the BoE’s next interest rate decision in the crosshairs.

GBP/USD technical outlook

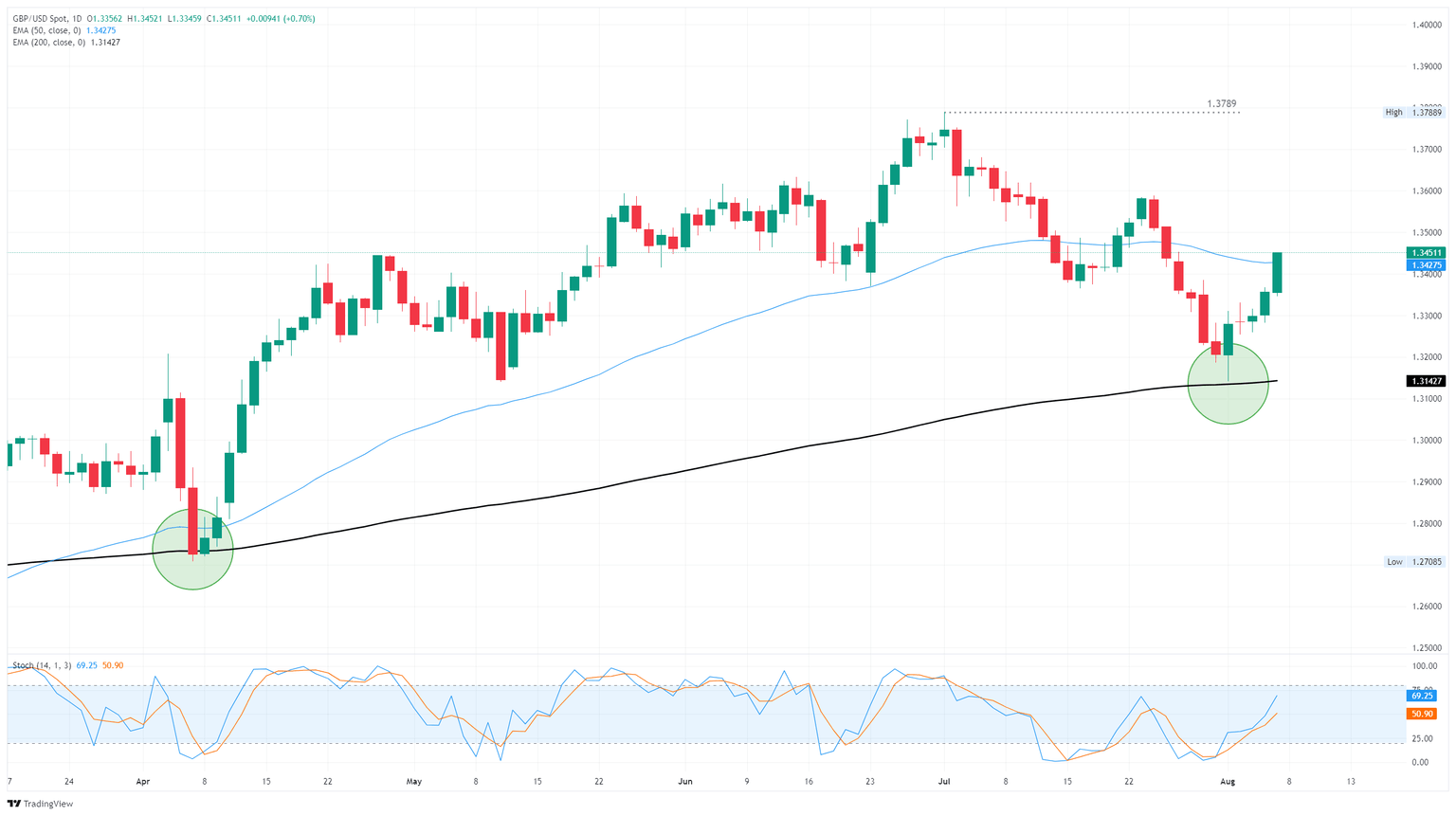

Thursday’s bullish momentum carried GBP/USD back over the 50-day Exponential Moving Average (EMA) near 1.3425, carrying Cable bids above 1.3450 and chalking in a third consecutive day of accelerating Pound gains. GBP/USD has closed higher or flat for five straight sessions, and heads into the Friday market window looking for a sixth.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.