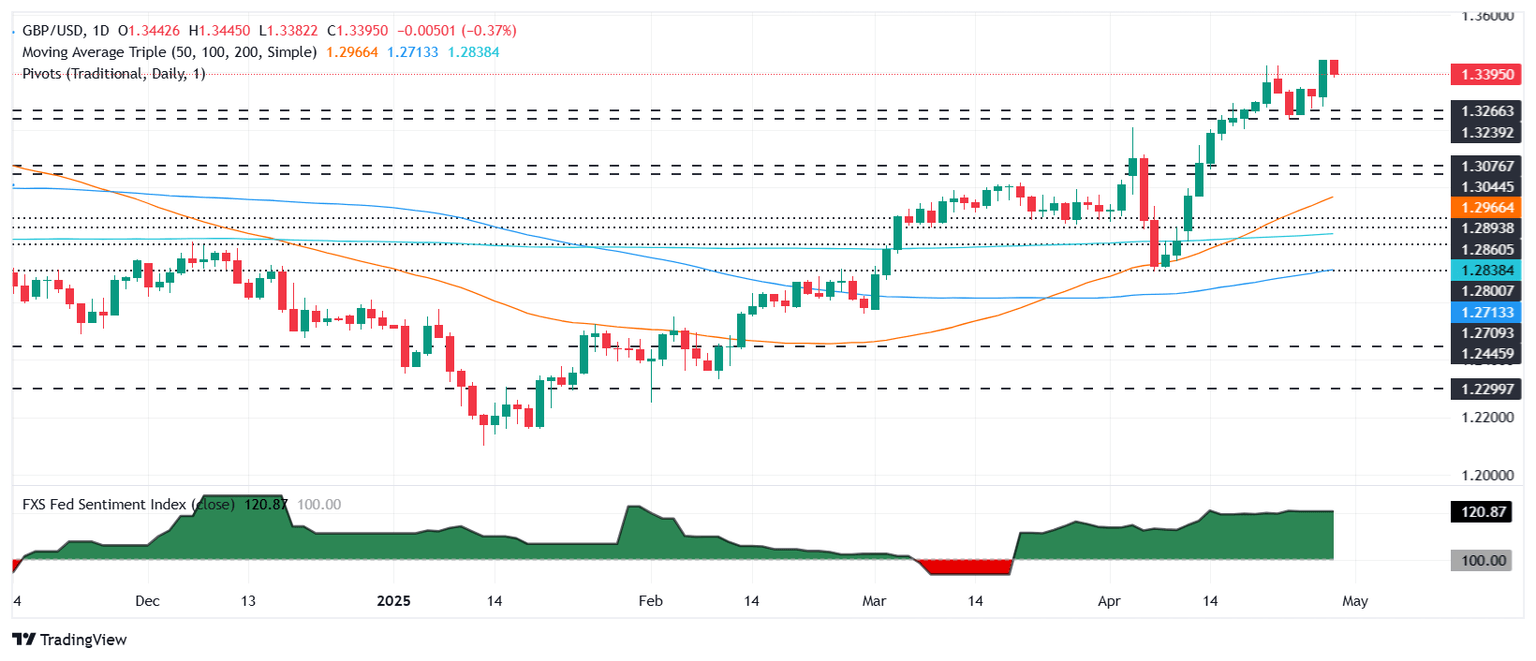

Pound Sterling Price News and Forecast: GBP/USD depreciates as the USD strengthens ahead PCE Index release

GBP/USD breaks below 1.3400 due to stronger US Dollar, BoE rate cut expectations

GBP/USD extends its decline for a second straight session, hovering near 1.3390 during Wednesday’s Asian trading. The pair is under pressure as the US Dollar strengthens on renewed optimism surrounding US-China trade developments. Traders now turn their attention to the upcoming release of the US Personal Consumption Expenditures (PCE) Price Index for March, a key inflation gauge for the Federal Reserve.

The US Dollar Index (DXY), which measures the USD against six major currencies, remains comfortably above the 99.00 mark, meanwhile a rebound in US Treasury yields. Both the 2-year and 10-year yields on US bond coupons snapped a four-day losing streak, trading around 3.66% and 4.17%, respectively, at the time of writing. Read more...

GBP/USD holds positive ground above 1.3400, eyes on key US data releases

The GBP/USD pair trades with mild gains near 1.3405 during the early Asian session on Wednesday. The weaker-than-expected US economic data drags the Greenback lower. Later on Wednesday, the US ADP Employment Change will be released, along with the Personal Consumption Expenditures Price Index (PCE) and the flash Q1 Gross Domestic Product (GDP) report.

Data released by the US Bureau of Labor Statistics on Tuesday showed that US job openings fell to 7.19 million in March, the lowest since September 2024, compared to a revised 7.48 million in February. This figure came in below the market consensus of 7.5 million. Meanwhile, the Conference Board’s Consumer Confidence Index declined to 86.0 in April from 93.9 in March (revised from 92.9). This figure registered the lowest level since April 2020. Read more...

GBP/USD slips below 1.34 as risk rally fades, US data disappoints

The Pound Sterling (GBP) depreciates against the US Dollar (USD) and falls after testing the year-to-date (YTD) high of 1.3443. However, it fails to remain above 1.34 as it extends its losses. At the time of writing, GBP/USD trades at 1.3379, down 0.29%.

Investor confidence seems to have improved as US Treasury yields tumbled following the release of worse-than-expected US data, which could warrant easier policy by the Federal Reserve. Read more...

Author

FXStreet Team

FXStreet