Pound Sterling Price News and Forecast: GBP/USD could target the nine-day EMA support at 1.2613

GBP/USD Price Forecast: Tests 1.2650 support near nine-day EMA

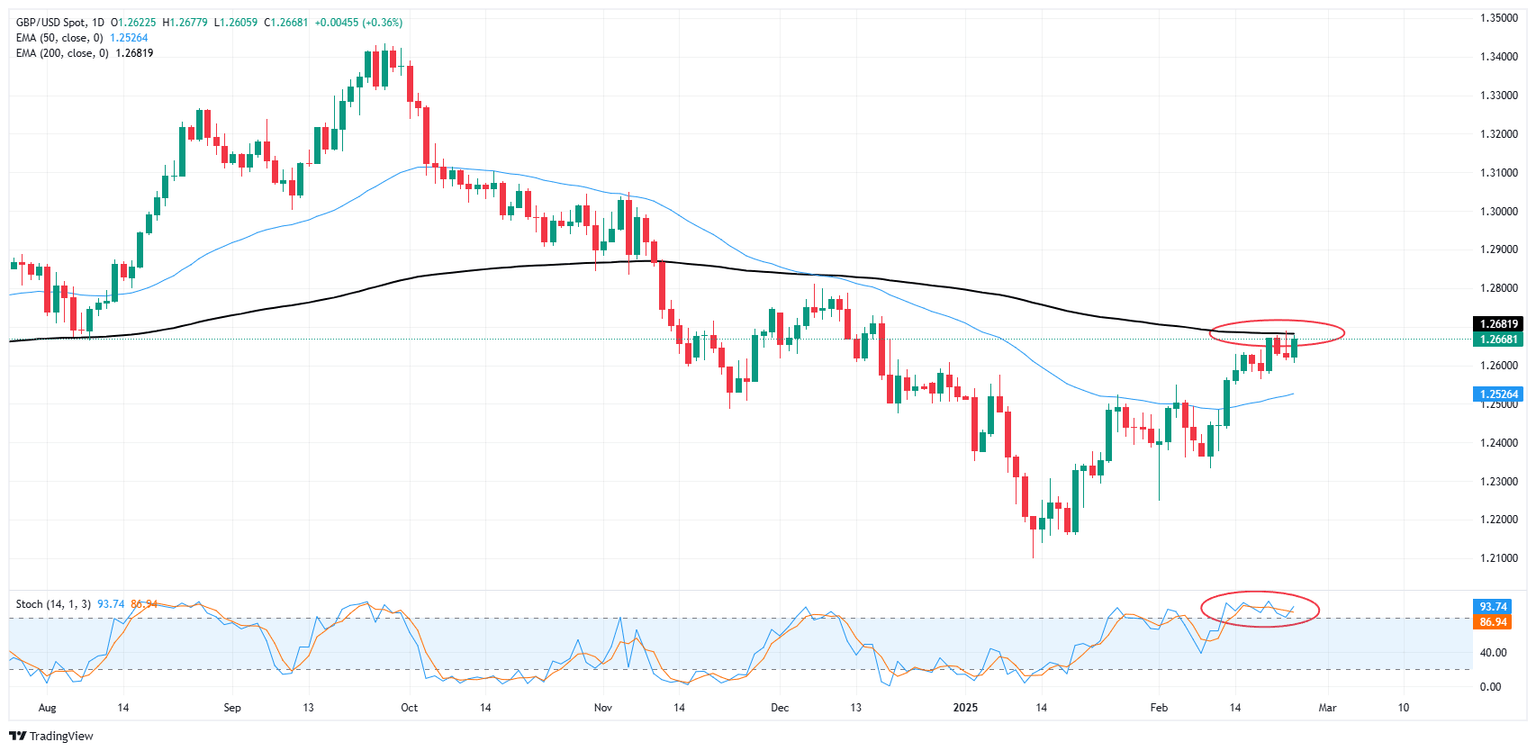

The GBP/USD pair gives up part of its recent gains from the prior session, hovering around 1.2650 during Wednesday’s Asian session. Despite this pullback, technical analysis of the daily chart indicates a sustained bullish outlook, as the pair remains within an ascending channel pattern.

The 14-day Relative Strength Index (RSI) stays above the 50 mark, reflecting strengthened bullish momentum. Additionally, the pair continues to trade above the nine- and 14-day Exponential Moving Averages (EMAs), highlighting robust short-term price dynamics and confirming the prevailing upward trend. Read more...

GBP/USD continues to churn near key technical levels

GBP/USD caught a small lift on Tuesday, bolstering Cable back into the high end of near-term consolidation and keeping bids pinned close to the 200-day Exponential Moving Average (EMA). US consumer sentiment dipped in February, adding more weight to economic slowdown concerns, and US President Donald Trump has reaffirmed his intent to impose stiff import taxes on his own citizens as a trade war threat against the US’ closest trading partners.

Despite weakening consumer sentiment, driven largely by fears of President Trump’s own tariff packages, Cable maintained a positive tilt on Tuesday. Despite a fresh go around the wheel of President Trump’s trade war attempts, markets continue to believe that the US President will find an 11th hour reason to kick the can down the road on his own tariff threats. Read more...

GBP/USD climbs as US Dollar weakens due to falling yields

The Pound Sterling (GBP) advanced early in the North American session, bouncing off a two-day low of 1.2605, as the Greenback weakened due to falling US Treasury yields. The GBP/USD pair trades at 1.2669, gaining 0.37%.

The market mood shifted sour amid US President Donald Trump's threats of tariffs. On Monday, he reiterated that duties on Canadian and Mexican products would be enacted as planned. In the meantime, weaker-than-expected data from the United States (US) has begun to take its toll on the US Dollar (USD) and is also sending US Treasury bond yields plunging. The US 10-year Treasury note plummets 10 basis points (bps) to 4.30% at the time of writing. Read more...

Author

FXStreet Team

FXStreet