Pound Sterling Price News and Forecast: GBP/USD climbs above 1.3500 as solid US data caps US Dollar

GBP/USD climbs above 1.3500 as solid US data caps US Dollar

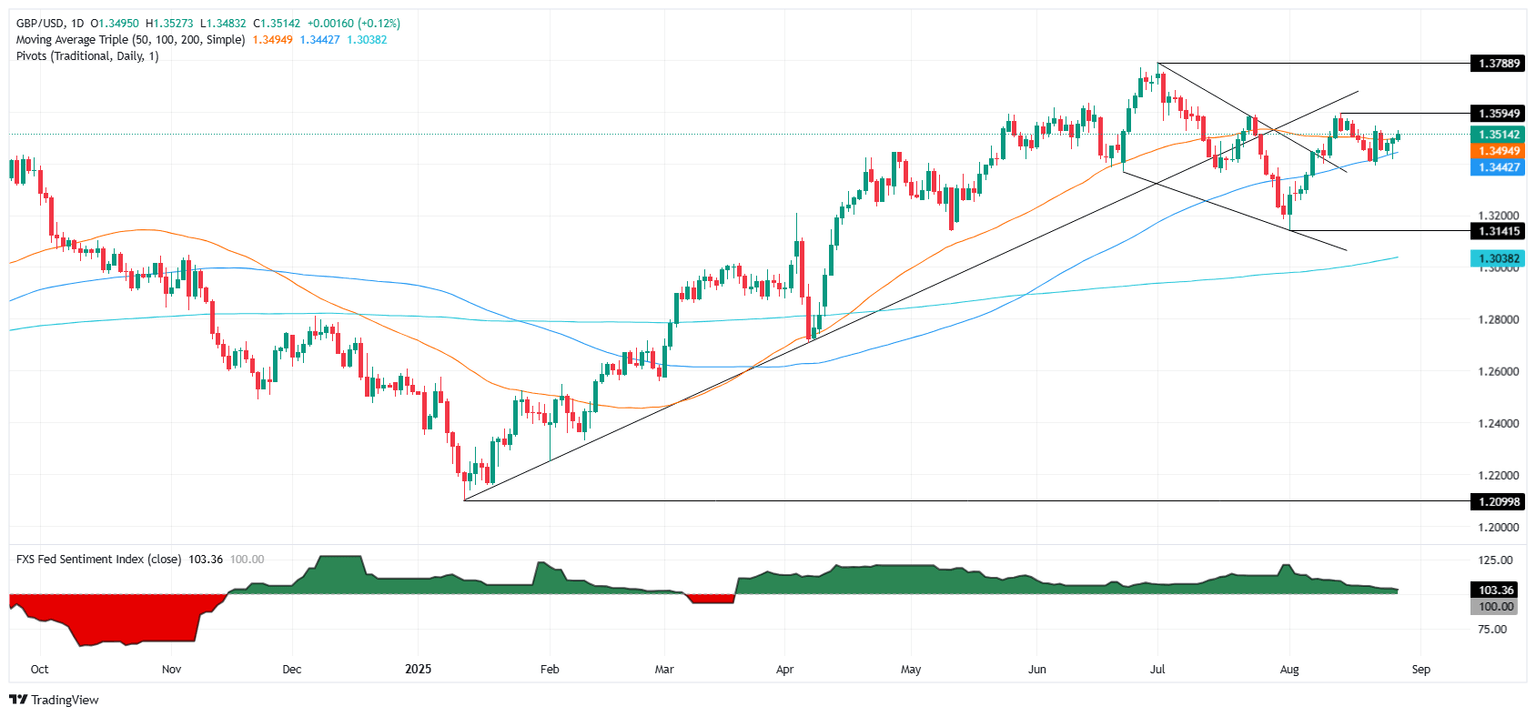

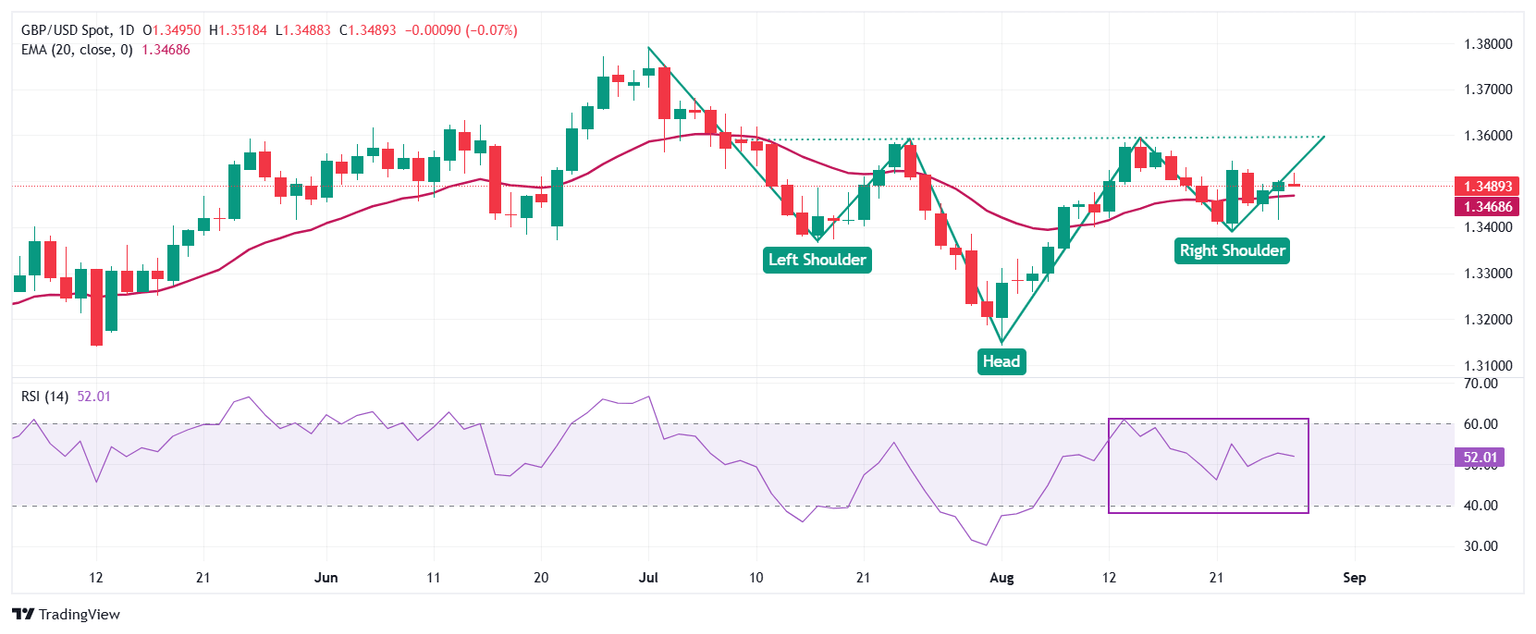

GBP/USD rises during the North American session after economic data released in the United States (US) showed that the economy remains solid, suggesting it may not warrant an interest rate cut. At the time of writing, the pair trades at 1.3524, up 0.19%. Read More...

GBP/USD retreats towards 1.3500 as US GDP growth outpaces expectations

The British Pound (GBP) eases against the US Dollar (USD) on Thursday, trimming all of its earlier gains after climbing to a session high of 1.3526. At the time of writing, GBP/USD is trading near the 1.3500 psychological level, with subdued price action reflecting investor caution following a series of mixed US economic data releases. Read More...

Pound Sterling rises against US Dollar as Fed Willians signals potential rate cuts

The Pound Sterling (GBP) extends its winning streak for the third trading day against the US Dollar (USD) on Thursday. The GBP/USD pair rises to near 1.3520 as the US Dollar declines, following dovish comments on interest rates from New York Federal Reserve (Fed) Bank President John Williams on Wednesday. Read More...

Author

FXStreet Team

FXStreet