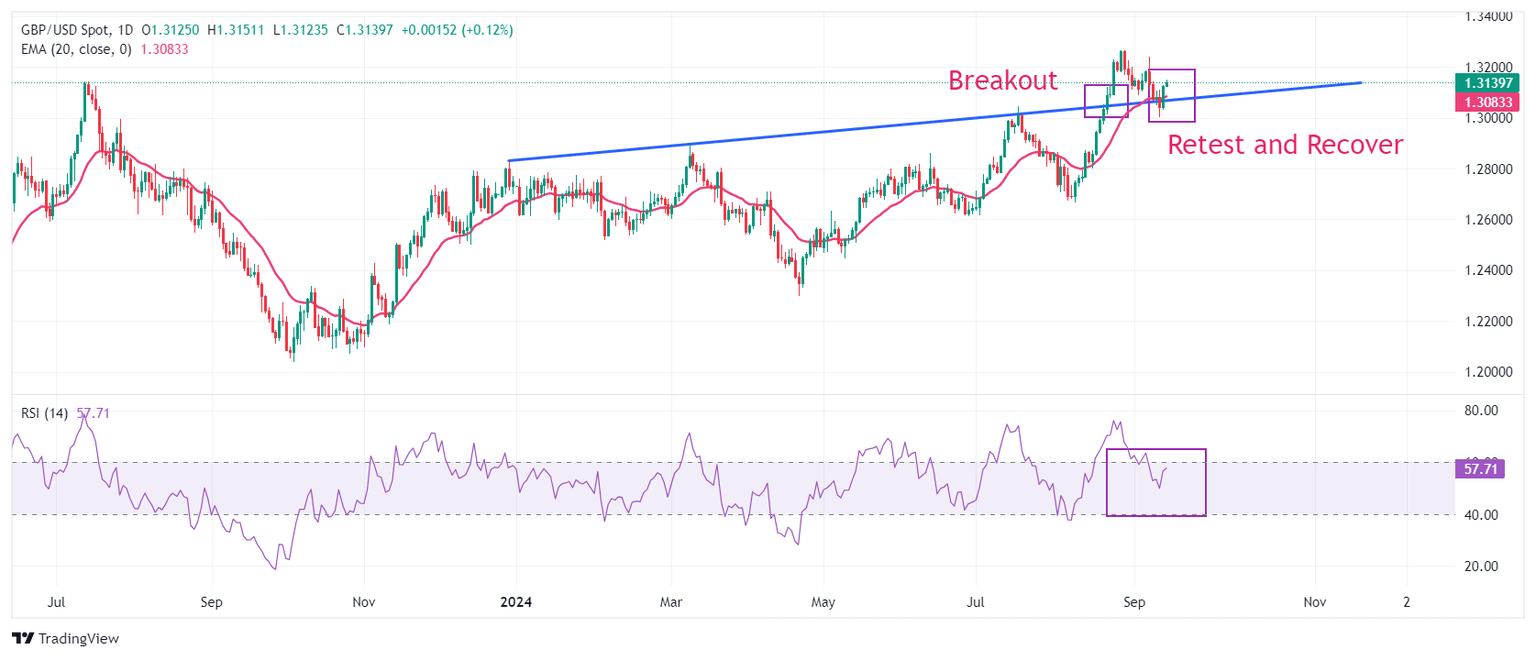

GBP/USD Price Forecast: Climbs above 1.3100 as Fed rate cut speculation intensifies

The GBP/USD edges higher during the North American session, registering gains of over 0.18%, due to increasing expectations that the US Federal Reserve could cut

rates by 50 basis points next week. At the time of writing, the pair trades at 1.3147 after bouncing off daily lows of 1.3114.

Read More...

Pound Sterling gains as soft US PPI reaffirms debate over Fed rate cut size

The Pound

Sterling (GBP) rises to near 1.3150 against the US Dollar (USD) in Friday’s North American session. The GBP/USD pair remains firm as the US Dollar (USD) falls sharply after the United States (US)

Producer Price Index (PPI) data for August prompted market expectations for the Federal Reserve (Fed) to begin reducing interest

rates next week aggressively.

Read More...

GBP/USD advances to fresh weekly top, around mid-1.3100s amid notable USD supply

The GBP/USD pair gains positive traction for the second straight day and recovers further from over a three-week low, around the 1.3000 psychological mark touched on Wednesday. The momentum lifts spot prices to mid-1.3100s, or a fresh weekly top during the Asian session, and it is sponsored by the heavily offered tone surrounding the US Dollar (USD).

Read More...